Since the start of the pandemic, investors have been scouring the market for the best deals. Initially, it was all the top TSX stocks and defensive investments being bid up.

Soon after, however, almost every stock recovered in some form or another, as long as they weren’t too badly impacted by the coronavirus pandemic.

One of the worst-hit industries was airlines. With travel restrictions worldwide and planes seen as potential super spreaders, not only do consumers not want to travel, but many can’t.

That’s one of the main reasons these stocks have sold off so badly and have hardly seen a recovery.

TSX airline stock

Despite a relatively flat last couple of months, one of the top stocks on investors’ radars since the market crash has been Air Canada (TSX:AC). As of Thursday’s close, Air Canada traded for just $19.05, that’s more than 60% below where it started the year.

It’s natural to be interested in buying Air Canada while it’s in distress. After all, the whole point of investing is to buy low. However, Air Canada faces several issues that will only be solved with time.

You don’t want to make the mistake of tying capital up in Air Canada now when there are so many other high-potential TSX stocks.

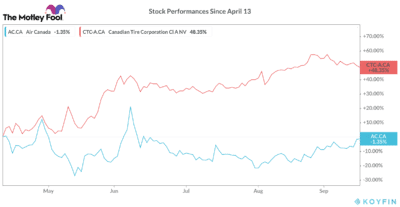

I’d warned investors to avoid an investment back in April when the stock rallied past $20 a share. And although it reached a high of $23, it’s mostly been flat and is now down 15% from that peak.

One of the stocks I’d recommended instead of Air Canada at that time was Canadian Tire; since then, the stock is up 48%. At the time, Canadian Tire was cheap, but nowhere near as cheap as Air Canada.

The problem is, Air Canada has too many headwinds at the moment. These will need to be sorted out and overcome before sentiment returns to the stock.

This is an important lesson to learn in investing. Sometimes a stock is cheap for a reason. So, if it seems too good to be true, it very likely could be.

A TSX stock to buy today

Rather than Air Canada, if you have cash to invest today, I would consider a stock like Algonquin Power and Utilities (TSX:AQN)(NYSE:AQN).

This TSX stock is also nowhere near as undervalued as Air Canada. However, it’s got a tonne of momentum, has seen only minimum impacts from the pandemic, and is currently in the middle of a massive long-term capital growth plan.

The company’s makeup is roughly two-thirds utilities and one-third renewable energy generation. However, with management’s aggressive growth plan and numerous countries and jurisdictions looking to increase their green energy exposure, you can expect Algonquin’s share of renewable energy to increase swiftly over the next few years.

And while past performance never can fully predict future returns, looking at Algonquin’s last few years, it’s clear what a high-quality company it is.

Plus, in addition to the impressive capital gains growth investors have seen, the TSX stock also consistently increases its dividend, earning itself a spot on the Canadian Dividend Aristocrats list.

Bottom line

In times of uncertainty, investors should focus on proven, high-quality TSX stocks. These companies will almost always perform better than distressed businesses facing significant headwinds, no matter how cheap they are.