For many new investors, the journey towards building wealth can often start with a sense of disappointment.

When they learn that investing in broad stock market indexes like CRSP U.S. Total Stock Market Index or the S&P 500 Index typically yields a 7-10% annualized return, it might not seem like a path to riches.

In a world where instant gratification is often the norm, these returns can appear modest, leading some to seek out more speculative, get-rich-quick opportunities in meme stocks, penny stocks, and cryptocurrencies.

However, this perspective is short-sighted. The true power in investing doesn’t lie in chasing the next big thing but in understanding and harnessing the power of compounding, especially when time is on your side.

Compounding, coupled with consistent investments, reinvested dividends, and disciplined strategy, can turn even modest amounts into substantial wealth over time.

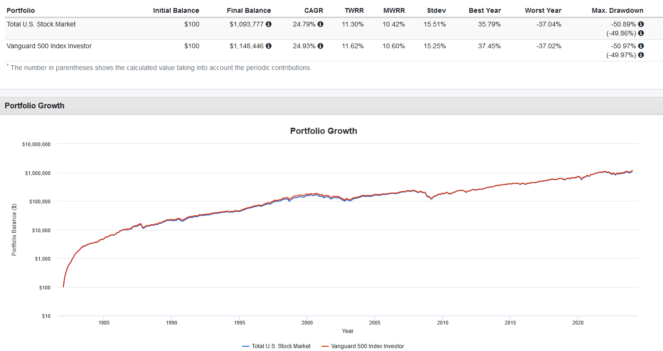

Consider this: a $100 investment in both the aforementioned indexes back in 1982, with additional monthly contributions of $100, would have grown to over a million dollars each by 2024. And the effect would have been even more pronounced with a longer timeframe or higher monthly contributions.

If this approach resonates with you, and you’re looking to build your wealth steadily and securely, then exchange-traded funds (ETFs) can be great vehicles to make this happen. Here are two ETFs that embody these principles, offering a pragmatic and disciplined path to potentially becoming a millionaire.

An ETF for the S&P 500

For investors seeking exposure to the U.S. stock market, particularly the S&P 500, one ETF stands out: Vanguard S&P 500 Index ETF (TSX:VFV). VFV offers a straightforward and efficient way to invest in the 500 of the largest U.S. companies, encompassing a wide range of industries.

Cost efficiency is a major highlight of VFV. It charges a management expense ratio (MER) of just 0.09%. This low fee structure is a boon for investors, as lower costs typically lead to better net returns over the long term, especially when compounded.

Another appealing aspect of VFV is its ease of purchase. It’s as simple to buy as any other stock. Investors can simply enter its ticker symbol in their brokerage account and indicate how many shares they want to buy. This simplicity removes many barriers that typically prevent new investors from starting.

An ETF for the total U.S. stock market

While the S&P 500 is a widely recognized benchmark for the U.S. stock market, it doesn’t encompass the entire market. For investors looking for a more comprehensive snapshot of the U.S. stock landscape, the CRSP U.S. Total Market Index serves as a more inclusive benchmark.

To track this broader index, Vanguard U.S. Total Market Index ETF (TSX:VUN) emerges as a solid choice. VUN is an interesting proposition for those seeking wider market exposure beyond the S&P 500.

Essentially, about 85% of VUN’s composition mirrors that of VFV, which covers the S&P 500 stocks. The remaining 15% is where VUN sets itself apart — it includes a selection of mid- and small-cap stocks not found in the 500 stocks that VFV covers.

This additional slice of the market can provide greater diversification, tapping into the potential of smaller, perhaps more dynamic companies that are not part of the S&P 500.

However, this broader exposure comes with a slightly higher cost. VUN has a management expense ratio (MER) of 0.16%, which, while higher than VFV’s 0.09%, is still fairly low in the grand scheme of investment fees. This slightly higher fee is the trade-off for the broader market exposure that VUN offers.