BlackBerry (TSX:BB)(NYSE:BB) is a stock with a glorious and painful past. Are better days ahead?

BlackBerry story

BlackBerry once held the envious position of being the dominant player in the global smartphone market. Everyone wanted a BlackBerry for work, and many bought the phones for personal use as well.

Today, you would be hard-pressed to find someone you know who still uses a BlackBerry smartphone. The rise and fall of the Waterloo-based company is both a great Canadian tech innovation story and a disappointment. The firm failed to stay ahead on the innovation curve and missed the boat when it came to offering consumers the options they wanted from their mobile devices.

Samsung and Apple eventually ate BlackBerry for lunch on the design side, and once BlackBerry lost its cool appeal, it was game over in the consumer market.

BlackBerry initially maintained is dominance with government and corporate clients due to its rock-solid security. However, as soon as companies and public agencies became more comfortable with competitors on that front, BlackBerry lost its key competitive advantage.

In the end, people wanted to use their own phones for work. BYOD gained traction, and BlackBerry found itself struggling to keep SMEs and other commercial clients.

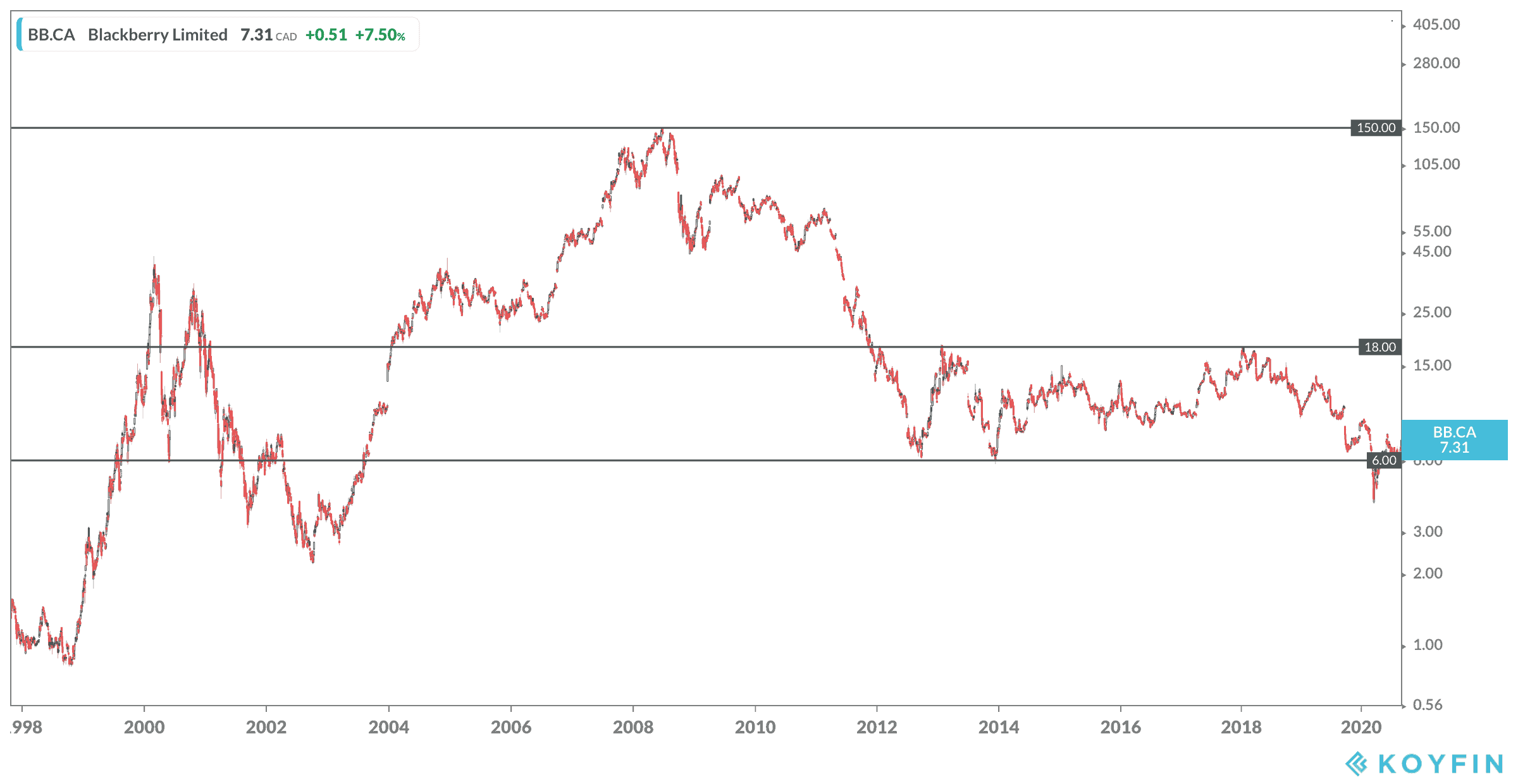

The stock peaked at $150 per share in the summer of 2008. By the end of that year, it was back down to $50.

A few head fakes occurred in 2009 and 2010, but the downward trend picked up speed in the next two years, taking the stock below $7 in the fall of 2012. Since then, BlackBerry stock has traded in a range of $6 to $18.

At the time of writing, BlackBerry trades near $7 per share, about where it was eight years ago.

IoT opportunity

BlackBerry effectively exited the handset market and spent the past few years trying to reinvent itself as a leading security player for the emerging Internet of Things (IoT) industry. Pundits say the IoT market could be worth tens of billions of dollars, as everything from your toothbrush at home to the lock on your shed at the cabin will eventually be able to connect to the web and send endless streams of data.

Commercial applications likely hold the most promise. BlackBerry’s QNX division has already carved out a leadership niche in security software for cars and trucks. The QNX systems are present in 175 million vehicles and all of the top automotive OEMs use the products.

BlackBerry is also targeting healthcare, banking, insurance, education, energy, and utilities.

Acquisition challenges

BlackBerry spent US$1.4 billion in early 2019 to buy Cylance, a leader in the emerging AI and cybersecurity segments. The deal beefed up BlackBerry’s security capabilities and offerings for enterprises but hasn’t produced the sales and revenue windfall that was expected.

Now called BlackBerry Spark, the group offers products and software that helps enterprises provide security when employees are working remotely and using their own devices.

The pandemic might actually be the spark that ignites growth in the enterprise security division. Major financial firms and tech giants have announced plans to keep office staff at home until at least the end of 2020. Many say employees will work remotely until mid-2021, and some plan to remain in this situation indefinitely. This poses security challenges that weren’t an issue when the entire team operated out of one building.

Should you buy BlackBerry stock today?

Investor shouldn’t expect BlackBerry to return to the glory days it enjoyed before the Great Recession. However, there might be an opportunity to make some money on the stock, as the world shifts to remote work and 5G technology starts to make IoT a bigger reality.

Patience is required, but BlackBerry could be an interesting recovery play for contrarian investors at the current share price. A move back to $12 wouldn’t be a surprise in the next year or two, and $18 could be a possible target on any news of potential takeover offer.