Teck Resources (TSX:TECK.B)(NYSE:TECK) is a highly cyclical stock. And that’s what made it possible to make a big run from $5 to $60 per share, a 12-bagger, more than a decade ago.

More recently, from 2015 to 2018, it had another nice ride from $5 to $38 per share for a seven-bagger.

The stock’s most recent low of $9 in March this year didn’t seem nearly as attractive as its sell-offs before. Because the stock is still trading at a relatively low price of $18 from markedly higher levels before, many investors have forgotten about the mining stock.

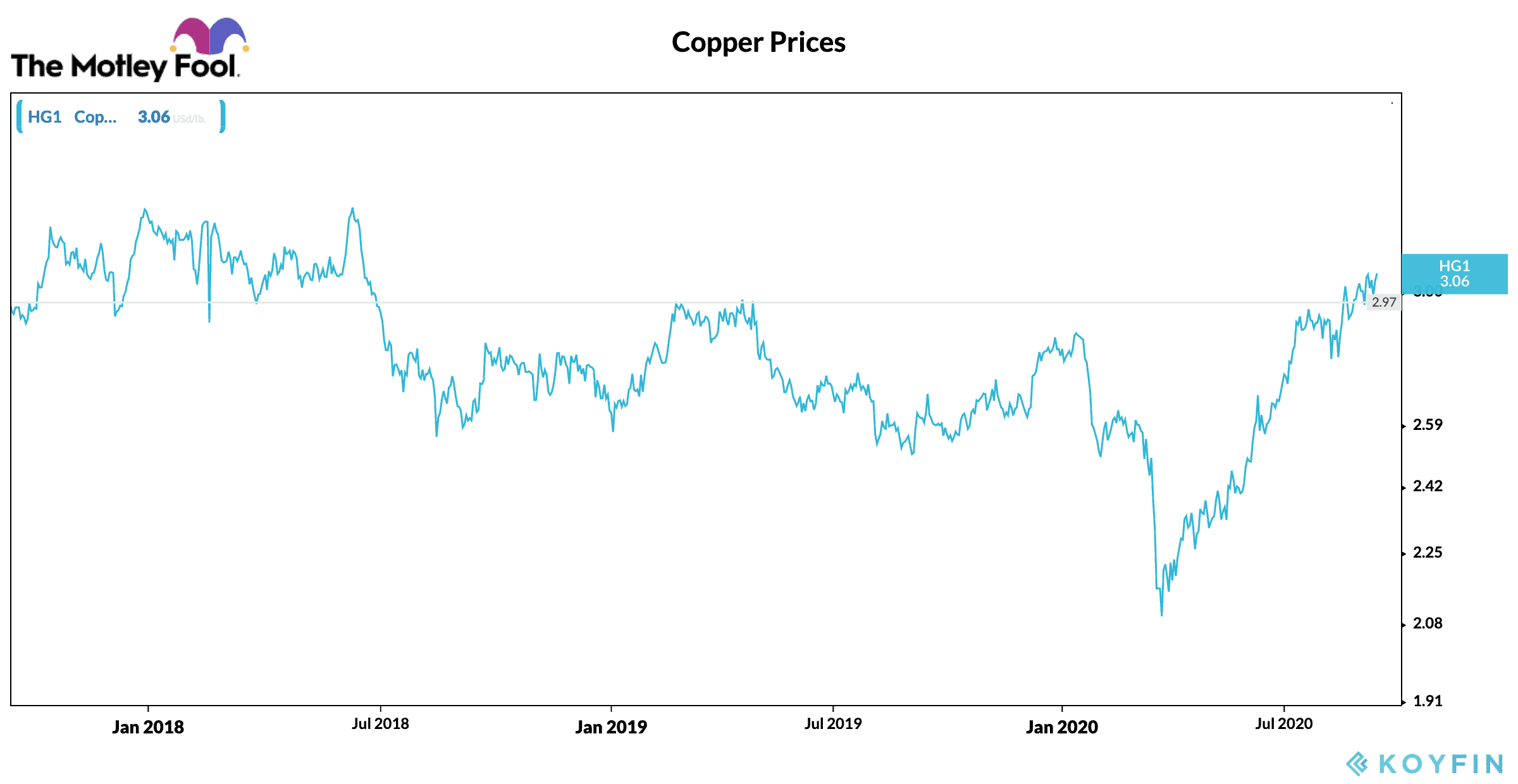

However, the cyclical stock has consolidated since the March low. Moreover, the chart below shows that copper prices have broken above a resistance and trades at its highest levels in two years.

There’s a good chance that Teck Resources stock can appreciate another 16% or so to the consensus analysts’ 12-month price target of roughly $21 per share in a pretty short time.

The driving force behind the mining stock’s breakout is higher copper prices supported by greater demand from higher manufacturing activity in China. The Chinese market is super important, because it is the largest consumer of copper, taking in close to half of the world’s copper each year.

The recovery in Chinese copper consumption is lowering copper inventories and thereby increasing copper prices.

Since the net cash costs for Teck Resources’s copper production were US$1.31 per pound in the first half of the year, and it expects them to be between US$1.20-1.30 in the second half of the year, the higher copper prices should boost the company’s revenues and earnings.

Recent results

There’s lots of room on Teck Resources’s path to recovery.

In the second quarter, its revenues fell 45% year over year from $3.1 billion to $1.7 billion, and its EBITDA, a cash flow proxy, dropped more than 78% to $177 million. In the same period, its adjusted earnings per share declined 80% to $0.17.

Its trailing 12-month results provide a bigger picture. Revenues fell more than 25%. Adjusted EBITDA declined 57%, while it reported a net loss.

A turnaround investment

Amid the pandemic, Teck Resources took action to maintain the strength of its balance sheet and lower costs. Specifically, it was able to reduce its near-term debt maturities and further increase its liquidity by US$1 billion through a revolving credit facility.

Although its current ratio fell from 2.5 times a year ago, it remains healthy at 1.5 times. As of the end of the second quarter, it reduced operating and capital costs by $250 million and $430 million, respectively.

Additionally, it’s positioning itself to improve margins meaningfully towards the end of this year and early next year, as it completes major capital projects.

The Foolish takeaway

Other than copper, Teck Resources also produces steel-making zinc and coal and is invested in energy assets. Therefore, the company’s performance is highly correlated with economic booms and busts.

Right now, we’re closer to a low than a high in the cycle given the pandemic’s disruption to the economy. So, there’s a good chance of nice upside from an investment in Teck Resources stock today with an investment horizon of at least a year.