Look, I’m not the biggest fan of gold stocks.

Their movement is largely tied to the price of gold, which makes them speculative bets in my book. For my long-term holdings, I much prefer “cash cows” with clear competitive advantages that aren’t so leveraged to volatile commodity prices.

But that doesn’t mean I don’t love a smart (and small) gold bet once in a while — particularly in my TFSA account. Well right now, I think Barrick Gold Corp. (TSX:ABX)(NYSE:ABX) might be an attractive way to make that kind of wager.

Let’s take a look, shall we?

Barrick keeps on bricking

First, the obvious: Barrick shares are hurting. The stock is down about 17% over the past year versus a gain of 9% for the S&P/TSX. Weak production, along with the slumping price of gold, has weighed heavily on the shares.

And the bearish news just seems to keep coming.

Earlier this week, Barrick disappointed Bay Street yet again with its preliminary Q2 press release. While the company reaffirmed 2018 gold production, it snipped its full-year copper production. Meanwhile, full-year cost estimates increased due to operational challenges at its Lumwana mine in Zambia.

Q2 gold production of 1.07 million ounces was in line with Q1 production. However, all-in sustaining costs — an industry benchmark — came in at 5-7% higher than expected.

Thus, Barrick isn’t exactly tearing it up operationally. And as far as the price of gold goes, it’s still relatively soft.

So, why do I like the stock as a potentially attractive turnaround play? Simple: company fundamentals are still firm.

Golden opportunity?

Despite this recent bump in gold production costs, Barrick remains one of the clear cost leaders in the industry. Ah, the benefits of massive scale.

In fact, Barrick still expects 2018 gold output of between 4.5 million and five million ounces at all-in sustaining costs of $765-815 an ounce. Even at the high end of that range, those costs are well below today’s gold price of about $1,200 an ounce.

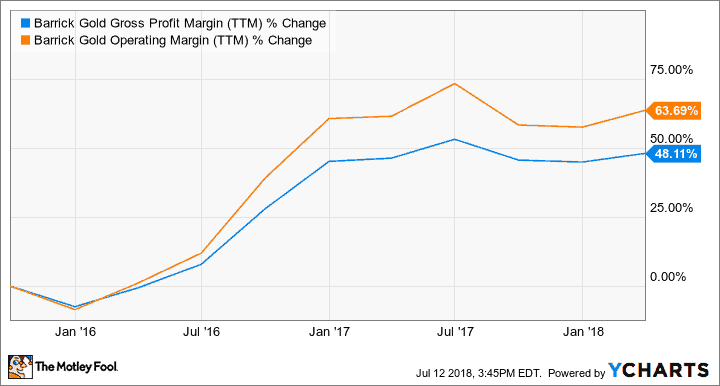

This robust spread is reflected in Barrick’s still-healthy margins.

The company’s overall financial health also continues to improve.

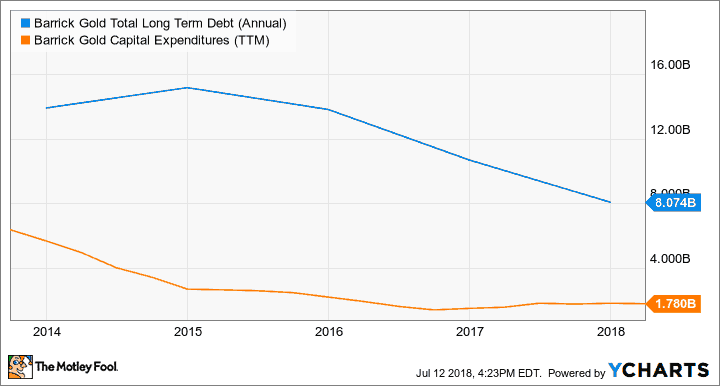

In recent years, management has drastically cut capital expenditures, along with its debt load. Over the past five years, capex and total long-term debt have fallen roughly 70% and 40%, respectively.

Now, a bet on Barrick is certainly still largely tied to the price of gold. But the company’s low-cost leadership and decreasing leverage should go a long way in dampening the risks.

The Foolish bottom line

Barrick’s operations might not be firing on all cylinders. And the stock might not be the best long-term holding.

But when you couple the recent slump in the price of gold with Barrick’s firming fundamentals, the shares seem like an attractive medium-term buy for less risk-averse TFSA accounts.