The coronavirus outbreak and the travel restrictions that accompany it have had a profound impact on airlines around the world. Carriers have suffered massive losses in their business due to lockdown restrictions and the decline in demand for air travel that followed. This, in turn, caused job losses and wage cuts. Despite financial losses and operational setbacks associated with the pandemic, Onex (TSX:ONEX), which owns WestJet, is still popular. Onex’s slow but steady recovery from market lows in March has sparked investor interest.

Onex stock is still well below pre-pandemic levels

WestJet Airlines, which formerly traded on the TSX under the ticker WJA, was acquired by investment and asset management company Onex in December 2019. Besides WestJet, Onex’s portfolio of investments includes companies like ASM Global, Advanced Integration Technology, Celestica, etc.

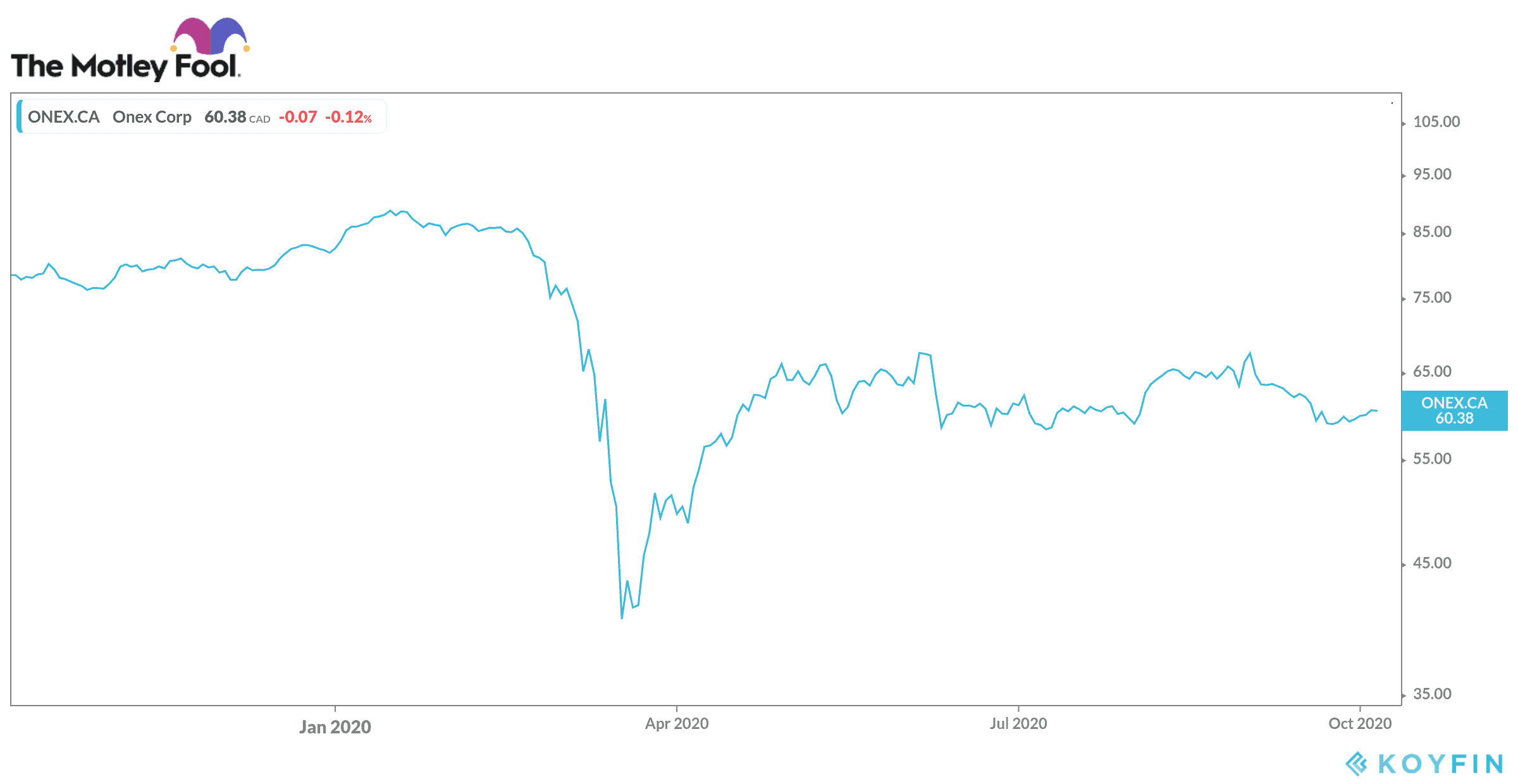

Shares of Onex were trading at $89.25 on January 21, their highest level so far in 2020. As the markets tanked amid the coronavirus pandemic in March, Onex’s stock price lost nearly 55% of the value, diving to a low of $40.6 on March 19.

Onex stock price has rebounded from its March lows but is still below its pre-pandemic levels. The stock has risen by 15% over the last six months but is down 25% year to date.

WestJet recently announced a pay cut of up to 53% starting September 27. In a company memo, the airline company said that its furloughed employees who avail the Canada Emergency Wage Subsidy (CEWS) could face a reduction from $847 to $400 in their maximum weekly payment. This decision came days after the federal government announced it would update the extended federal wage subsidy.

The airline has incorporated passenger safety measures such as COVID testing campaigns in an attempt to change the Canadian government’s mind on travel restrictions.

WestJest also attracted some attention last month when a flight was canceled after a toddler not wearing a mask onboard led to police being summoned.

Onex swings to profit in the second quarter

Onex swung to a profit in the second quarter, rebounding from segment losses of more than $1.1 billion in the first three months of the year as markets rebounded despite the pandemic.

The investment management firm publishes reports in U.S. dollars. Net gains from Onex private equity and credit investments in the quarter ended June 30 increased to a net profit of $629 million — a jump of 144% from $258 million a year earlier.

At the end of the latest quarter, Onex had cash and near-cash on hand totalling $1.9 billion. The company saw segment net earnings of $689 million in Q2 2020. This included net earnings of $657 million from its investing segment and $32 million from its wealth and asset management segment. Earnings are expected to increase by 138.5% to $0.31 per share for the current fiscal year.

Onex declared a quarterly dividend of $0.10 on September 17. The dividend yield is currently 0.7%. The company has a market cap close to $6 billion. The stock is dirt cheap with a price-to-book (P/B) ratio of 0.68 and a P/E ratio of 1.02. It might be a good idea to buy some shares of Onex while the price is low.