Investors in Capital Power (TSX:CPX) have had a very good return on the stock so far in 2018, as the power-generation firm continues to make a bold claim as an income investment holding of choice that offers a juicy dividend yield, while its growth projects and acquisitions activity has added some growth momentum to the share price.

Capital Power is an Alberta-headquartered, growth-oriented power producer that owns and operates power-generation facilities in Canada and the United States using a variety of energy sources on 24 facilities with a 4,500-megawatt capacity. It has new development projects in Alberta, North Dakota, and Illinois at advanced stages to add about 1,000 megawatts of owned generation capacity.

The company has made impressive growth progress since inception nine years ago. Since 2014, the accelerated growth in adjusted funds from operations (AFFO) at a compounded annual rate of approximately 10% is a welcome achievement. The performance has also come with an average annual dividend increase of 7% since 2015.

The dividend on the common stock currently yields 6.17% on an annualized basis, and the company guides for a further 7% annual dividend increases to 2020. The dividend was recently raised by 7.19% to $0.4475 per quarter, and the ex-dividend date is on September 27 for those who may want to initiate a position and capture this new quarterly income installment.

At the expected dividend-growth rate through 2020, one could expect to enjoy an annual income yield of 7% by the end of 2020, which is not bad on a growing quality income stock.

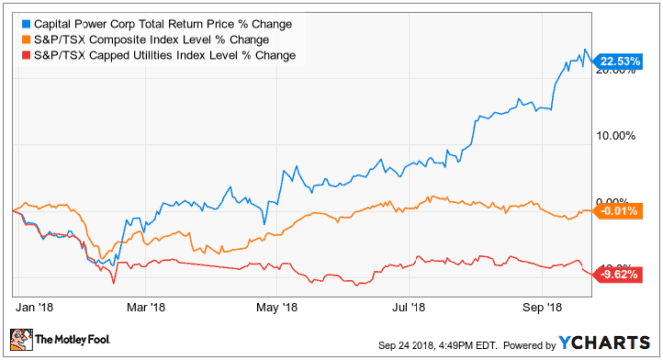

Total investment returns on Capital Power have been great so far in 2018, significantly outperforming the broader TSX and beating the S&P/TSX Utilities index by a wide margin.

Why this sustained share price growth momentum?

Capital Power has seen ever-improving business prospects in Alberta. Low natural gas prices have improved operating margins, while a strong recovery in power prices in the province have been a hugely positive development, boosting both profitability and cash flow generation as the company moves to optimize the use of gas-fired generation technology in its gas- and coal-powered facilities.

Further, there an improved cash flow visibility for the firm, as 82% of its annual production is contracted, up from just 66% just three years ago, and that’s a favourable development.

Most noteworthy, Capital Power has significantly diversified its market exposure. The company had a 74% exposure to the Alberta power market in 2015, and today this province accounts for only 57% of the company’s production.

The company has maintained its investment-grade rating as it executes for growth, while U.S. tax policy has already generated some one-time gains on renegotiated terms.

Share-repurchase program

The ongoing normal course issuer bid is favourable to potential capital gains, as the energy firm reduces its total outstanding common share count. The current share-buyback program aims to repurchase up to 9,300,000 common shares for cancellation and will expire in February 2019. About 1,700,000 shares worth $42 million have been re-purchased and cancelled by mid-year this year.

This could partly explain the sustained share price growth on the stock this year. The company is likely active in the open market at this point.

Accretive acquisitions

There’s an announced plan to acquire a 580-megawatt contracted natural gas-fueled facility in Arizona. The acquisition is expected to increase AFFO by 6% as well as improve projected earnings per share by 2%% during the next five years. The company will not raise new equity to finance the deal, thus avoiding direct shareholder dilution, but the transaction will add more permanent debt to the capital structure.

Investor takeaway

The current share price momentum on this income growth stock is appealing, as it could generate welcome capital gains if it is sustained. That said, momentum may easily be followed by future valuation corrections.

The current dividend seems well covered and the expected annual dividend increases in the future supports an income investment thesis on this power-generating firm. Any dip in the stock price would be a great entry point for long-term investors.