If I had to pick one single stock to form the core of my portfolio, it would be Enbridge (TSX:ENB). For Canadian investors seeking dependable passive income, Enbridge has proven to be a reliable cash-flow machine, churning out juicy dividends to investors through every imaginable economic cycle. It’s a prime candidate for a long-term “buy-and-hold” investment strategy, especially in a retirement account. Its history shows exactly why it has almost never disappointed loyal, income-oriented investors.

Enbridge stock: A dividend history you can bank on

Enbridge boasts an expansive asset base comprised mostly of pipelines that continue to flow throughout all economic seasons. It is more than just a reliable dividend payer; it’s a consistent dividend grower. The company has proudly paid dividends to its shareholders for over 70 years. Even more impressively, it has increased its payout for 29 consecutive years.

Just think about that: this payout has survived the past eight economic recessions. While other companies were cutting or suspending their dividends during periods of market panic, Enbridge stock’s 29-year dividend growth spree continued right through the three most recent downturns.

Enbridge’s dividend stability and dependability provide consistent portfolio cash flow and reliable passive income, which is exactly what so many of us need – more so during tough economic times. This unmatched track record alone makes it a top Canadian dividend stock to buy now.

More than just income: ENB stock a total return powerhouse

While Enbridge’s current 5.7% dividend yield is the main attraction for income seekers, early investors have also been handsomely rewarded with capital gains. The real magic happens when you combine the two.

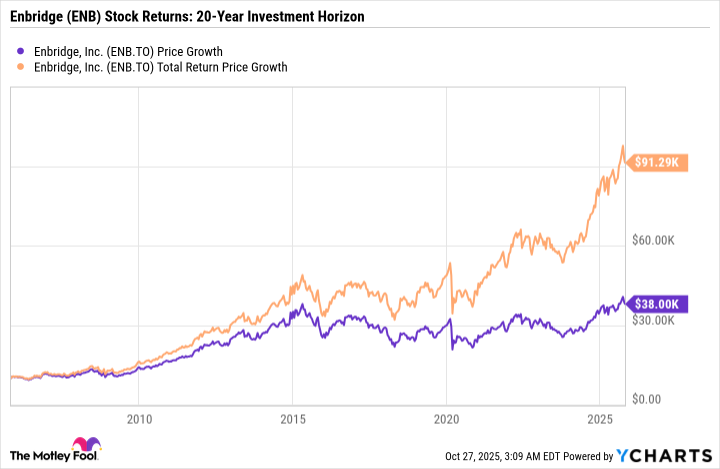

A $10,000 investment in Enbridge stock 20 years ago, with all dividends reinvested, could have grown to over $91,000. That’s a staggering total return of 813%.

Even if you had spent every single dividend cheque along the way, your initial $10,000 capital would still have grown to $38,000, a 280% capital gain.

Enbridge’s dividends have been a massive and critical component of the long-term total returns from owning ENB stock.

How will Enbridge fund future payouts

Past performance is great, but how will Enbridge keep rewarding investors for the next decade?

The company’s business is built on a massive, low-risk foundation. Enbridge owns an extensive and irreplaceable network of midstream assets, transporting about 30% of all crude oil produced in North America. It also operates Canada’s largest natural gas distribution company. This is a steadily growing business generating over 98% of its earnings before interest, taxes, depreciation, and amortization (EBITDA) from regulated assets or long-term contracts. Its revenue and earnings remain relatively immune to U.S. tariffs on Canadian energy, and Enbridge’s business model insulates it from wild swings in commodity prices.

Enbridge is growing its footprint; its recent quarterly results prove the growth story is accelerating. The company delivered record second-quarter EBITDA. More importantly, Enbridge is actively funding its next decade of dividends by sanctioning new projects. It recently green-lit the US$0.9 billion Clear Fork Solar project to support Meta Platforms’s (NASDAQ:META) data centre operations and new expansions to its gas pipelines to serve rising industrial demand and the LNG export market.

The company is leveraging its revenue and cash flow stability to expand through a $32 billion secured capital program. This includes investing heavily in its gas transmission and renewables businesses to serve the surging power demand from new industries like artificial intelligence (AI) data centres. Management expects investment programs to support 5% annual growth in distributable cash flow (DCF) per share after 2026. DCF funds dividends, and a growing DCF supports sustainable dividend growth into the future.

Investor takeaway

Enbridge stock is a defensive investment that offers an attractive package of high yield and steady growth. With a strong balance sheet, an investment-grade credit rating, and a clear plan for growth, this is a dividend growth stock that truly lets long-term investors sleep well at night.