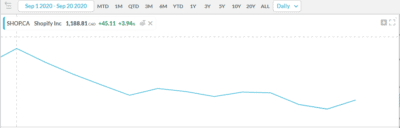

Shopify (TSX:SHOP)(NYSE:SHOP) continued to crash last week, falling to $1,190 by its close on Friday. Last week’s losses cap a generally poor month for the stock. As you can see in the Koyfin chart below, it’s been basically in a free fall for most of September.

To an extent, this correction was expected. It was never a secret that SHOP had reached a nosebleed valuation after its Q3 earnings beat. In fact, it had traded at a consistently steep valuation for most of the last five years. Q3, however, took the stock to new heights. It reached not only a record high price, but also an even steeper valuation than normal.

On top of that, there’s the fact that tech stocks in general have been selling off in September. In the rush to get into “pandemic-proof” stocks, investors bid the tech sector up to new heights. This made sense for a while. But eventually, investors started to perceive more value in traditional, beaten-down industries.

Which brings us to today. At $1,190, SHOP is down 20% from its all-time high. It’s still a massive gainer for the year, but if the beating continues, there could be trouble. The only question is whether it will continue. High P/E ratios never stopped tech stocks from rising — just ask Jeff Bezos. But if tech as a sector continues to sell off, it could be bad news for Shopify shareholders.

Why tech is selling off

Ultimately, nobody knows with 100% certainty why an entire sector moves the way it does. With that said, it appears that tech is selling off on valuation concerns. Many of the world’s biggest tech stocks trade at more than 10 times sales. Even “mature” tech stocks like Microsoft are trading at more than 35 times earnings. Amazon’s P/E ratio recently went over 100 again, and Netflix isn’t much lower. Even the historically cheap Apple now has a 32 P/E ratio.

Tech stocks as a class are generally expensive. But now, they’re more expensive relative to earnings than they were a year ago. In part, that appears to be due to the COVID-19 market crash. When the COVID-19 lockdowns hit, traditional industries got crushed. Initially, almost all stocks sold off. But eventually earnings started to come out. It turned out that tech was relatively unscathed. So, investors scrambled out of the battered sectors and into tech. Eventually, though, some really stratospheric valuations started to emerge. In early September, for example, SHOP traded at more than 70 times sales. That couldn’t last forever, and a correction began to take shape.

Strong growth metrics

Despite all of the above, SHOP is still cranking out some impressive growth metrics. In its most recent quarter, it grew sales by 97% year over year. Gross Merchandise Volume climbed 119%, while Merchant Solutions revenue grew 148%. Thanks to these dramatically improved sales figures, SHOP managed to crank out positive GAAP earnings in Q2. If this kind of growth can be maintained, then perhaps SHOP will resume is steady upward climb. We should get word on that shortly: reports suggest that Q3 earnings will be released November 3.