If you’re a mining investor, you don’t need a reminder about how rough it’s been in recent years. Slumping resource prices and lackluster production have weighed heavily on the sector.

But with the stock market continuing to soar, one could argue that these plays now provide a decent hedge against a downturn. If operations are improving, a few of them can even add massive upside to boot.

Case in point: Pretium Resources Inc. (TSX:PVG)(NYSE:PVG). The shares soared a staggering 19.4% on Friday after posting Q2 results.

Is there more meat on the bone? Let’s find out.

Pretty Pretium

Here’s quick breakdown of the quarter: EPS clocked in at $0.26 (smashing estimates by $0.20) on revenue of $146.5 million (smoking estimates by $63 million).

The results were driven by much stronger-than-expected production at Pretium’s Brucejack Mine in British Columbia. In Q2, production totaled 111,340 oz. of gold and 118,205 oz. of silver. Moreover, all-in sustaining costs were $648 oz. of gold sold — also better than expectations.

But this is what has Bay Street really pumped: the rest of 2018 looks even better.

Management now expects second-half Brucejack gold production of 200,000-220,000 oz. That translates to total 2018 gold production of 387,000-407,000 oz. And with Brucejack having now reached steady state production, Pretium will finally be able to focus primarily on efficiency.

“In the first half of the year, we’ve reached steady state production, fully implemented our grade control program and met our production guidance,” said CEO Joseph Ovsenek. “We intend to build on this positive momentum for the remainder of the year, firmly establishing Pretium as a premier high-grade gold producer.”

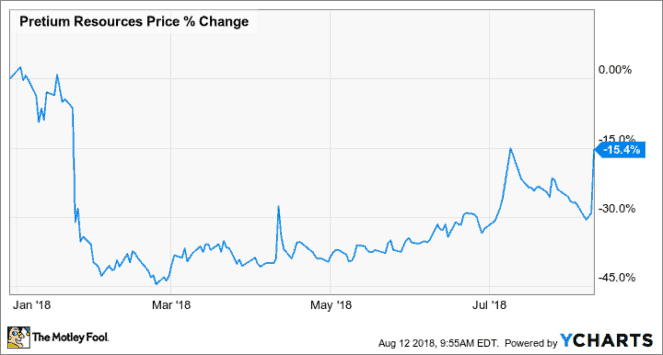

Remember, Fools: Pretium stock was walloped in January — down 30% in a single day — after announcing extremely disappointing production and costs forecasts.

So, it’s no surprise that investors are breathing a massive sigh of relief right now.

Further, the company’s cash balance shot up by more than $72 million in Q2 to $142.5 million. The company currently has working capital of $132 million. At the same point last year, it had negative working capital of $12.9 million. With management explicitly stating that it will keep looking to stack cash, Pretium’s risks seem to be decreasing.

Pretium’s foundation is strengthening on all fronts: production, costs, and the balance sheet. That’s usually a good recipe for continued share price gains.

The bottom line

Pretium looks to be a good place going forward, but you still need to be cautious. The stock swings wildly, boasting more than double the volatility of the overall market. So, it’s definitely not ideal for retirees.

But with the shares still off more than 20% from their 52-week highs, less risk-averse investors might want to use Pretium as a market hedge with some golden upside.