There are two main schools of thought when it comes to dividend investing. The first is yield-at-all-costs, whereby investors chase the highest payouts possible, often at the expense of stability. The second is dividend growth, which doesn’t always offer the biggest headline yield but focuses on companies that increase their dividends year after year without interruption.

I lean toward the latter camp because dividend growth signals strong balance sheets, sustainable cash flows, and management confidence. One Canadian ETF designed specifically for this approach is the Hamilton CHAMPIONS™ Canadian Dividend Index ETF (TSX:CMVP). Here’s why I like it as a core holding in a tax-free savings account (TFSA).

How CMVP works

CMVP tracks the Solactive Canada Dividend Elite Champions Index, which screens for companies with at least six consecutive years of dividend increases and no cuts. This results in an average annual dividend growth rate of 10%. The result is a blue-chip tilt, with holdings averaging a $73 billion market capitalization.

In practice, this means you’re getting Canada’s most established dividend payers – banks, insurers, utilities, railways, and pipelines – names many investors already trust as core holdings.

By demanding both dividend growth and stability, the index avoids yield traps, where a high dividend today masks underlying business risk. Instead, it emphasizes companies with durable cash flows and balance sheet strength that can keep raising payouts year after year.

CMVP outperformance

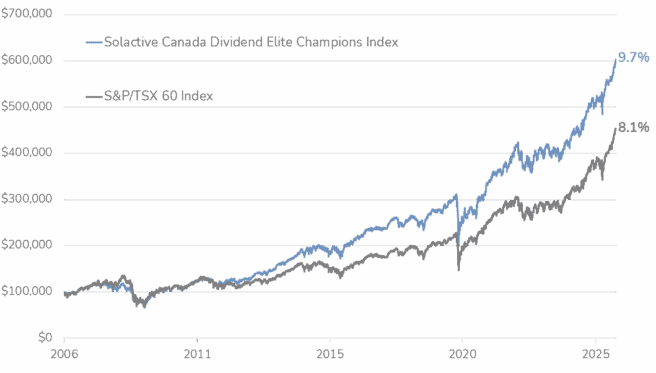

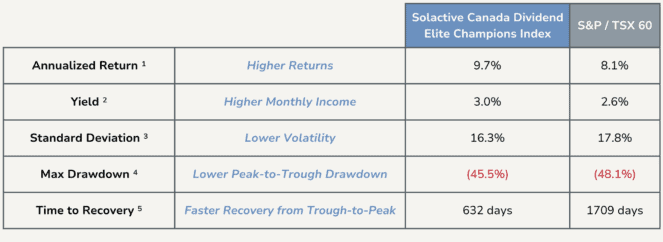

Performance isn’t just about returns, but also how smoothly those returns are delivered. In Hamilton’s backtested data, CMVP’s benchmark not only outpaced the S&P/TSX 60 over the long term, but it did so with less volatility.

That means it captured stronger compounding without as many gut-wrenching drawdowns. The index also delivered a higher yield than the TSX 60, which makes sense given the dividend-focused screen. Perhaps more importantly, when markets did stumble, the index recovered faster.

That combination – higher returns, less risk, quicker recovery – is exactly what long-term dividend investors want. It suggests that CMVP’s methodology rewards patience by sticking with companies that not only pay dividends, but steadily grow them, reinforcing shareholder value through both cash flow and resilience.

The Foolish takeaway

CMVP’s 2% yield isn’t the biggest, but this ETF isn’t about chasing yield. It’s about owning a portfolio of dividend champions that combine growth, quality, and stability, all of which are factors that matter far more in a TFSA where compounding is tax-free.

On top of that, CMVP is currently fee-free until January 31, 2026. After that, the management fee is just 0.19%, still well below the cost of most managed dividend ETFs in Canada.