If you held Bank of Nova Scotia (TSX:BNS) stock through 2025, you are likely smiling right now. The “American Pivot” is paying off, and may keep doing so in 2026.

The “International Bank” has finally started to look a little less international and a lot more North American. With the stock up 28.7% year to date, management’s bold turnaround strategy of exiting high-risk Central American markets to double down on the stable United States is garnering applause from Bay Street.

But looking ahead to 2026, the investment outlook should answer a key question. We know the restructuring is working, but is the Canadian bank stock still a buy after such a massive run? Here is the outlook for BNS stock as we head into the new year.

The great “de-risking” continues

For years, Scotiabank stock traded at a discount compared to peers because of its exposure to volatile emerging markets in Colombia, Peru, and Chile. 2025 significantly changed that narrative.

On December 1, Scotiabank completed the sale of its Colombia and Central America assets to Davivienda. Simultaneously, it cemented its footprint in the U.S. by completing a 15% investment in KeyCorp and announcing a new regional office in Dallas.

The impact on earnings quality is undeniable. During the fourth quarter of 2025 (Q4 2025), U.S. earnings contributed 16% to the total pot, a massive structural shift for the bank’s earnings quality.

By swapping volatile emerging market earnings for stable U.S. dollars, Scotiabank is effectively lowering its earnings risk profile. Investors are generally willing to pay more for a dollar of earnings from a stable source, and they discount earnings from volatile economies. For long-term investors, this “de-risking” often leads to a higher share price over time (a phenomenon called multiple expansion), even if earnings growth is modest.

Scotiabank stock’s dividend outlook

Scotiabank stock is a passive-income source for many Canadian dividend investors. Heading into 2026, BNS stock yields a generous 4.4%. The bank has paid dividends continuously since 1832, and 2026 should be no exception. With a common equity tier-one (CET1) ratio of 13.2%, the bank’s balance sheet is fortress-strong, ensuring your quarterly cheque is safe.

However, income investors need to watch the payout ratio. Currently sitting just under 75%, the payout is safe, but it is on the high side relative to industry peers. A high payout ratio means the bank retains less capital to reinvest into organic growth. It weighs down the bank’s organic growth capacity.

While I fully expect Scotiabank to raise its dividend in 2026, investors should temper their expectations regarding the size of that hike. Until the bank’s earnings growth fully outpaces its dividend commitments, we will likely see low-to-mid single-digit dividend increases. That’s perfectly acceptable for income investors holding this bank stock in a Tax-Free Savings Account: you get a high starting yield and safety, with inflation-matching growth.

BNS’s restructuring: The new normal?

If there is a grey cloud in this silver lining, it is the recurring “one-time” charges.

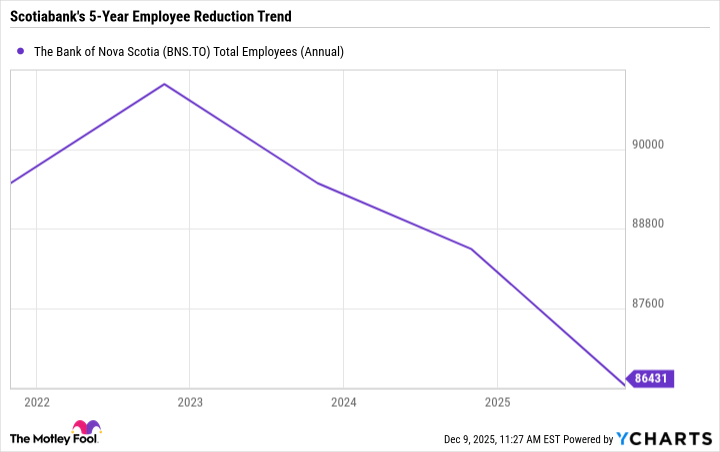

In Q4 2025, the bank took $373 million in restructuring charges, largely for workforce reductions. This follows similar charges in 2023 and 2024. With its employee count now down to 86,431 (levels last seen in 2018), Scotiabank could be aggressively using technology to replace headcount.

BNS Total Employees (Annual) data by YCharts

While restructuring charges drag down immediate return on equity, they signal a leaner, more digitized future. If these cuts result in sustained efficiency in 2026, the temporary pain will be worth the long-term gain.

Valuation: Scotiabank stock still a bargain

Despite the 28% rally in 2025, the BNS stock hasn’t entered overbought territory. Scotiabank heads into 2026 trading at a forward price-to-earnings (P/E) ratio of just 11. This remains one of the cheapest valuations among the Big Five Canadian banks, offering a tantalizing entry point for value investors who believe the U.S. strategy is just getting started.

The Foolish bottom line

Bank of Nova Scotia is entering 2026 as a structurally different bank than it was five years ago. It’s leaner, more focused on North America, and less exposed to geopolitical volatility. Despite an outlook for slower dividend growth in 2026, BNS looks ready to deliver in 2026 for investors seeking a blend of steady income and a value-priced turnaround story.