Here at the Fool, it’s always fundamentals first. As far as we’re concerned, analyzing price charts and staring at ticker tape all day is a waste of time.

We care most about what the business is doing, not the stock.

That said, especially sharp near-term moves need to be looked into — just in case they reflect changes to the long-term investment case.

With that in mind, I’ll highlight three stocks that fell sharply last week. Will they keep crashing? Or will they bounce right back?

Let’s dig in.

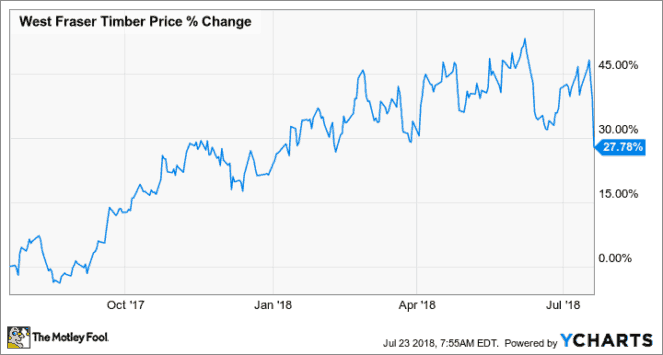

West Fraser Timber

West Fraser Timber Co. Ltd. (TSX:WFT) is down 10% over the past five days, with most of that loss coming at the end of the week.

But here’s the crazy part: the lumber company actually posted very strong Q2 results on Friday. Operating margins jumped 890 basis points to 25.3%, while revenue climbed nearly 39% year over year. Management even repurchased $256 million worth of shares.

So, what’s the problem? Well, Bay Street was clearly expecting more, given the huge run-up in West Fraser shares over the past year.

The price of lumber also fell well below $500 last week.

Still, I’d really consider using this pullback to buy in. West Fraser remains highly diversified and financially strong. After last week’s crash, maybe it’s finally reasonably priced to boot.

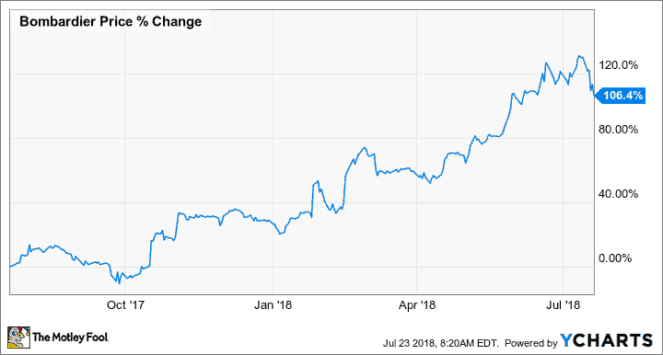

Bombardier

Our next big faller is Bombardier, Inc. (TSX:BBD.B), whose shares are also down 10% over the past five trading days.

Here’s the good part: investors don’t seem to be reacting to any specific bit of bad news. Of course, Bombardier shares have rallied monstrously over the past year. So, it isn’t taking much for investors to take profits off the table.

Remember: Bombardier remains a turnaround story. It’ll need to keep showing progress and providing more signs of sustainable growth. Maybe some investors simply aren’t willing to bet on that anymore.

That’s understandable — even prudent.

But after the huge pullback of late, Bombardier looks attractively priced. I’m siding with fellow Fool Ambrose O’Callaghan on this one: the stock is a buy ahead of its Q2 results in August.

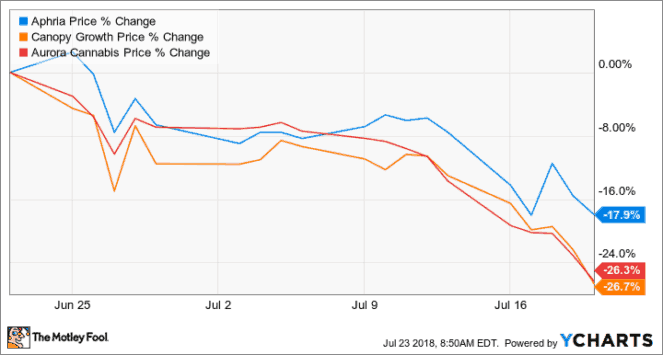

Weed stocks (once more)

Rounding out this week’s losers are marijuana stocks — again.

Major players Aphria Inc. (TSX:APH), Canopy Growth Corp. (TSX:WEED)(NYSE:CGC), and Aurora Cannabis Inc. (TSX:ACB) are all down double digits over the past five days. In fact, their average loss over the past month is now 24%. Ouch.

But just like Bombardier, the huge decline isn’t linked to any specific bad news. Instead, we can chalk it up to the “normal” wackiness of marijuana stock investing.

Because of that reason, I’ll say this: if you’ve been yearning to get into the space, this is a window you should take advantage of. You don’t need to take a big bite — even a little nibble will do the trick. But if you want exposure to marijuana legalization, capitalizing on pullbacks is the way to do it.

Just make sure you have the right risk tolerance (high) and the right time horizon (long) to do it.

The Foolish bottom line

There it is, Fools: five ice-cold stocks that are falling hard. Whether you want to buy, sell, or hold, make sure to do your homework first.