The recent massive sell-off in marijuana stocks amid a general stock market decline could easily sway CanniMed Therapeutics Inc. (TSX:CMED) shareholders towards the cash plus stock conversion option in the Aurora Cannabis Inc. (TSX:ACB) takeover offer, as long as Aurora’s share price remains below a critical point.

As of close of trade on February 2, Aurora shares exchanged hands at $8.50, while CanniMed stock traded at $26.45 after a broader stock market valuation decline.

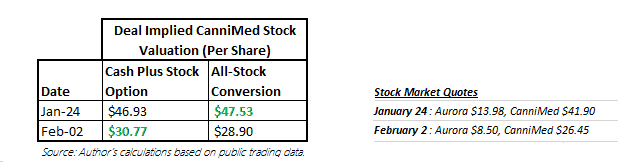

Aurora’s stock price was down 39.20% from its $13.98 trading level on January 24, the day both CanniMed and Aurora announced an updated (and now friendly) Aurora takeover offer for all the outstanding shares of CanniMed at $43 a share in a deal valued at $1.1 billion.

Aurora is offering either 3.40 Aurora shares for each CanniMed share in an all-stock conversion option, or 2.9493 Aurora shares plus $5.70 in cash for each CanniMed share tendered in the alternative payment option. The offer is open until March 9, 2018.

At current trading levels, the stock plus cash option is much more superior to the all-stock option.

Superior cash option

CanniMed investors would most likely have favoured the all-stock option if Aurora shares had continued to trade north of the $13 price point during the period up to the close of the offer. This option would have offered them superior value than the cash alternative.

However, as Aurora’s stock falls, the $5.70 cash portion of the alternative conversion makes the cash option much more superior to the all-stock alternative. In fact, as shown in the table below, at $8.50 trading levels for Aurora stock, the cash option was 6% more valuable and will remain more lucrative as long as Aurora’s stock price remains below the $12.65 volume-weighted average share price used in the revised offer.

CanniMed shareholders are better off taking the all-share conversion option at any share price above $12.65 for Aurora stock. As the stock trades below this price point, they realize better value by receiving cash and buying Aurora stock at prevailing market quotes.

Excluding trading costs and taking the $8.50 for Aurora stock on Friday, they could get up to 3.6199 Aurora shares for each CanniMed share, which is much better than the 3.40 Aurora shares on offer in an all-share transaction.

Lower dilution for Aurora shareholders?

Using Aurora’s 452.73 million outstanding share count reported by TMXMoney.com on Friday, CanniMed shareholders will own 15.65% of the combined firm on an undiluted basis if they choose to get the 84 million Aurora shares in an all-stock conversion option. They will own 2% less should they fully take the cash-infused deal.

The cash-infused option could set off Aurora some $140 million in cash if fully subscribed, but it would result in less dilution for current Aurora shareholders. However, it seems like Aurora investors still face the risk of further dilution after the CanniMed deal closes.

Investor takeaway

It’s highly likely that most CanniMed shareholders will opt to receive some cash in a merger with Aurora if the current dip in Aurora stock persists until March 9, 2018. The option is much less dilutive for current Aurora investors, but it may rob the combined entity of much-needed liquidity to fund current and future expansion programs.

CanniMed had some $48 million in cash and cash equivalents on its balance sheet by October 31, 2017. The liquid assets will be available to Aurora for deployment, but they may not be enough to fully fund expansion programs.

Moreover, the most recent $55 million private placement deal Aurora entered with soon-to-be-listed The Green Organic Dutchman, the $103.5 million placed on Liquor Stores N.A. Ltd., and the Denmark expansion deal are all cash-draining endeavours that could ultimately require Aurora to source for new financing in an increasingly volatile financial market.

It’s not surprising that Aurora may announce a new equity raise later during this first half of the year to replenish its cash coffers, as it pursues aggressive expansion programs.

Investors should take note of the potential for further near-term dilution as Aurora grows.