What’s the best way to beat the market without taking on extra risk?

According to historical averages, the best way to beat the market is by investing in dividend-growth stocks.

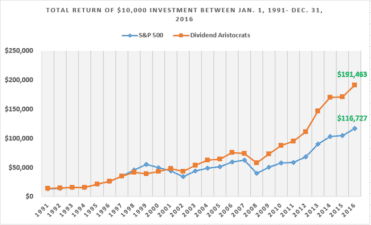

Since 1991, the S&P 500 Dividend Aristocrats index has beaten the pants off the S&P 500. If you’d invested $10,000 in the S&P 500 in the early 90s, you’d be up to $116,000 by the end of 2016; but if you’d invested in Dividend Aristocrats, you’d be up to $191,000. While the broader S&P has delivered slightly higher capital gains, the difference has been tiny, and the Aristocrats have more than overcome it with dividend payouts — resulting in a higher total return.

What does this mean?

Quite simply, it means that a particularly low-risk group of stocks (dividend growers) has beaten the market averages consistently over the decades. Although the degree of outperformance is not massive, it goes to show that the risk/return spectrum is not as cut and dry as it seems.

Assuming you’d like to capture some of those low-risk dividend profits in your portfolio, the following are three stocks that might fit the bill.

Canadian National Railway

Canadian National Railway (TSX:CNR)(NYSE:CNI) is Canada’s largest railway with thousands of kilometres of track spanning most of Canada and part of the U.S.

The company has seen strong growth in recent years, driven by the strength of its crude-by-rail business. As long as pipelines keep being delayed, oil companies will have to ship oil by rail; as a result, CN’s petroleum and chemicals unit has been growing at 30% year over year. So, we’re looking at a blue-chip dividend payer that has been growing revenue and earnings by 10% or more year in and year out. The stock’s current yield is low at about 1.8%, but historically has tended to rise.

Toronto-Dominion Bank

Toronto-Dominion Bank (TSX:TD)(NYSE:TD) is Canada’s second-largest bank. With a 4% yield and an average annual dividend increase of about 10%, it’s a classic Dividend Aristocrat. In its most recent quarter, TD surprised everyone by beating analyst estimates with 9.5% earnings growth. Its U.S. Retail business is growing even faster at 29% year over year. One major risk factor for this stock is housing: with Canadian house prices falling, the company could lose out on mortgage revenues going forward. However, TD’s U.S. businesses provide a measure of geographic diversification to protect bottom-line results.

Alimentation Couche-Tard

Alimentation Couche-Tard (TSX:ATD.B) is a convenience store operator whose Circle K chain is rapidly taking over the Canadian convenience store market (and even moving successfully into the States). Largely thanks to the success of Circle K, Alimentation’s revenues grew 4.6% last quarter, while its earnings shot up 27%. Alimentation’s dividend only yields about 0.6% right now, so it’s more on the “growth” side of the “dividend-growth” equation, but with average returns that trounce the TSX and the fundamentals needed to keep it up, it’s a great value.