Big short-term gains aren’t our goal here at The Fool. We tend to take the long-term approach, picking solid companies at reasonable prices.

But here’s the thing: if you consistently invest in fundamentally sound businesses, good things tend to happen. And one of things is sometimes a massive short-term pop.

Case in point: yesterday my fellow Fool Stephanie Bedard-Chateauneuf highlighted Enercare (TSX:ECI) as one of her “5 Top Dividend Stocks to Buy in August“.

She did it primarily because of the residential utility specialist’s long-term dividend appeal. But guess what?

Not even a day later, the stock is rocketing more than 50%!

Let’s take a closer look at the pop.

What happened?

Here’s the news that catapulted Enercare shares: Brookfield Infrastructure Partners L.P. (TSX:BIP.UN)(NYSE:BIP) agreed to purchase it for a whopping $4.3 billion.

Enercare shareholders will receive $29 per share. They also have an option to receive some of the price in equity. All-in, the offer represents a huge 53% premium to Enercare’s closing price on Tuesday.

Simply put, it’s a wonderful Wednesday for Enercare shareholders.

What makes Enercare so special?

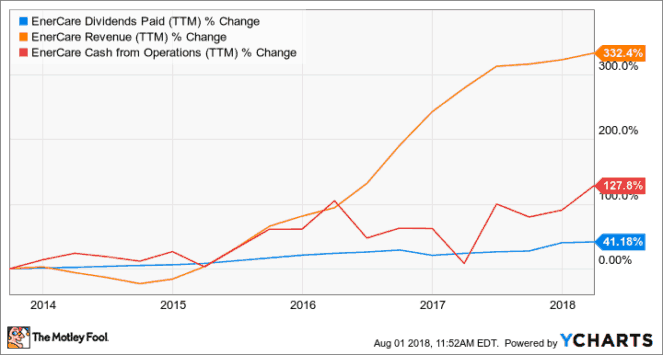

Why is Brookfield making this move? Well, it’s largely for the same reasons that Stephanie singled out Enercare: it’s a high-quality business with a massive base of more than 1.2 million customers, and it has robust dividend-supporting cash flows.

Brookfield obviously loves the price, too. Given Brookfield’s reach in the residential space, management thinks it can grow Enercare and create synergies, even at a 50% premium.

“[Enercare] benefits from stable, long-term cash flows through equipment rentals to a well-established customer base,” said Brookfield Infrastructure CEO Sam Pollock, “and we see attractive opportunities to grow the business and continue to create value.”

Of course, we individual investors will never buy a public company whole.

But here’s the lesson we can take from Stephanie’s call: stable businesses with recurring revenue, growing cash flows, and increasing dividend payments are rare.

As such, they’re highly coveted by small investors and big investors alike.

So, if you see one selling at a good price, give it serious consideration. You don’t want a bigger whale like Brookfield beating you to the punch.

Now what?

Enercare’s upside is limited at this point. Its board unanimously supports the bid. And after today’s 53% surge, the stock basically trades at the $29 offer price.

Now, the deal isn’t completely closed. It still needs two-thirds of support from Enercare shareholders as well as regulatory clearance. But chances are it’s as good as done.

Don’t be too upset, though. Even if you missed the Enercare boat, the market is filled with tonnes of other opportunities.

We’ll never sell you on the dream of big short-term gains. But if you constantly put the odds on your side — good businesses at good prices — they are definitely possible.