When the stock market crashed back in early March, some of the earliest TSX stocks to rebound were defensive, recession-resistant companies.

Once the initial fear set in, it was clear that reliable businesses, seeing little impact, and with high-quality operations could be relied on through the pandemic. So, naturally, these stocks started to see a big rally.

That momentum in stocks, coupled with massive stimulus from governments, helped set the market on a major bull run. Some stock indices have even hit record highs as a result.

Unfortunately, however, a lot of the momentum in recent months has come from high-risk growth stocks. Those investors who were a little too conservative may have missed out.

It’s understandable to be conservative; after all, that’s better than being too aggressive and losing a massive sum of money. However, if you can manage to buy defensive stocks with significant growth potential, you can find the best of both worlds.

These companies will protect your hard-earned money should a recession or another stock market crash materialize. And if they don’t, these stocks are high enough quality to continue growing your money.

Here are two of the top defensive stocks on the TSX that both hit 52-week highs this week.

A top consumer staple stock on the TSX

First on the list is an extremely impressive consumer staple: North West Company (TSX:NWC).

I’ve recommended investors consider North West stock numerous times, as it’s an extremely high-quality company. First and foremost, however, it’s a defensive business.

North West has many qualities that make it attractive, including a significant dividend yield that you won’t find in its peers.

Plus, on top of that, it’s been reoptimizing its business over the last few years. Developments and improvements, such as buying its own airline and bringing the maintenance in house, will help to control shipping costs better and integrate the company.

The company also divested non-core, underperforming stores. These have all played a major role in North West smashing expectations and growing its business so rapidly.

The TSX stock already had an attractive dividend; however, after last week’s earnings, that dividend was increased another 9%.

It’s a top stock that’s extremely reliable, can provide significant growth, and pays an attractive dividend. An investment seems like a no brainer to me, especially in this highly uncertain environment.

A leading renewable energy stock on the TSX

Another stock I’ve recommended to investors on several occasions is Northland Power (TSX:NPI).

The reason Northland Power is a great investment in this economic environment has to do with two main factors.

Firstly, the company has highly defensive operations, which help make it extremely resilient to adverse market or economic conditions. Secondly, green energy is one of the best long-term growth industries.

Investing in a defensive growth industry is key, as we’ve seen in the last few months.

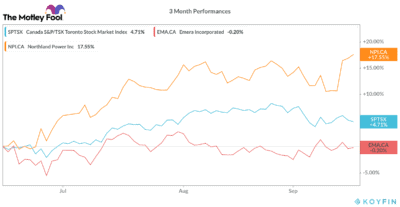

This is especially true, as we’ve seen typical defensive equities, such as a utility like Emera, significantly underperforming the market.

Instead, investors should opt for a stock like Northland that’s almost as robust but offers investors significant long-term growth potential. That potential is a huge factor and makes up most of the difference in the two companies’ performances over the last three months.

It’s clear from this chart that after the initial recovery, Emera and other utility stocks have stayed flat. Over the last three months, Emera is actually slightly negative compared to Northland, which is up more than 17%.

Bottom line

Investing is about balance. You never want to take on too much risk; however, at the same time, you don’t want to be too conservative either.

It’s important you cover all bases, be conservative, and protect your money, but don’t neglect TSX growth stocks. By doing this, you’ll maximize your investing potential.