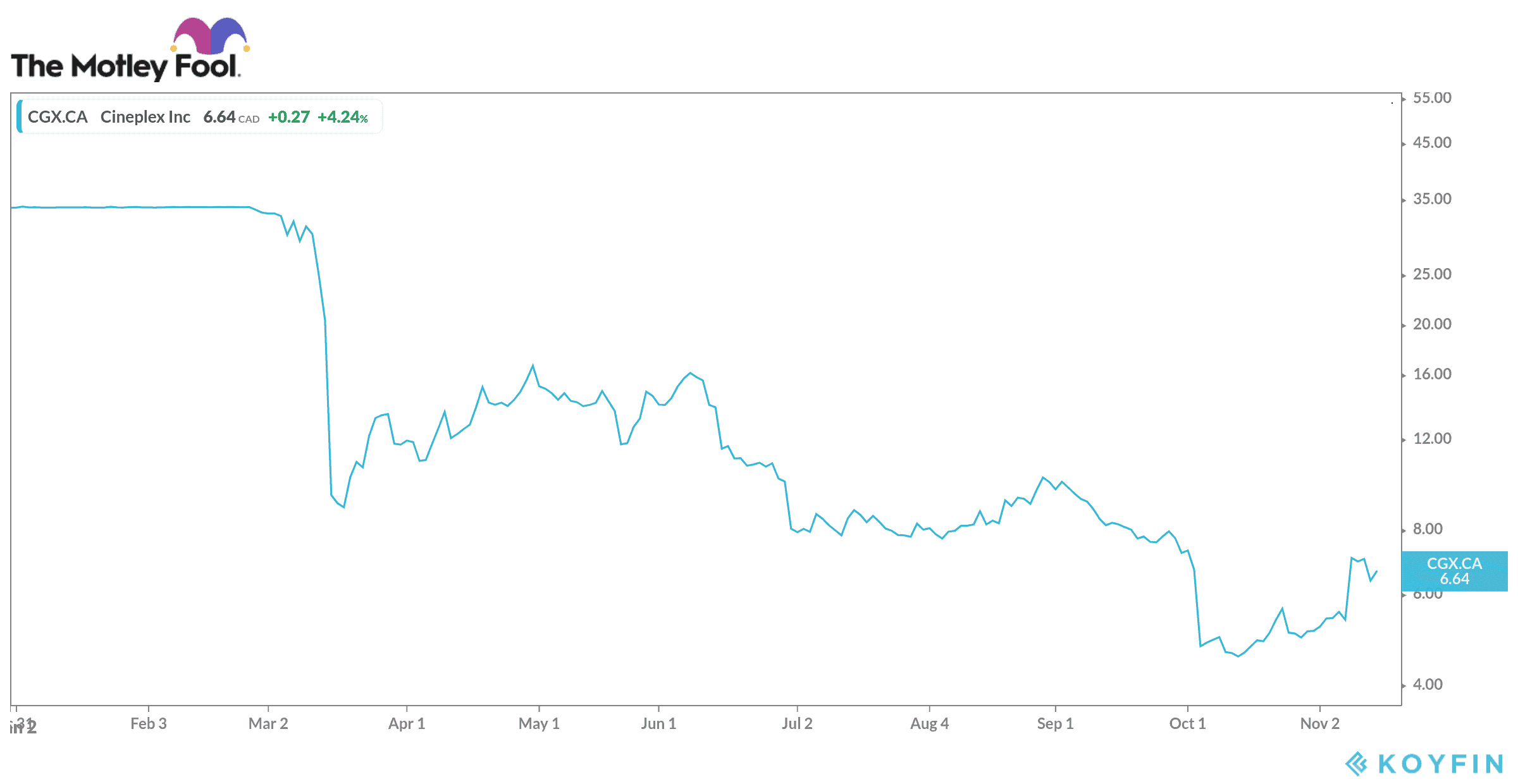

Cineplex (TSX:CGX) reported its financial results for the three months ended September 30, 2020, on Friday morning. The movie theatre chain’s third-quarter results were hit by the COVID-19 pandemic, as the company temporarily closed all of its location-based theaters and entertainment venues as of March 16, 2020, only starting to reopen in some markets during the last weeks of June. Cineplex stock is down about 80% for the year.

Cineplex revenue sinks 85% as restrictions hit attendance

To lessen the impact of theatre closures, Cineplex temporarily laid off staff, cut wages, and attempted to negotiate leases with landlords.

Even when theatres were open, there have been struggles. Local health regulations have drastically reduced the number of moviegoers Cineplex can accommodate at a time, and the chain has had to pay for increased sanitization and the costs associated with physically distancing guests and protecting staff.

Cineplex says its sales this summer were more than 85% lower than summer 2019, with the COVID-19 pandemic contributing to a 91% drop in moviegoers. Cineplex reopened its full chain of theaters with show hours and limited seating on August 21 but was only able to attract 1.6 million people to theaters in the quarter, up from 17.5 million in the last summer, even with the release of the much-anticipated movie Tenet.

The Toronto-based theatre chain says it ended the third quarter with a net loss of $121.2 million, or $1.91 per share, while this time last year Cineplex made a profit of $13.4 million, or $0.21 per share.

The company says it had revenue of $61 million in the three months ending September 30, up from $418.4 million in the same period in 2019.

Analysts polled by Refinitiv expected Cineplex to lose $57.3 million, or $1.31 per share, on revenue of nearly $75.2 million.

Ellis Jacob, President and CEO of Cineplex said: “Cineplex is a resilient organization and we remain confident in our financial position and business recovery plans, despite the tough industry and economic conditions.”

The company, which is still awaiting trial over a broken deal to buy Cineworld, says it has raised an additional $303 million in credit, reduced rental costs by $58 million, and received around $22.5 million in wage subsidies.

Restrictions and delays are hurting Cineplex profits

After September 30, 2020, restrictions on social gatherings were reinstated in several key markets Cineplex operates, including parts of Ontario, Quebec, and Manitoba. The restrictions have resulted in the mandatory temporary closure of some LBE theaters and venues. It is possible that other restrictions may be reinstated in the future if there are other outbreaks of COVID-19 in Canada.

Like other chains, Cineplex suffers from the delay of several major titles. Last month, Metro-Goldwyn-Mayer postponed the release of the James Bond film No Time To Die until April, bringing shares down to an all-time low.

Cineplex stock is still far from pre-pandemic levels

Cineplex stock jumped 31% Monday, like that of many other companies whose activities are paralyzed by the Covid-19, after Pfizer said its Covid-19 vaccine may be 90% effective. Investors are hopeful that a vaccine in early 2021 will revive several sectors, including indoor entertainment and cinema.

This does not mean that Cineplex is out of the woods, however. Rather, Cineplex’s profitability will be impacted until all of its theaters can reopen. Given that COVID-19 cases are rising throughout the country, this may take some time. Plus, with a P/E of 40.7, Cineplex stock is expensive.