BlackBerry (TSX:BB)(NYSE:BB) continues to announce security partnerships with global firms. Is this the time to add BlackBerry stock to your contrarian portfolio?

BlackBerry and Microsoft Teams

BlackBerry recently announced a partnership with Microsoft Teams to help governments and large organizations manage crisis events. The BlackBerry AtHoc system provides organizations with end-to-end crisis communication capabilities.

BlackBerry’s critical event platform now integrates with Microsoft’s real-time collaboration platform. The partnership provides a boost to BlackBerry’s status as a leader in secure communications.

Remote worker security opportunity

BlackBerry has an opportunity in the current global environment to ramp up revenue in its Spark security solutions group. The pandemic forced people to work from home in the past seven months, and it appears the trend will continue, even beyond COVID-19.

Corporations ranging from leading tech giants to financial institutions say they will shift to hybrid systems, where people split their work time between home and the office. Microsoft recently said it will allow employees to work from home 50% of the time. Some other firms are going 100% remote.

The situation presents security challenges for businesses of all sizes. In an office environment, it is easy for the firm to control internet security, since everyone is using company hardware.

In the work-from-home environment, however, people are accessing the company’s systems and communicating with clients using a wide range of devices and service providers. The bring-your-own-device trend was already in place ahead of the crisis, but it is likely to expand in the new era of remote work.

5G and IoT impact BlackBerry stock

BlackBerry is a leader in providing secure connections in the Internet of Things (IoT) world. the IoT industry hasn’t ballooned as quickly as anticipated, but that could change.

The expansion of 5G networks will enhance the ability of wireless data collection for homes and businesses. The safe transfer of the data from the device to the storage location is critical, and BlackBerry is positioned well to play a major role across a wide variety of industries.

Should you buy BlackBerry stock?

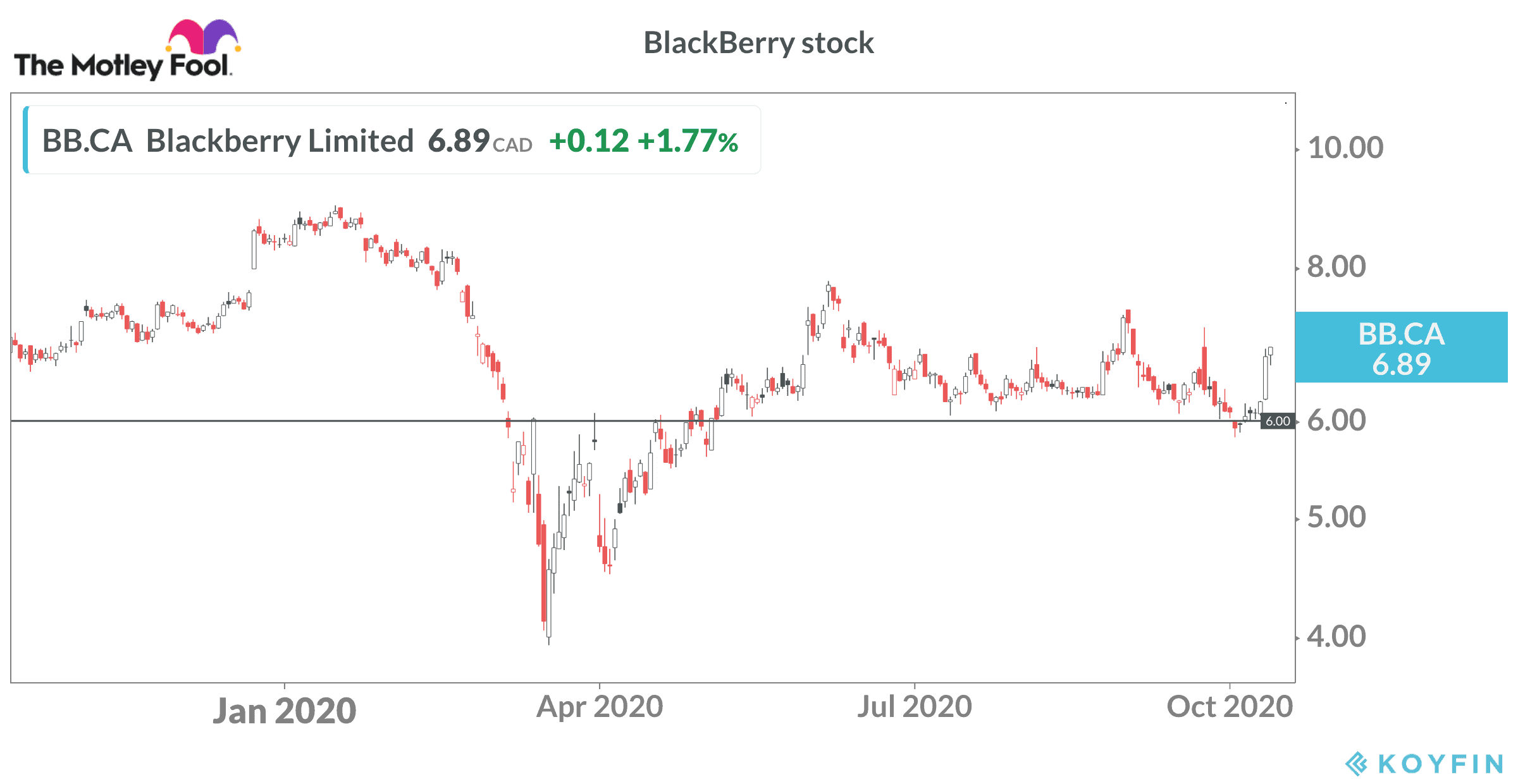

BlackBerry trades near $6.75 per share. The stock started 2020 around $8.50 and was at $17 in early 2018 when hype around IoT hit a high point. Long-term watchers of the stock remember the glory days when BlackBerry dominated the smartphone market and traded above $100 per share.

BlackBerry has a large portfolio of great security products and solutions, including its QNX group that has its software installed in 175 million vehicles, and the Spark business that delivers security to assist companies with remote workers.

However, the company continues to disappoint investors on revenue and earnings.

The 2019 acquisition of Cylance for $1.4 billion positioned BlackBerry to be the planet’s leading AI cybersecurity company. Unfortunately, the deal hasn’t delivered the anticipated revenue boost, but better days could be on the horizon.

Why?

Things should improve across the board in 2021, especially in the the Spark division, which is seeing demand improve for “work-from-anywhere” solutions. The auto industry should also have a stronger 2021, as the industry normalizes.

I wouldn’t back up the truck, but patient investors might want to consider a small position in BlackBerry stock near this level. The tide could finally turn next year for BlackBerry and its investors.