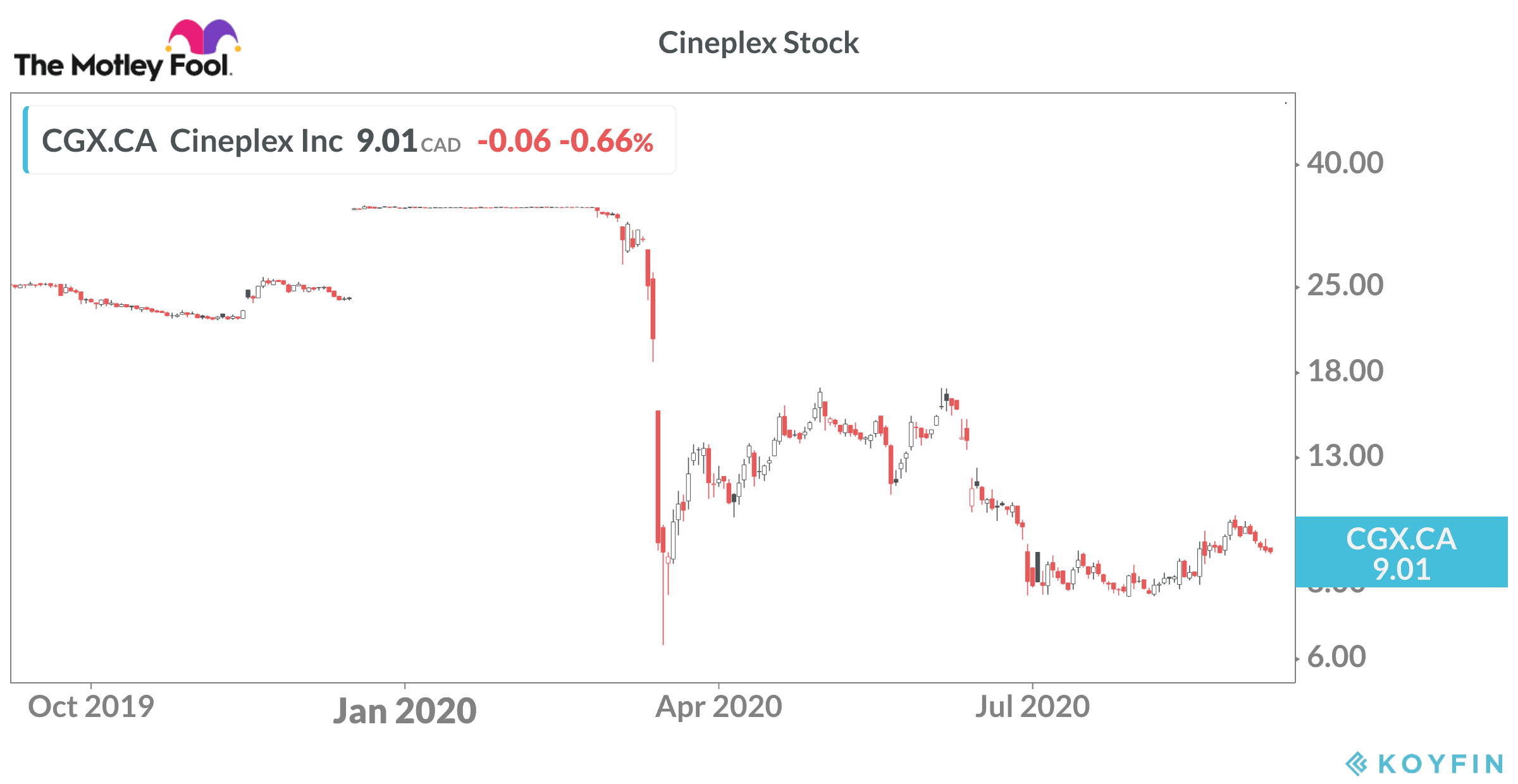

Cineplex (TSX:CGX) saw its stock price plunge in recent months due to pandemic lockdowns. Canada’s cinema giant now has all its theatres open again investors wonder if the stock might be a contrarian buy.

COVID-19 risk for Cineplex stock

Open theatres doesn’t mean full theatres. Social distancing measures are in place at all of the 164 cinema sites operated by Cineplex across the country. This puts a large dent in ticket and concession revenue. Less people in the seats means lower sales of high-margin popcorn, candies, and soda pop.

Coronavirus cases continue to climb off the summer lows many provinces. This was expected as part of the reopening process. However, the larger provinces with the most people, and the highest number of theatres, are starting to consider implementing new restrictions.

British Columbia just closed bars and banquet halls again due to rising COVID-19 cases. Alberta, Ontario, and Quebec are also seeing numbers increase. The two largest provinces have moved to a colour code to indicate risk and make it easier to put regional restrictions in place where hot-spots occur. The largest cities remain at a higher risk of seeing new lockdown measures.

In the event theatres go back on the list of places that must be shut, Cineplex’s share price could take another large hit.

Cineplex stock trades near $9 per share at the time of writing. That’s down about 10% from the August 2020 peak. Cineplex traded around $34 at the beginning of the year and fell as low as $7 during the market crash.

Growth in streaming services

Dividend investors who relied on the stock for years are shocked. The pandemic came as a surprise, but other challenges have been present for some time.

The rise in popularity of internet streaming services remains a large threat to the current theatre model. The success of Netflix might be the reason Cineplex stock started to slide in 2017 and continued to struggle until it received a takeover off late last year. Cineplex stock traded above $50 per share a few years ago and was down to $22.50 last November before UK-based Cineworld offered to buy Cineplex.

Today, people have more streaming options. Disney, Apple, and Amazon are all targeting the sector. Getting unlimited content for $10-15 per month from a major streaming company is much cheaper than taking a family of four to the big screen for two hours.

Lack of big-budget movies

Cineplex doesn’t create the content it shows in theatres. As a result, it relies on film companies to create movies that millions of people want to see, ideally more than once. With companies like Disney now in the steaming business, there is a risk the content producers could simply skip the theatre chains completely with their top films.

In fact, Disney just tested this out by releasing Mulan straight to its streaming service for an additional fee on top of the regular streaming price. If the straight-to-streaming model brings in as much money on a big film as it would by going to theatres in the same markets, Cineplex and its peers might be in for a rough ride, regardless of the pandemic outcome.

Opportunity for Cineplex stock

Cineplex stock looks cheap at $9 per share if you think the big movie studios will still need to reach audiences in theatres and people will continue to flock to the big screen venues in the coming years.

Cineplex stock might also be an interesting takeover play. Cineworld dropped its plan to buy Cineplex. That leaves the door open for another bidder to pick up the company at an attractive price. Pundits even speculate that one of the streaming giants might decide to add the theatre experience to their offerings.

If that turns out to be the case, Cineplex stock could rise to $15-$30 per share in a bidding war.

The bottom line

Cineplex could turn out to be a great contrarian buy at the current price, but investors might want to keep the position small until COVID-19 vaccines are readily available. I would also watch for any revenue numbers from Disney on how streaming subscribers reacted to the Mulan release.