With interest rates in Canada on a downward trend – and expected to continue their decline – the real estate sector, particularly Real Estate Investment Trusts (REITs), is becoming increasingly attractive.

When bond yields fall, investors often seek alternatives for income, making REITs appealing due to their higher yield potential and nature of leveraging lower interest rates to finance property purchases more cheaply.

In this environment, REIT ETFs stand out as a potent choice for those looking to gain broad exposure to the real estate market while also harvesting steady, above-average monthly income.

Among the lineup of REIT ETFs available in Canada, one particularly notable option for those seeking diversified exposure across North America is the Hamilton REITs YIELD MAXIMIZER ETF (TSX:RMAX). Here’s what you need to know.

What does RMAX hold?

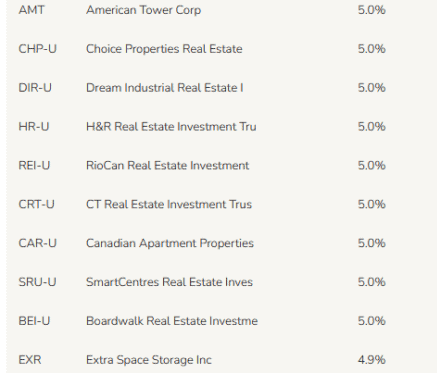

Currently, RMAX maintains an equally weighted portfolio consisting of 20 of the largest REITs across North America.

This strategic design ensures that the ETF does not overweight any particular subsector of the real estate market.

Consequently, investors gain exposure to a diverse mix of REIT types, including self-storage, office, retail, residential, industrial, data centres, and cell towers.

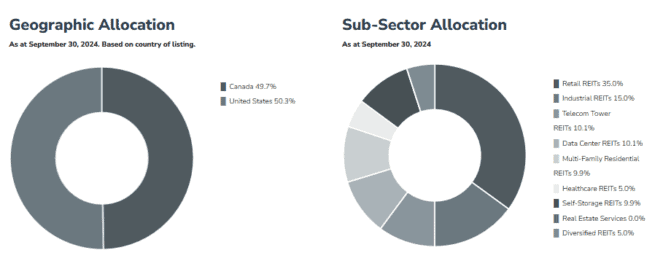

The inclusion of U.S. REITs alongside Canadian ones is a distinctive feature of RMAX, setting it apart from many other REIT ETFs that typically focus solely on Canadian properties.

This North American scope significantly enhances the diversification benefits for investors, spreading risk across different markets and real estate sectors.

How does RMAX generate income?

RMAX generates its notable yield through two primary income streams: the inherent distributions from the REITs it holds and the strategic use of covered calls.

REITs are typically favoured for their robust distribution yields, and by holding a portfolio of the 20 largest North American REITs, RMAX already establishes a solid base yield.

To further enhance income, RMAX employs a covered call strategy on up to 30% of its portfolio. This approach involves selling call options on holdings within the ETF.

Simply put, covered calls involve sacrificing some potential upside in exchange for immediate income. This means that while investors still benefit from 70% of the portfolio’s potential price appreciation, they also enjoy significantly higher monthly income.

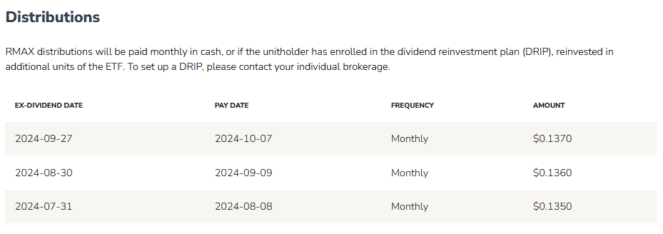

As of the latest data from October 7th, with an NAV of $18.05, the last monthly distribution paid was $0.137 per share, which annualized works out to a 9.1% yield.