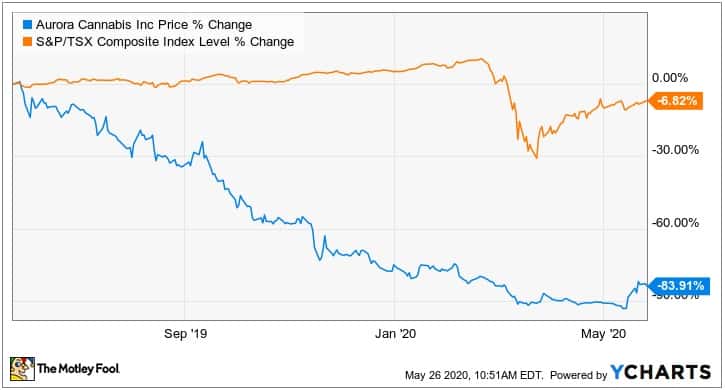

Cannabis stocks are attracting considerable negative attention. Deeply embattled Aurora Cannabis (TSX:ACB)(NYSE:ACB) rallied strongly after releasing its fiscal third quarter 2020 results. While that saw Aurora gain a whopping 73% over the last month, it is still down an incredible 84% over the last year.

This means that many investors in Canada’s third largest cannabis cultivator are still substantially underwater. Despite the improved performance, there is still considerable uncertainty ahead for Aurora.

History of diluting shareholders

One decidedly unappealing aspect of Aurora is its history of diluting shareholders. By the end of the third quarter, Aurora’s issued common stock, after allowing for the 12 to 1 share consolidation, had increased by a worrying 30%. That’s a whopping 135% greater than two years earlier. The issuing of common shares was being used to raise capital and fund questionable acquisitions at a time when Aurora’s market value had declined.

For the latest deal to acquire Reliva, in an all share acquisition, Aurora intends to issue US$40 million of stock to fund the purchase. That’s not good news for shareholders who have become weary of constant equity capita raising which have diluted their investment.

Reverse splits are a red flag

Reverse splits — also known as a share consolidations — are not typically perceived to be a positive development. The real reason for Aurora’s share consolidation was its need to remain in compliance with the New York Stock Exchange listing requirements.

Aurora’s NYSE shares had fallen below the minimum value to remain listed on the exchange. Aurora had received a notification that because its price was below an average of US$1 for 30-day trading period, it was not in compliance with NYSE’s continued listing requirements.

Reverse splits are a big red flag for investors. Typically, they are associated with penny stocks which have been unable to be consistently profitable. The burgeoning legal cannabis industry is fast gaining a reputation for being populated by penny stocks.

Cannabis stocks lack of profitability

The legal cannabis industry has been battling to achieve profitability. Aurora is no different from its peers. The cultivator has only reported one profitable year since publicly listing on the TSX in July 2017. For its last full year of operation ending June 30, 2019 Aurora reported a $298 million net loss.

For the nine months ending March 31, 2020 Aurora’s net loss ballooned out to $1.4 billion, indicating that it will post an even worse result for its fiscal full year.

Aurora committed to be being adjusted EBITDA positive for the fiscal first quarter 2021, an ambitious goal. For the fiscal third quarter 2020, Aurora reported adjusted EBITDA of just under negative $51 million, which was 36% greater than a year earlier despite Aurora’s quarterly revenue growing 16% year over year and operating expenses falling by 15%.

More worrisome still is that the US$40 million acquisition of cannabis company Reliva forms part of Aurora’s plan to be adjusted EBITDA positive. This indicates that management has little confidence in being able to turn a profit from its existing operations.

The questionable quality of Aurora’s earlier acquisitions raises further concerns over the planned deal.

Inflated cannabis asset values

Another red flag is the considerable value of Aurora’s intangible assets. The cultivator as at the end of its third quarter had just under $501 million of intangible assets on its balance sheet and a further $2.4 billion in goodwill. Those inflated values are mostly associated with earlier questionable asset acquisitions.

Combined, goodwill and intangible assets have a reported value of $2.9 billion, which is greater than Aurora’s $2.5 billion market cap. The write-downs and impairment charges of Aurora’s intangible assets and goodwill were responsible for its shock second quarter 2020 $1.3 billion net loss.

There are signs of further impairment charges ahead, especially with the coronavirus pandemic and other issues weighing on cannabis sales for the foreseeable future.

Foolish takeaway

Cannabis stocks are struggling to survive in the current harsh operating environment. Despite Aurora’s improved third-quarter results, it has a long ways to go before it can be considered a worthwhile investment.

The considerable uncertainty regarding the outlook for legal cannabis sales and derivative products makes Aurora an unappealing investment.

That is magnified by its history of diluting shareholders and inflated value of goodwill and intangible assets. For these reasons, Aurora is a stock to avoid.