The share price of Cineplex (TSX:CGX) continues to give back the brief gains it racked up last month. Contrarian investors who missed the August rally want to know if this is a good time to add Cineplex stock to their portfolios.

Pandemic impact on Cineplex stock

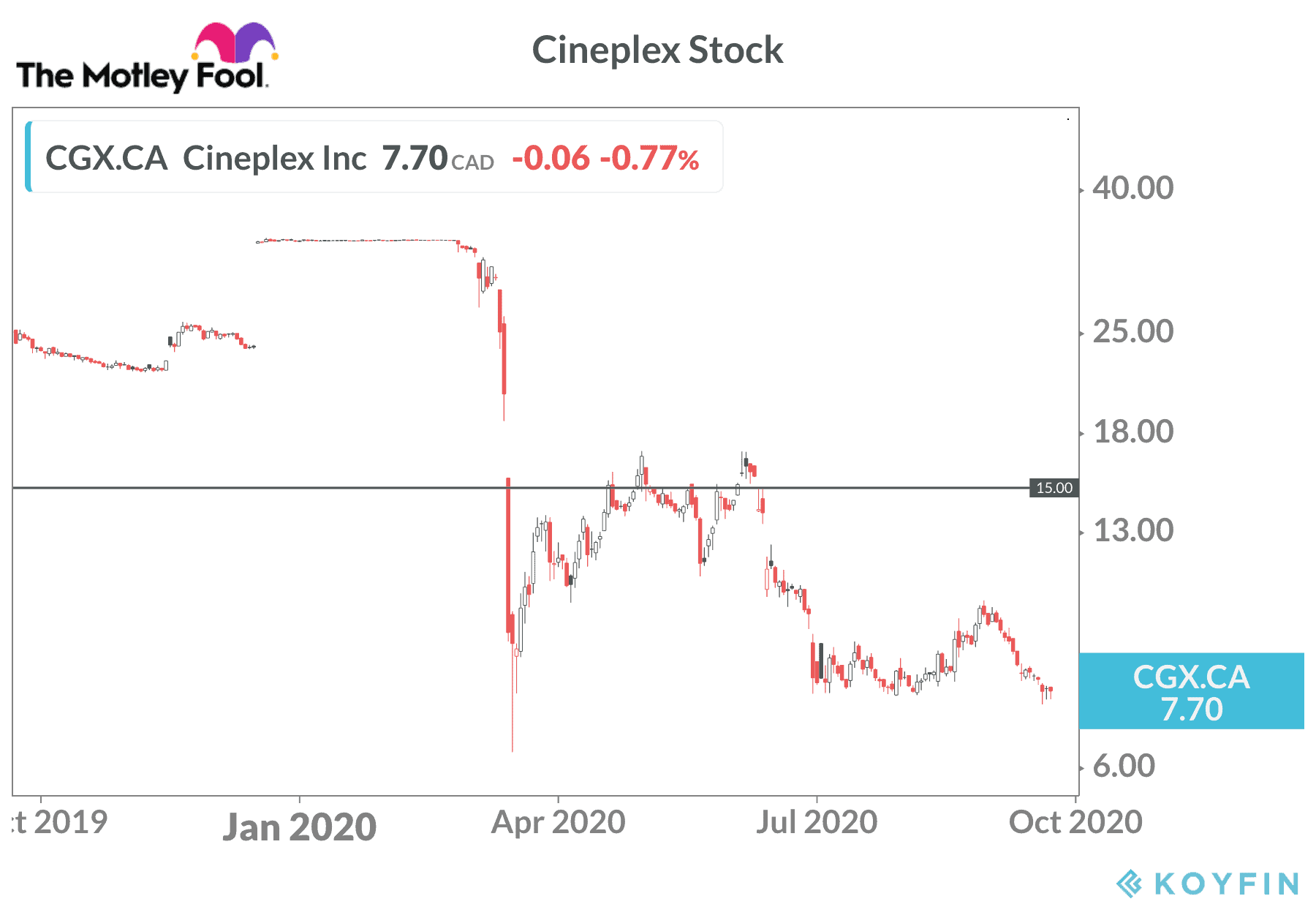

Cineplex stock started 2020 close to $34 per share. The share price had surged from $24 in December after U.K.-based Cineworld announced plans to acquire Cineplex for more than $2 billion.

The pandemic then arrived and forced lockdowns, and the closure of theatres around the world. Cineplex is Canada’s largest theatre chain with 164 locations across the country. In a matter of days, the future of the business suddenly became uncertain.

How bad is the situation?

Cineplex stock fell from $31 to just $9 per share in a single week in March. The stock price climbed back up to $16 by the end of April and again hit that mark in early June after a May pullback. Investors hoped declining COVID-19 cases would support more aggressive reopening plans across the country.

On June 12, Cineworld announced its intention to back out of the deal to acquire Cineplex. This triggered a selloff that continued through the end of July when Cineplex stock fell to $8 per share. Cineplex is contesting the decision and hopes to force Cineworld to follow through on the deal. The market apparently thinks that will not occur.

Outlook for Cineplex stock

Bargain hunters started buying the shares in August and continued to push the share price higher through the end of the month. Cineplex stock briefly topped $10. The move wasn’t a surprise, as Cineplex gradually reopened all of it theatres. Contrarian investors hoped the momentum would continue through September.

Unfortunately, COVID-19 cases numbers soared in major markets across the country in recent weeks. This has investors wondering if people will stay away from theatres. A larger threat is the possibility of renewed lockdowns.

The availability of big-budget films to attract audiences is another factor in the mix. Film creators have delayed the release of a number of new movies, or even bypassed theatres altogether with a direct-to-streaming release. Disney decided to snub North American theatres and released Mulan directly to streaming subscribers for a US$30 premium.

Investors need to decide if this is the new normal or simply a unique trial run during the pandemic.

Takeover play?

The Cineworld takeover deal appears dead, at least at a stock price north of $30 per share. Whether or not Cineplex and Cineworld will hammer out a new agreement at a new price is yet to be seen.

Pundits speculate a different bidder could emerge. COVID-19 vaccines are expected by the middle of 2021. There is a chance the theatre experience could be back in full form by the second half of next year. In that scenario, Cineplex stock appears cheap today.

Potential buyers could include private equity firms or even one of the major streaming players. The big screen venues offer a wide range of opportunities to leverage relationships with subscribers and drive additional revenue on popular movies, documentaries, or even a TV series.

Should you buy Cineplex stock now?

New investors have to feel confident the theatre business has a positive future. If you fall in that category, it might be worthwhile to take a small contrarian position in Cineplex stock. At the time of writing, the shares trade around $7.50.

Near-term volatility could push the share price lower. However, a move back to $15 wouldn’t be a surprise in early 2021 on positive vaccine news. In addition, a takeover bid at that price or higher is certainly possible in the next six to 12 months.