The world of investing is fraught with uncertainties, and one question seems to perennially echo in the minds of both seasoned investors and novices alike: “Is it safe to invest today?” It’s a query born out of genuine concern, but obsessing over it can lead to a myriad of investment pitfalls.

From attempting to time the market’s ebbs and flows to buying high (lured by the siren song of soaring stocks) and selling low (in the grip of panic), to parking funds in ultra-conservative assets that barely keep pace with inflation – the list goes on.

But what if we’ve been asking the wrong question all along? What if there’s a more constructive framework to guide us, one that dispels the anxiety and empowers us to make informed decisions?

In this piece, I’ll not only propose a fresh perspective to help navigate these financial waters, but I’ll also introduce an ETF that embodies this approach, offering a practical way to put it into play.

Investing comes with unavoidable risks

At the heart of every investment lies a balance of risk and reward. The financial world operates on a fairly straightforward principle: the return investors earn is often commensurate with the risks they shoulder.

This might seem daunting, but the secret sauce isn’t about avoiding risks; it’s about understanding and taking the right ones. In investment parlance, we often talk about ‘compensated risks’.

For instance, consider the decision between investing in a globally diversified, broad-market index fund versus pouring all your capital into a single sector – a specific stock pick, or the latest meme stock making waves on social media.

The former strategy spreads your risks across a vast landscape of industries and geographies, providing a safety net against the unpredictable gyrations of specific sectors or companies. On the other hand, the latter approach, while potentially lucrative, hinges on the success (or failure) of a singular entity or trend.

So, let’s be clear: there’s no reward without some risk. If you’re looking for investments devoid of volatility, you’re limited to the modest returns of risk-free instruments, like Treasury bills or Guaranteed Investment Certificates (GICs). While these instruments promise safety, their returns are often barely enough to outpace inflation.

The journey of investing will have its peaks and troughs, its sunny days and storms. But remember, volatility isn’t necessarily the enemy; it’s the price of admission for the long-term growth potential that equities offer. The key is to be strategic about where and how you accept those risks, ensuring they’re not just taken, but pay you fairly.

What you should be asking instead

Switching our focus from the vague concern of safety to the more tangible metric of diversification can be a game-changer on our investing journey. Instead of nervously pondering, “Is it safe to invest?”, reframe the question to, “Am I sufficiently diversified?”

Why is this reframe so critical? Let’s break it down. Investing in a single stock can be akin to putting all your eggs in one basket. If that particular company faces issues or its sector becomes beleaguered, your investment might plummet and never fully recover.

But when you spread your investments across a diverse range of stocks spanning various sectors and countries, you’re not just distributing risk, you’re also harnessing the power of collective growth. The odds of hundreds or thousands of these diversified stocks never recovering are considerably slimmer.

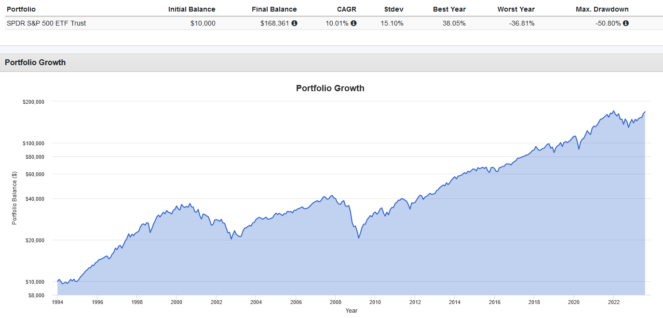

Take the S&P 500 Index as an illustrative example. Despite facing severe downturns during events like the Dot-com bubble of the early 2000s, harrowing 2008 Great Financial Crisis, and unexpected 2020 COVID-19 crash, the index has shown resilience.

Over the past few decades, and amidst these challenges, it has still managed to churn out a 10% annualized rate of return since 1994, as seen below.

This isn’t magic; it’s the power of diversification. By ensuring a well-balanced, varied portfolio, investors can be better positioned to weather storms and capitalize on growth opportunities.

The good news? You can easily invest in the S&P 500 via low-cost index ETFs like the Vanguard S&P 500 Index ETF (TSX:VFV), which charges a low 0.09% expense ratio.