This article first appeared on our U.S. website.

Since I began my investing journey about 10 years ago, I’ve witnessed my share of emerging themes built on hype, euphoria, and hope. From blockchain technology to the metaverse, I don’t think I’ve seen anything quite like the excitement around the artificial intelligence (AI) megatrend.

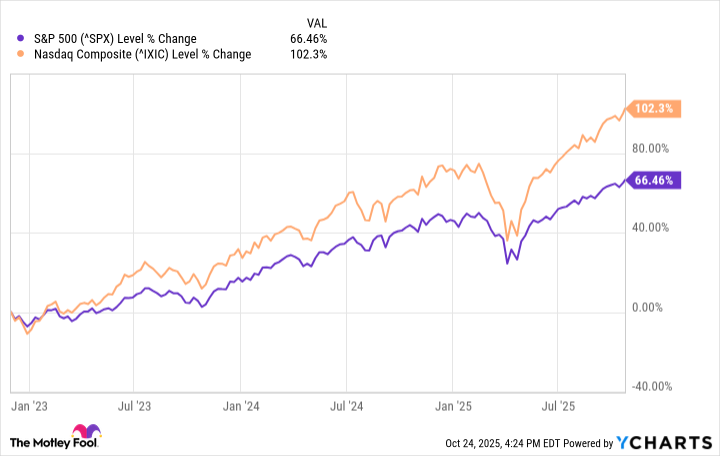

Since OpenAI commercially launched ChatGPT on Nov. 30, 2022, the S&P 500 has returned 66% while the tech-heavy Nasdaq Composite has soared by more than 100%. In case you’re new to investing, these are abnormally high returns for such a short time period.

^SPX data by YCharts

That said, the AI revolution has been anything but ordinary. One company in particular — semiconductor powerhouse Nvidia (NASDAQ: NVDA) — has emerged as the most potent company in the tech sector over the last few years. And I don’t think its momentum is slowing anytime soon.

Let’s explore how Nvidia became the most powerful force in the AI arena and assess what catalysts are on the horizon.

How and why Nvidia became king of the AI realm

Back in the late 1990s, Nvidia developed a piece of hardware known as the graphics processing unit (GPU). At the time, these chips were primarily used for one application: enhancing visuals for video games.

However, the company’s visionary CEO, Jensen Huang, understood that the GPU was far more ubiquitous. While use cases remained limited for years, the rise of AI paved the way for Nvidia to make a splash given these applications’ need for higher processing power.

Today, Nvidia is the gold standard for training and inferencing myriad generative AI products — from humanoid robotics, autonomous vehicles, and large language models (LLMs).

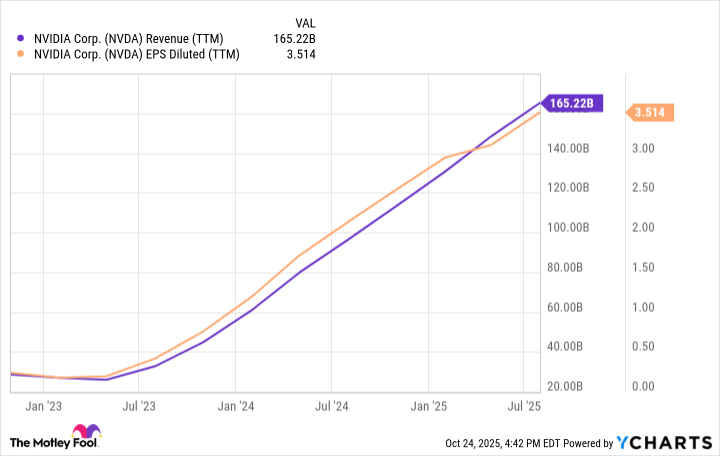

NVDA Revenue (TTM) data by YCharts. Currency in U.S. dollars.

Unprecedented demand for Nvidia’s GPUs has ushered in a wave of historical revenue acceleration that’s been augmented with record profit growth — a testament to the company’s enormous pricing power in the chip market.

Perhaps unsurprisingly, Nvidia has seen its market value rise by a factor of nearly 13 times during the AI revolution — propelling the company past Apple and Microsoft as the most valuable business in the world.

Tailwinds worth trillions

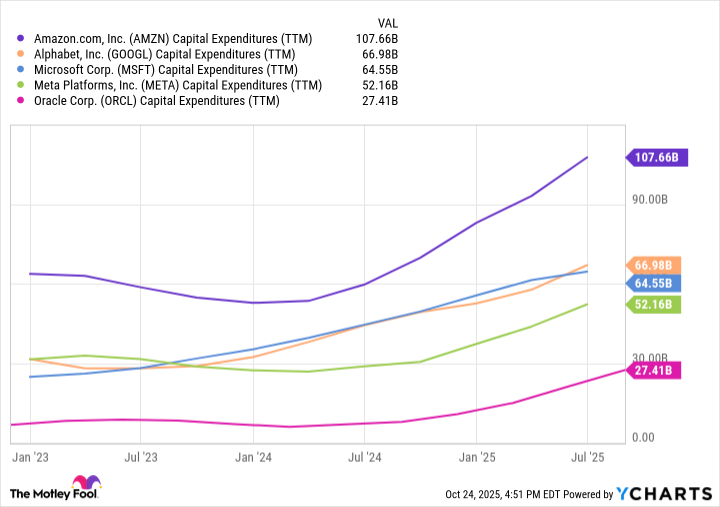

At its core, a large portion of Nvidia’s future growth can be summed up by one accounting term: capital expenditures (capex). Capex is just Wall Street jargon for spending related to infrastructure and property buildouts, such as data centers.

AMZN Capital Expenditures (TTM) data by YCharts, Currency in U.S. dollars.

Over the last three years, hyperscalers have collectively spent several hundred billion U.S. dollars on capex — much of which has been allocated to procuring Nvidia’s GPUs. While investors may be wary that demand is peaking, think again.

According to Huang, AI infrastructure buildouts are in their early innings. He expects capex to accelerate to US$4 trillion by 2030. Management consulting firm McKinsey & Company is even more optimistic — calling for nearly US$7 trillion to be spent on data centres, networking equipment, and renewable energy services to keep up with chip and power demand through the rest of the decade.

Piggybacking off of this opportunity is an emerging service called the neocloud. Companies such as Nebius Group, CoreWeave, and Iren are pioneers of the neocloud movement — a business model in which businesses equip data centres with GPUs and then rent that hardware to other companies.

The value proposition of infrastructure services is that it helps mitigate supply chain bottlenecks while offering companies with limited financial resources access to industry-leading AI development protocols. This is important for Nvidia, as neocloud providers help ensure demand for the company’s chips remains steady.

Lastly, Nvidia has been using some of its excess cash flow to strike a number of strategic partnerships. Perhaps most notable was a deal announced last month with Intel. As part of their alliance, Intel will be designing custom CPUs for Nvidia’s infrastructure — potentially giving the chip behemoth even more of a leg up in its chief rival, Advanced Micro Devices.

What will Nvidia’s stock price be in three years?

The secular tailwinds explored above — namely, accelerating capex from hyperscalers — has one analyst on Wall Street, Beth Kindig of the I/O Fund, forecasting a market capitalization of US$6 trillion for Nvidia by the end of 2026 — a target that I, too, think is well within reach.

Furthermore, I recently broke down in a separate article what growth rates would be required in order for Nvidia to reach a US$10 trillion valuation by 2030.

By 2028, I think Nvidia could be trading around the midpoint of the ranges above — close to US$8 trillion. But what does that mean in terms of share price? Let’s break down the math.

Nvidia currently boasts a market value of roughly US$4.5 trillion and has 24.3 billion outstanding shares. This translates to a share price of about $185. For the sake of this analysis, I’ll hold the company’s share count steady. This means an US$8 trillion valuation would yield an implied future share price of about US$329 — representing 78% upside from current levels.

For investors, the key here is not to get too hung up on the precision of future price targets. After all, the analysis above is more of a theoretical exercise — having a bit of fun with numbers.

While I do not have a crystal ball, I remain bullish over Nvidia’s prospects over the next few years as AI infrastructure spending continues to accelerate and view the stock as a compelling buy-and-hold opportunity.