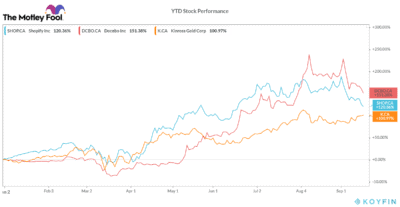

Those who invested in the shares of Docebo (TSX:DCBO), Shopify (TSX:SHOP)(NYSE:SHOP), and Kinross Gold (TSX:K)(NYSE:KGC) at the beginning of this year have a lot to cheer about. For instance, a $1,000 investment in Docebo stock at the beginning of the year would be worth $2,514 now.

Meanwhile, if you would have invested the same amount in both Shopify and Kinross Gold stock, they would be worth $2,204 and $2,010, respectively. The stellar growth in these stocks is due to their resilient businesses and high demand for their products and services. Moreover, all these companies benefited from secular industry tailwinds.

The steep rise in value might make you think that you have missed the opportunity to earn big. However, investors should note that these companies aren’t done making money for investors. The favourable industry trends and the recent selloff provide strong reasons why investors could consider buying shares of these high-growth companies.

Kinross Gold

The stock market selloff in March and fear of an economic slowdown significantly boosted the price of physical gold in 2020 and drove the shares of gold mining companies like Kinross Gold higher. While gold prices have cooled off a little bit, the uncertain economic outlook and continued increase in COVID-19 infections suggest that the shiny yellow metal is likely to remain in demand for the rest of 2020 and beyond.

Investors should note that Kinross Gold’s higher production from its low-cost mines provides a significant boost to its margins and its stock. Kinross Gold’s margins soared 53% in the most recent quarter, outgrowing the 31% rise in average realized gold price.

With the favourable outlook for gold, Kinross Gold could continue to make investors rich. Moreover, the company is generating solid cash and is focusing on deleveraging its balance sheet, which is encouraging and should support further growth.

Docebo

Docebo has benefited from the growing demand for corporate e-learning. Meanwhile, the pandemic accelerated the demand for its platform, as reflected through the higher utilization rate. Docebo has been performing exceptionally well with its revenues and gross profit, recording year-over-year growth of 46.5% and 49.3%, respectively, in the most recent quarter.

Even in the pre-pandemic phase (FY16 to FY19), Docebo performed well on the financial front with its revenues growing at a compound annual growth rate of 61%. Its average contract value rose over 2.7 times during the same period.

Docebo has been growing its customer base at a double-digit rate, which is encouraging and provides a strong underpinning for growth. Moreover, its recurring revenues remain strong and indicate that the momentum is likely to continue in the coming years.

The corporate learning market is growing fast, and Docebo’s average deal size is expanding, which implies that the company could continue to outgrow the broader markets in the foreseeable future.

Shopify

With a structural shift toward e-commerce platforms, Shopify witnessed astounding growth in traffic at its platform, which drove its stock higher. As small- and medium-sized businesses (SMBs) continue to use its platform to shift online, Shopify is likely to generate stellar growth.

While the coronavirus gave a significant boost to Shopify, the trend is likely to sustain even in the post-pandemic world. The spending on e-commerce is only likely to increase in the coming years, providing multi-year growth catalyst for Shopify stock.

The company’s strong competitive positioning, partnerships with Facebook, Pinterest, and Walmart, and expansion of its high-margin products like Shopify Capital and Shipping provide a solid base for future growth. Moreover, the recent correction in its stock presents a good buying opportunity for investors.