This article first appeared on our U.S. website.

After plummeting by 33% back in 2022, the Nasdaq Composite (NASDAQINDEX: ^IXIC) has staged a remarkable comeback fueled by one unstoppable megatrend: artificial intelligence (AI). From cutting-edge semiconductors powering hyperscale data centres to cloud platforms deploying generative AI at scale, investors are witnessing the dawn of a new industrial revolution.

With trillions of dollars of AI infrastructure spending set to reshape the global economy, there may be no better time to put $1,000 to work in the companies driving this transformation.

Three standouts dominate this next wave of growth: Nvidia (NASDAQ: NVDA), Taiwan Semiconductor Manufacturing (NYSE: TSM), and Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG). Each plays a unique yet indispensable role in the AI ecosystem — and each still offers significant long-term upside for patient investors.

1. Nvidia: The engine powering the AI revolution

It’s nearly impossible to talk about growth stocks today without mentioning Nvidia — the company that has become virtually synonymous with the AI boom. Nvidia’s graphics processing units (GPUs) form the backbone of the world’s most advanced data centres, powering the training and inference of large language models (LLMs), autonomous systems, and next-generation smart devices.

But Nvidia’s dominance extends far beyond hardware. The company’s CUDA software platform has created one of the most tightly integrated ecosystems in the tech industry — a moat so deep that competitors struggle to disrupt it or convince developers to switch. As hyperscalers like Meta Platforms, Oracle, Microsoft, and Amazon race to expand their AI infrastructure, demand for Nvidia’s chips — particularly its Blackwell architecture — continues to surge at an unprecedented pace.

With these powerful tailwinds, Nvidia’s growth runway looks extraordinary. Some analysts project the company’s future market value could reach between US$10 trillion and US$20 trillion in the long run — implying more than 300% upside from current levels.

2. Taiwan Semiconductor: The sleeper “picks-and-shovels” play

While Nvidia commands the spotlight, Taiwan Semi quietly makes the entire chip industry possible. As the world’s largest and most advanced contract chip manufacturer, TSMC fabricates the cutting-edge semiconductors that power everything from AI accelerators to Internet of Things (IoT) devices and smartphones.

The company’s importance to the global tech ecosystem can’t be overstated. Major chip designers — from Nvidia and Advanced Micro Devices to Apple — rely on TSMC’s unmatched precision and process innovation. Its leadership in advanced node technology has cemented a commanding lead over rivals like Samsung and Intel — allowing it to set the pace for the entire semiconductor industry.

As worldwide demand for high-performance computing and AI infrastructure surges, TSMC stands to benefit from powerful secular tailwinds driving record levels of capital expenditure (capex) across the chip supply chain. Meanwhile, the company’s geographic diversification strategy, including new fabs in the U.S., adds a layer of resilience that should appeal to Western developers and governments alike.

For investors seeking a durable pick-and-shovels play in the AI gold rush, TSMC is hard to beat.

Image source: Taiwan Semiconductor Manufacturing.

3. Alphabet: The overlooked AI powerhouse

Alphabet may not be the flashiest AI stock, but it’s arguably the most deeply woven into our everyday lives. The company’s vast ecosystem — spanning Google Search, YouTube, Android, and Google Cloud — gives it unparalleled access to both consumer and enterprise data, creating a powerful foundation for AI-driven innovation.

Alphabet is now embedding AI across nearly every corner of its business. Its flagship AI platform, Gemini — the company’s answer to ChatGPT — is reshaping everything from Google Search queries and Workspace tools like Sheets and Docs to YouTube’s recommendation engine.

On the enterprise front, Google Cloud continues to gain momentum against rivals like Microsoft Azure and Amazon Web Services (AWS) — highlighted by recent megadeals with Meta Platforms and OpenAI.

What makes Alphabet so compelling is its ability to monetize AI across multiple verticals — advertising, cloud computing, and workplace automation software. With one of the strongest data moats and balance sheets in tech, Alphabet isn’t just adopting AI; it’s redefining how the world interacts with it.

The bottom line: 3 AI leaders, 1 long-term opportunity

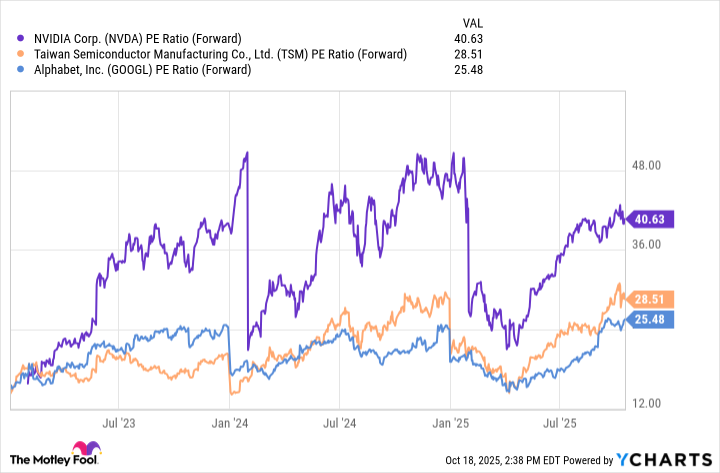

The chart below illustrates trends in the forward price-to-earnings (P/E) ratios of Nvidia, Taiwan Semi, and Alphabet over the last five years.

NVDA PE Ratio (Forward) data by YCharts. Calculations based on U.S. dollars.

Nvidia’s premium multiple reflects investor conviction in its unmatched dominance as the engine of AI computing. As demand for next-generation GPUs and AI infrastructure continues to surge, the company’s earnings growth could easily support even higher valuations.

Taiwan Semi, meanwhile, maintains strong pricing power as the world’s most advanced chip manufacturer. As AI chip production scales globally and new fabrication capacity comes online, TSMC’s profitability and valuation multiples could both see meaningful upside.

Alphabet, by contrast, trades at the most modest multiple of the group — a sign that it may be undervalued relative to its broad, diversified exposure to AI across many use cases and applications.

Collectively, all three stocks are trading at or below prior peaks in valuation ratios, despite enjoying more catalysts than ever before. This disconnect suggests room for valuation expansion as AI adoption deepens across every major industry.