TSX:ET (Evertz Technologies Limited)

About ET

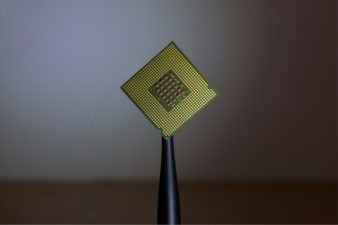

Evertz Technologies Limited (TSX: ET) designs, manufactures and markets video and audio infrastructure solutions for the television, telecommunications and new-media industries. The Company's solutions are purchased by content creators, broadcasters, specialty channels and television service providers to support their increasingly complex multi-channel digital, and high and ultra-high definition television ('HDTV' and 'UHD') and next generation high bandwidth low latency IP network environments and by telecommunications and new-media companies. The Company's products allow its customers to generate additional revenue while reducing costs through efficient signal routing, distribution, monitoring and management of content as well as the automation and orchestration of more streamlined and agile workflow processes on premise and in the 'Cloud'.

Evertz Technologies Limited (TSX: ET) Latest News

Dividend Stocks

3 Tech Stocks Trading at 52-Week Highs to Buy Right Now

Tech Stocks

Forget Shopify (TSX:SHOP): These 2 Tech Stocks Have Much More Potential

Tech Stocks

These 2 Cheap Tech Stocks Are Not Worth Investing in

Dividend Stocks

These 2 Top Dividend Stocks Are a Stock Picker’s Dream Come True

Dividend Stocks

2 Small-Cap Dividend Stocks for Young Investors to Feed Off

Dividend Stocks

2 Cheap Stocks I’d Buy Right Now

Dividend Stocks

2 Undervalued Small-Cap Dividend Stocks That Are On Sale Now

Dividend Stocks

Have Your Tech and Income, Too

Dividend Stocks

The Top 10 Canadian Stocks Ranked by Overall Strength