If you’re starting a portfolio with just $500, that’s a solid beginning. Investing this amount wisely beats spending it on things that don’t offer you a return.

But the challenge isn’t just starting—it’s choosing the right stocks. With thousands to choose from, picking winners can seem like a shot in the dark. So, what’s the solution for a newcomer?

The strategy is straightforward: instead of trying to pick stocks, why not invest in the whole market? You can do this efficiently with $500 by investing in an index fund. Here’s how this approach works.

What is an index fund?

Imagine you have a set of rules for choosing stocks, such as only selecting U.S. stocks across all market sizes—large, medium, and small—and ensuring your picks cover all 11 stock market sectors. You also decide when to re-balance your portfolio or change your holdings based on specific criteria.

This set of rules, if programmed into a computer to automatically pick and manage stocks, creates what we call an “index.” An index is essentially a methodical way to select and group stocks based on predefined rules, often designed to represent the performance of a particular segment of the market.

An index fund, then, is an investment vehicle that aims to replicate the performance of a specific index. It does this by investing in the exact same stocks and in the same proportions as the index.

By investing in an index fund, you’re essentially buying into the performance of all the stocks in the index minus a small fee for managing the fund. This way, you get broad exposure to the market through a single investment.

Which index fund to buy?

With just $500, a great starting point is Vanguard U.S. Total Market Index ETF (TSX:VUN), which only costs around $100 per share.

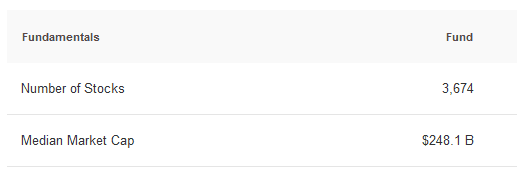

This exchange-traded fund (ETF) tracks the CRSP US Total Market Index, encompassing over 3,600 U.S. stocks across various sizes. Although it includes small- and mid-sized companies, the ETF is predominantly influenced by larger firms due to its market capitalization weighting.

One of the standout features of VUN is its cost-effectiveness. With a management expense ratio of only 0.17%, you would pay just $17 annually on a $10,000 investment.

This low fee is a small price to pay for the extensive diversification VUN offers, making it an ideal choice for beginners wanting broad exposure to the U.S. stock market.