Thankfully, it doesn’t take a rocket scientist to generate passive income to complement your active income. Anyone can do it!

Simply buy quality dividend stocks when they’re priced at good valuations and then hold them forever.

Here’s a buying opportunity in Pembina Pipeline (TSX:PPL)(NYSE:PBA) as it dips to the $47-per-share level. Conveniently, the energy infrastructure stock offers a monthly dividend that’s currently good for a yield of 5.1% yield. This is very attractive — a boost of about 80% in income — compared to the Canadian stock market’s yield of about 2.8%.

What makes Pembina even better is that it’ll likely continue increasing its dividend at a good clip. Since 2011, Pembina’s dividend has increased by 50%. So, if you had earned $500 per month from the stock then, you’d be earning $750 per month now!

Why Pembina is a quality stock

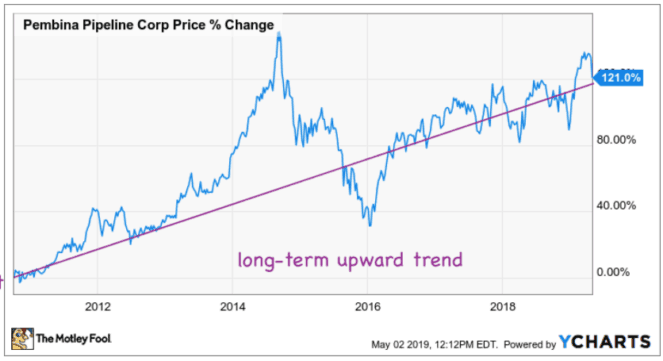

A quick way to identify that Pembina is a quality stock is that its long-term stock price chart has been in an upward trend with returns that beats the markets, indicating that investors recognize that Pembina has consistently created shareholder value.

In fact, since 2007, Pembina stock has delivered annual total returns of more than 12%, which beat the North American stock market returns of less than 8% in the period. This was supported by operating cash flow per share growth of about 12.8% per year in the period.

The bottom channel of Pembina’s upward trend is at roughly $40 per share. So, it would be a good time to build a position in the monthly dividend stock at the current price down to the $40 area.

Why Pembina’s dividend is safe

You want to generate passive income from safe dividends so you don’t experience those nasty dividend cuts that are way too common in the stock markets.

Here’s why Pembina’s dividend is safe. Its business consists of diverse and integrated assets including pipelines, midstream, and gas processing plant assets.

Together, they generate about 87% of cash flows supported by long-term contracts, which reduces the impact of swings in commodity prices or volumes. This, coupled with an adjusted funds-from-operations payout ratio of about 60%, makes Pembina’s juicy monthly dividend secure.

How to make $500 of passive income a month

To get $500 per month from Pembina, invest about $117,650 at the stock price of about $47 per share based on its yield of about 5.1%. However, if that’s all you’re investing in your portfolio, that’s too much concentration in one stock.

You don’t want all your eggs in one basket. Don’t stop at having just one dividend stock to generate your passive income. Instead, divide that roughly $120,000 to up to 12 quality dividend stocks.

That way, you’ll have your risk spread around and your hard-earned money well invested. Make sure your chosen stocks are diversified across different sectors. Utilities, banks, REITs, and telecoms are common places to invest for secure and growing passive income.