I am looking ahead following the perfect storm in an anomalous year, 2022, where growth stocks painfully tumbled and bonds and other fixed-income assets failed to protect portfolio values. My individual focus in 2023 is on revisiting tried-and-tested investing strategies that have consistently generated positive returns. Buying high-quality dividend stocks and holding them “forever” is a proven long-term winning strategy. Two favourite Canadian dividend stocks have consistently outperformed the market.

Fortis Inc. (TSX:FTS) and Franco-Nevada (TSX:FNV) are Canadian dividend-paying stocks that have consistently beaten the market over extended investment horizons. They paid cash in a choppy market, giving investors the dry powder to opportunistically buy the dips on favourite stocks. Their regular cash payouts had a somewhat dazzling glare during the recent down market and consistent dividend raises could amplify total returns in the future.

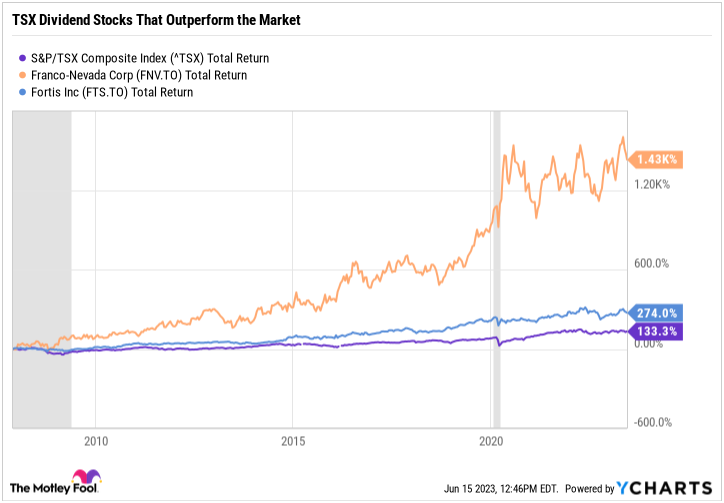

Our testing period starts in the Great Recession of 2007–9, and is bound by Franco-Nevada’s initial public offering (IPO) in March 2007.

Let’s start with an older outperforming dividend dazzler that constantly beat the TSX in historical times.

Fortis stock

Fortis Inc. is a $27.4 billion diversified electric and gas utility that enjoys the stability of regulated cash flows from its Canadian, U.S., and Caribbean customers.

The utility has raised its quarterly dividends for 49 consecutive years, a track record second only to another dividend aristocrat Canadian Utilities (TSX:CU), which increased dividends for 51 years in a row. However, not all utility stocks are the same. Fortis stock has produced market-beating returns that made FTS stock investors outshine passive investors in the TSX Composite Index.

Investors who acquired Fortis stock during the Great Recession of 2007–9 could have booked 274% in dividend-adjusted total returns today. The TSX generated 133% in total returns during the 16-year period. Increases in FTS stock price contributed less than half the return (109%). The utility stock’s ever-growing dividends did much of the heavy lifting, generating significant wealth for long-term investors who employed the Foolish Buy-and-Hold investment strategy.

Total returns on FTS stock also eclipsed those on the TSX in the 10-year and 5-year investment horizons.

Can Fortis stock continue to generate market-beating returns? Yes, it can. The company’s growing revenue base and budgeted dividend raises through 2027 could provide stable returns to shareholders over the next five years.

Fortis is investing $22.3 billion in a five-year growth plan through 2027. The plan could grow its rate base at a 6.2% compound annual growth rate. The company is on course to meet its $4.3 billion investment target for 2023. The current investment plan could sustain a 4% to 6% annual dividend growth range through 2027.

Given management’s track record of stellar execution and a funded program, Fortis could manage to grow its recurring revenue, generate growing free cash flows, and raise its dividends.

The Fortis stock dividend currently yields 4% annually.

Franco-Nevada Corp

Franco-Nevada Corp is a $37 billion debt-free precious metals streaming giant with a 16-year winning streak. The company generates high-margin and low-risk profits from royalties on precious metals production from mining partners located in mining-friendly jurisdictions. It has no typical mine exploration and operating risks to worry about, but enjoys the commodity price upside whenever a partner produces gold or silver, among other streamed minerals.

FNV stock has generated 1,420% in total shareholder returns since 2007. The TSX returned 133% during the same period. The stock continued to outperform the broader market over 10-year and 5-year investment horizons.

The cash dividend on FNV stock currently yields 1% annually. But looks can be deceiving. The company is a Canadian dividend aristocrat that has raised dividends every year for 15 consecutive years. Its current dividend of $0.34 per share is 36% higher than it was before the COVID-19 pandemic struck the market.

Can Franco-Nevada stock continue to generate outperforming returns? The company boasts long-life reserves and a long pipeline of new precious metals opportunities, including nickel and copper. In the near term, the production disruptions that contributed to 19% lower first-quarter production this year have since been resolved. Second-quarter revenue could be higher, and earnings could be higher.