No matter what kind of noise is rattling markets right now—Trump’s tariffs, ongoing geopolitical tensions, inflation worries, or central bank uncertainty—I remain bullish on quality stocks, especially those that consistently grow their dividends.

Over the long term, I’m happy to bet on businesses that generate real profits, reward shareholders, and can weather just about any economic environment.

That’s why, on the Canadian side, my two favourite exchange-traded funds (ETFs) for 2025 both embody these traits—one focused on the U.S. market and the other rooted in Canadian equities. I’d be more than comfortable splitting a $10,000 investment between the two. Read on to find out which ones.

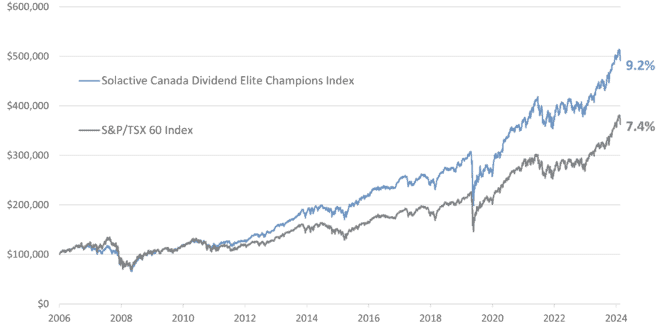

Canadian dividend growers

For Canadian dividend exposure, I want a fund that tracks an index that has historically outperformed the S&P/TSX 60—with higher returns, lower volatility, and a better yield.

That’s exactly what you get here. The ETF holds a portfolio of high-quality Canadian companies with at least six consecutive years of dividend growth. These are proven blue-chip names that offer both stability and income, and the fund weights them equally so no single stock dominates the portfolio.

You also get monthly payouts, no management fees for the first year, and a simple way to own a broad basket of Canada’s most consistent dividend growers—all in one ticker.

The ETF is Hamilton CHAMPIONS™ Canadian Dividend Index ETF (TSX:CMVP). After the fee waiver, the ongoing management fee is still just 0.19%, making it one of the more cost-effective dividend ETFs in Canada.

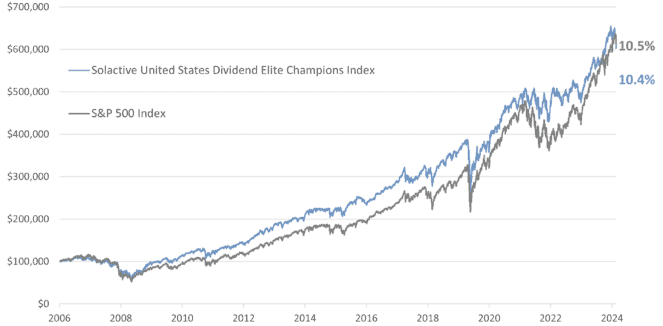

U.S. dividend growers

For U.S. dividend exposure, I’m looking for a fund that delivers similar advantages to CMVP—strong long-term returns, lower volatility, and reliable income—but tailored to the much larger U.S. market.

That’s where this ETF comes in. It follows the same core principles as CMVP but applies slightly different rules to account for the deeper U.S. stock universe. It only includes companies with 25 or more consecutive years of dividend growth. Out of more than 5,000 U.S.-listed stocks, only a select few meet that threshold.

The portfolio focuses on proven, household-name businesses and leans toward defensive sectors like healthcare, consumer staples, and industrials, offering steadier performance than tech-heavy alternatives.

To complement a $5,000 position in CMVP, I’d pair it with $5,000 in Hamilton CHAMPIONS™ U.S. Dividend Index ETF (TSX:SMVP). It provides monthly income, exposure to elite U.S. dividend growers, and, after the fee waiver, a low 0.19% management fee.