The best dividend stocks for retirees tend to be ones that pay reliable and growing dividends through good and bad economic times.

What are the best dividends stocks for retirees?

Canadian seniors need to get as much income as possible from their savings while minimizing the risk to their capital. That’s a challenge in the current environment. The Bank of Canada just announced plans to keep interest rates at record low levels. This situation could persist for years.

That means GICs from the big banks could stay low for a very long time. Right now, the best return is about 1% on a GIC. This doesn’t help seniors who need to generate income on investments to help pay the bills.

As a result, many investors are searching for the best dividend stocks to put in a TFSA. Fortunately, the TSX Index is home to a number of great dividend stock that tend to hold up well in tough times and should be solid buy-and-hold picks for an income portfolio.

BCE has always been one of the top dividend stocks for seniors

BCE (TSX:BCE) (NYSE:BCE) is Canada’s largest communications company. The stock has a great track record of providing income investors with generous dividends. This is likely the reason BCE has been a favourite among retirees for decades.

The company continues to be an attractive dividend pick and the stock trades at a reasonable price. BCE saw its share price dip a bit since the start of the year due to the hit on its media operations. Advertising revenue slipped in the TV and radio businesses and the pro sports teams have just recently restarted their games, although without fans in the seats.

BCE’s focus on Canada helps keep it sheltered from the turbulence in international markets. People are not going to cancel their phone or internet subscription services, so there is some built-in protection against tough economic times. The expansion of 5G in the next few years should provide BCE with new revenue opportunities.

The dividend growth is modest, but steady, and normally supported by rising free cash flow. Investors who buy BCE today can pick up a 5.8% yield.

The main risk to BCE’s stock price is rising interest rates. For the medium term, that shouldn’t be a concern.

Is TC Energy the top dividend stock for retirees right now?

TC Energy (TSX:TRP) (NYSE:TRP) used to be called TransCanada. The company is best known for its vast natural gas pipeline networks and gas storage facilities. TC Energy also owns oil pipelines and power generations assets.

The stock moves in step with the momentum of the energy sector, but TC Energy has limited direct exposure to changing oil and gas prices. The company’s energy infrastructure network essentially acts as a toll road. This might be why Warren Buffett’s Berkshire Hathaway recently invested US$10 billion to acquire assets similar to those operated by TC Energy.

The company has a large capital program in place that should ensure revenue and cash flow growth for years. TC Energy expects to raise the dividend by 8-10% in 2021 and by 5-7% per year afterwards. That’s one of the best dividend stock outlooks in the TSX Index. TC Energy’s current dividend provides a yield of 5.3%.

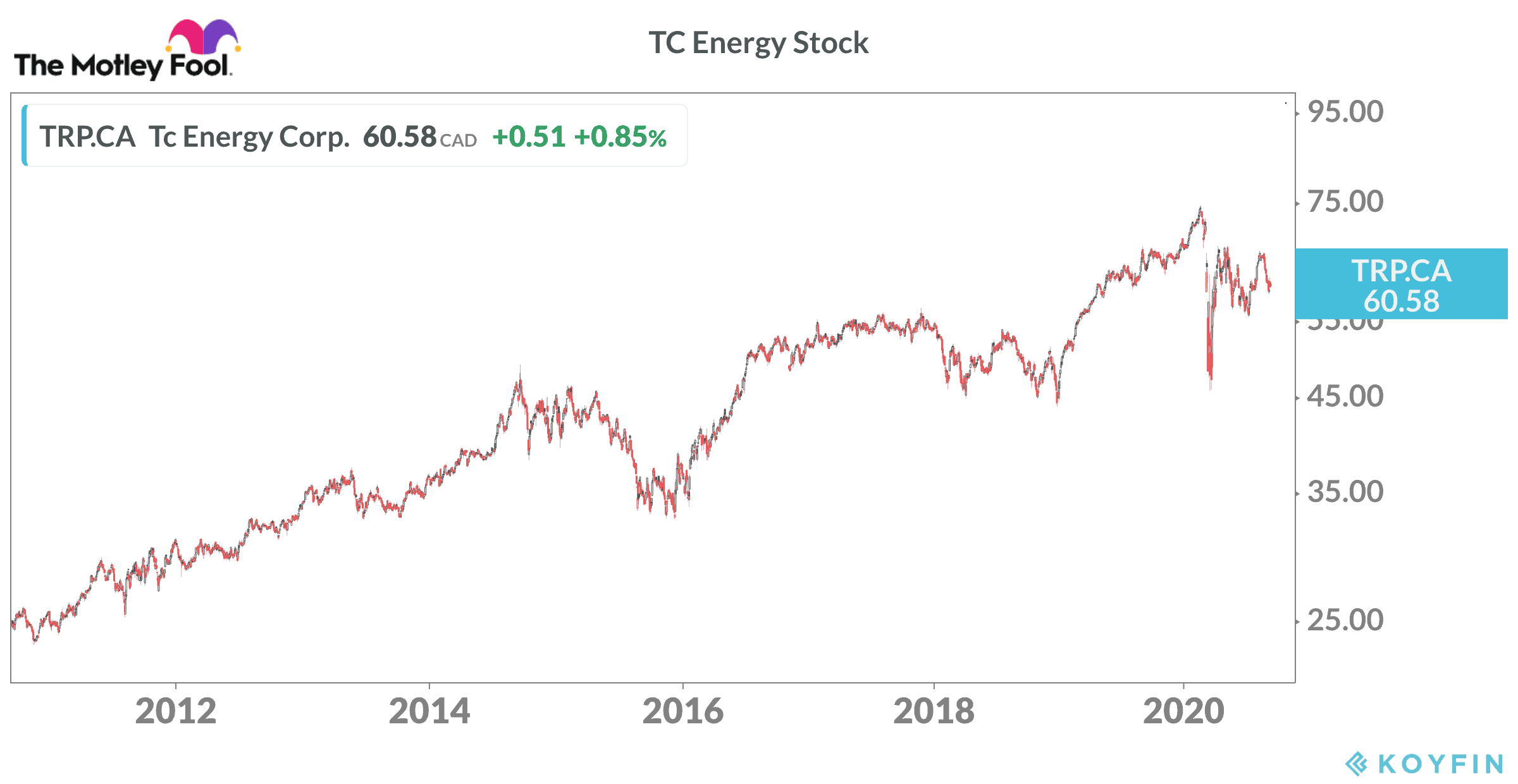

No wonder the stock has steadily climbed over the past decade.

The bottom line

BCE and TC Energy should be solid buy-and-hold picks at their current prices and are among the top dividend stocks in the Canadian market. If you only buy one, I would probably make TC Energy the first choice today.