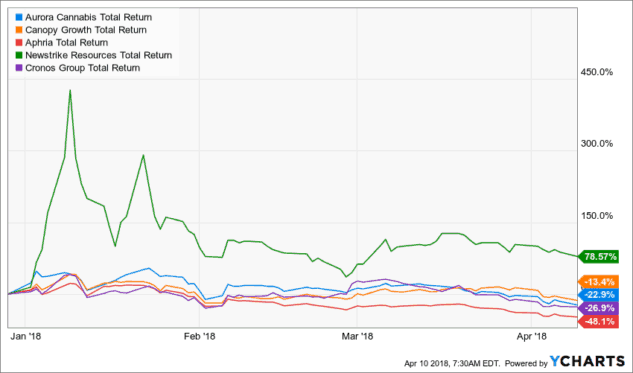

Canadian marijuana stocks are going through a period of severe weakness, and losses are compounding for leading names, including market leader Canopy Growth Corp. (TSX:WEED) and rising contender Aurora Cannabis Inc. (TSX:ACB). The stocks have underperformed a weak broader market of late. Could valuations recover in time to beat the S&P/TSX Composite Index this year?

Judging from the magnitude of the plunge, it may seem like all hope is gone, and a sell recommendation may seem obvious. That said, a look at the valuation forces ruling this market says otherwise, and bullish investors may have been afforded a lucrative entry point into the sector.

Aurora shares are down 23% year to date, Canopy stock has lost 13%, while Aphria Inc. (TSX:APH) is the worst hit among the top producers. The S&P/TSX Composite Index has lost 6.06% during the same period.

Is there panic selling?

Marijuana stock valuations were likely driven by investor herding behaviour that significantly lifted share prices in January. Severe market volatility across the global stock markets since February has evidently shaken investor confidence, while recent negative headlines, dominated by fears of a global trade war, have exacerbated market fears.

In this environment, speculative marijuana stock positions cannot be expected to hold. The weak hands, short-term traders, and speculators have no choice but to hit sell buttons and stop loss orders, as cannabis stocks trend lower in a self-reinforcing hysterical sell-off spiral.

Should you sell too?

While I suggested a diversifying marijuana stock sale back in January, the market was at its peak then. Now would be the worst time to exit a cannabis position and realize capital losses — unless one is convinced that the bear market is just starting and gaining dangerous negative momentum.

Case for a rebound

Recreational marijuana legalization is on its way. Even if global trade wars escalate, pharmaceutical demand for cannabis-based non-opioid pain-management solutions is growing in this defensive industry. Canada, by virtue of an early mover advantage, will rule the global medical marijuana export market for a good number of years.

To defend the new market, leading licensed producers are already investing in intellectual capital, as can be seen in the recent Canopy partnership with Beckley Foundation and Lady Amanda Feilding, a renowned global researcher in medical cannabis, in an effort to deepen industry research, and Aurora’s latest acquisition of CanniMed Therapeutics Inc., which has been investing heavily in medical cannabis research for a decade.

Positive momentum will likely return to this young, exponentially growing industry by mid-year. Although slightly delayed, recreational legalization by summer 2018 in Canada is still achievable, and a positive vote for the bill, C-45, may be a huge catalyst for the resurgence of euphoric cannabis market hype.

Evidently, marijuana stock valuations are still high, and no fundamental valuation model can justify the market capitalizations for almost all the industry incumbents today, but who can successfully argue against the market price? We are dealing with a nascent industry whose true potential is yet to be seen, and whose growth rate is not easy to project.

The growth of cannabis edibles and infused beer in a recreational market by 2020 could happen fast, and Constellation Brands is banking on that. Add the pharmaceuticals market potential of medical cannabis, and you have an industry that could be difficult to classify between a consumer defensive and healthcare/pharmaceuticals sector. Marijuana is a new and exploding defensive industry whose potential size and profitability is yet to be revealed.

The above industry attributes make the cannabis sector prone to market euphoria, and it’s easy to see valuations rise again towards recreational legalization and implementation in Canada.

Beating a seemingly weak TSX that may suffer from a financial capital exodus this year is a possibility, but this would largely depend on how much lower cannabis stocks will go from here, as any further weakness will require too big a rebound to outperform the main index.

Investors who are bullish on this new growth industry have been afforded another opportunity to start taking long-term positions in cannabis’s most promising high performers, but, as always, due diligence is necessary.