Founded in 2003, Nuvei (TSX:NVEI) provides payment solutions to merchants, technology, and distribution companies. The global payments technology company serves businesses in Canada, the United States, Europe, Latin America, and the Asia-Pacific region.

The company went public on September 22, 2020, issuing about 24 million shares at US$26 per share. Nuvei listing was the largest technology IPO in TSX history in terms of both equity capital raised and market capitalization. The company raised US$833 million during the IPO process. Nuvei stock has soared almost 20% since its IPO.

Nuvei made a number of acquisitions during its tenure, including Cardex Payments in 2007, Tangarine Payment Solutions in 2009, Capital Processing Network in 2014, Intuit in 2015, Matrix Payment Systems in 2018, SafeCharge in 2019, and Smart2Pay in 2020.

Currently, Nuvei has 50,000 customers and accepts payments in over 200 global markets and nearly 150 currencies, while allowing merchant customers to transact with 450 alternative payment methods.

Nuvei just reported its third-quarter results. Is Nuvei stock a buy? Let’s take a look at the company’s earnings and future outlook.

Nuvei stock soared after the company reported strong revenue growth

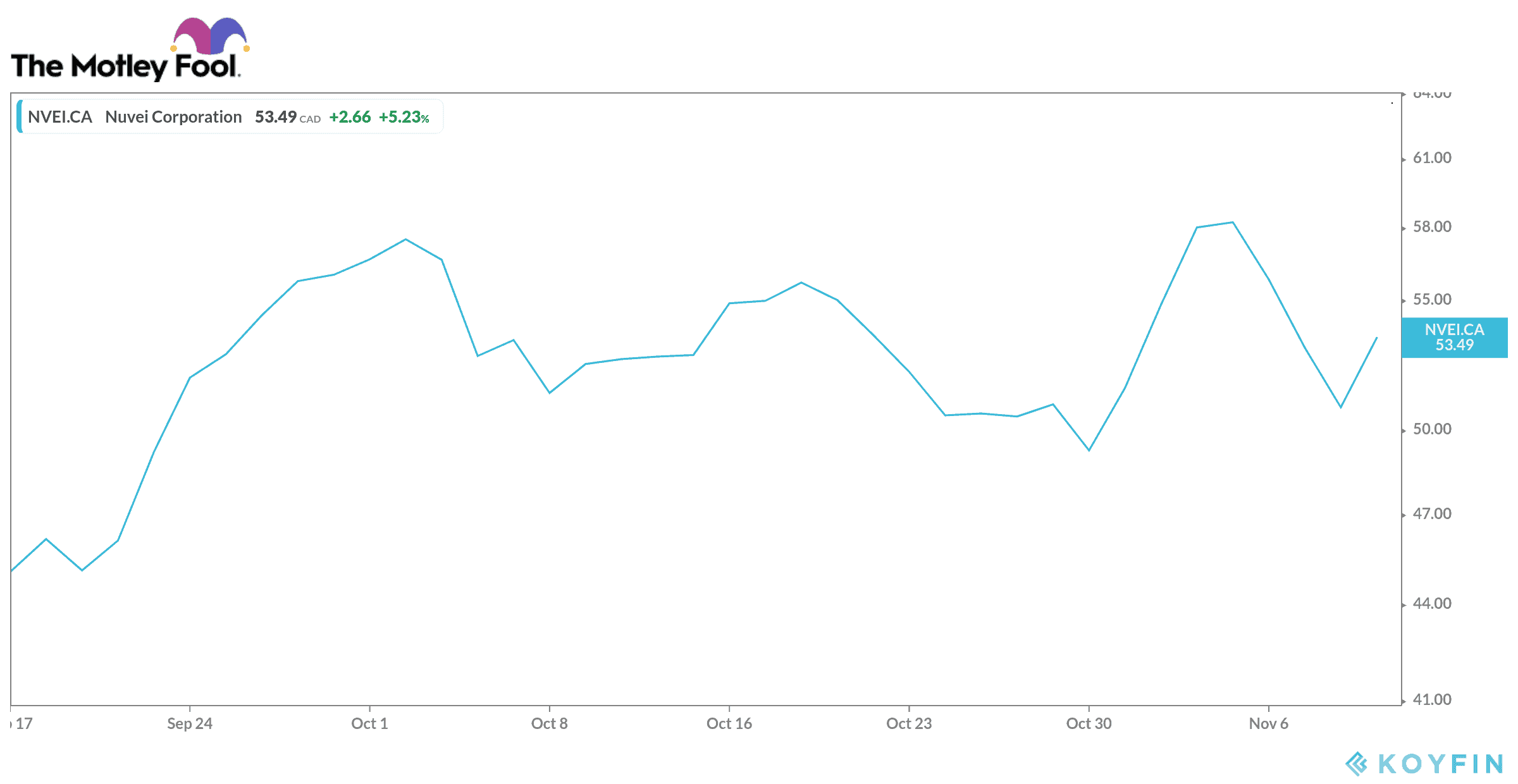

Nuvei released its third-quarter financial results for the period ending September 30 on Wednesday. The results include financial data from its IPO. Nuvei reports in U.S. dollars. Investors reacted positively to the results, as Nuvei stock soared by more than 5% after the release.

The Montreal-based payment solutions company saw a quarter of growth. It reported revenue of $93.6 million, an increase of 32% as compared to $70.8 million in the third quarter of 2019. The company’s adjusted net income was $16.5 million, as compared to $2.2 million last year.

The Q3 2020 net loss amounted to $77.9 million, up from $65.7 million in the same period last year. In particular, the net losses included $83.4 million of non-cash finance charges resulting from Nuvei’s IPO and related valuation.

The Montreal-based company also reported a total volume of $11.5 billion in transactions processed by merchants using its payment platform — an increase of 62% from $7.1 billion in the third quarter of 2019.

Nuvei is planning to use its IPO’s proceeds to fund growth

According to Wednesday’s report, Nuvei’s IPO generated $758 million in proceeds for the FinTech company. According to public filings for Nuvei’s IPO, the company planned to use the proceeds from going public to fund “organic growth and product innovation initiatives as well as future strategic acquisition opportunities.”

Notably, during this period, Nuvei was working on securing a deal to buy Dutch payment service provider Smart2Pay. Nuvei announced on November 2 that it had officially concluded the deal. According to the third-quarter report, Nuvei acquired Smart2Pay for $82.9 million in cash and 6,711,923 shares.

Nuvei said the deal, which marks its second acquisition in the past year, creates one of the world’s largest and most comprehensive alternative payment solution providers. The company said that Smart2Pay is also strengthening Nuvei’s presence in the digital gaming space and expanding its geographic footprint in countries like Russia and Brazil.

Strong growth is projected for Nuvei in 2021. Indeed, revenue is expected to increase by 27% from 2020 to about $445 million. Earnings per share are estimated to grow by 1,000% to $0.81. This growth is still not reflected in Nuvei stock price, so it’s a good buy now.