World-renowned investor Warren Buffett’s investment firm Berkshire Hathaway dumped airline stocks earlier this year, as the coronavirus started spreading across the globe.

Until 2019, the airline industry was benefiting from a consistent growth in travel demand and low oil prices. The pandemic-related travel restrictions and shutdowns devastated the industry. This was one of the key reasons why Buffett might have chosen to offload his positions in airlines, including United Airlines, American Airlines, Southwest Airlines, and Delta Air Lines.

Buffett’s decision to exit the airline industry triggered a debate. While some experts called it a smart move, others considered it as a big mistake. His critics believe that the airline industry isn’t going to face major troubles as the government would very likely come to its rescue — if needed.

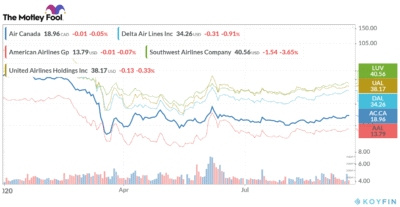

A massive decline in airline stocks

The year 2020 started on a horrifying note for Air Canada investors, as its stock nosedived by 68% in the first quarter. In the second quarter, the stock saw nearly 8% recovery and has gone up by 11.5% in the third quarter so far. Overall, the stock is still down by nearly 61% on a year-to-date basis.

By comparison, the U.S. airline industry isn’t performing any better. United Airlines, American Airlines, and Delta Air Lines have seen 57%, 52%, and 41% value erosion this year so far, respectively. Similarly, Southwest Airlines stock has lost 22% in 2020.

Looking at these massive losses, you might consider Buffett’s decision to exit the airline industry to be a wise one. However, we shouldn’t forget that he dumped these stocks when they were trading near their lowest level in years. That’s why I would consider Buffett’s decision to dump airline stocks nothing but panic selling.

When will Air Canada stock recover?

At the moment, it’s extremely difficult to predict when a sharp and sustainable recovery in airline stocks — including in Air Canada — would start. Nonetheless, gradually easing domestic as well as international travel restrictions across the globe suggest that the worst might already be over for Air Canada stock.

Most big pharmaceutical companies are racing to test and start producing coronavirus vaccines. As soon as these vaccines become available, it shouldn’t take very long for airline stocks to start a rapid recovery.

Another ray of hope

While the availability of the COVID-19 vaccine is likely to trigger a buying spree in Air Canada stock, it doesn’t mean that it may not recover until then.

The company’s management has been trying to improve its cargo operations for the last couple of quarters. I expect these efforts to pay off well in the third quarter — helping Air Canada beat analysts’ consensus earnings estimates.

Could it prove Buffett wrong?

This week, the International Air Transport Association urged the Canadian government “to relax its stringent travel restrictions and allow air travel within, to and from the country to return to a semblance of normalcy.” Even if the government eases travel restrictions a little bit, it could act as a big catalyst for a recovering in airline stocks — including for Air Canada.

Overall, most factors discussed in this article could lead to a rally in airlines and prove Buffett’s decision to offload his airline holdings — seemingly in a panic — wrong.