The coronavirus pandemic has caused a vast array of headwinds for Canadian companies this year. Some have been impacted slightly negatively, while others have gotten a positive boost to business. Then there are the well-known stocks like Cineplex (TSX:CGX) that have been impacted significantly since the start of the pandemic.

Cineplex is in the same boat as many other popular TSX stocks right now, such as airlines and restaurants. And because its business has been so significantly impacted, its stock has followed suit. Currently, Cineplex stock trades more than 70% off its 52-week high.

This insane discount has helped Cineplex attract several investors looking to take advantage of the major bargain in Cineplex shares. So, with all the interest in Cineplex stock, you may be wondering why more investors aren’t buying or why the stock has barely moved at all.

Cineplex stock performance

If you just look at a five-day chart or even a one-month chart, you may be wondering what I’m talking about. After all, the stock has had a considerable rally as of late. This is due to some of the positive vaccine news.

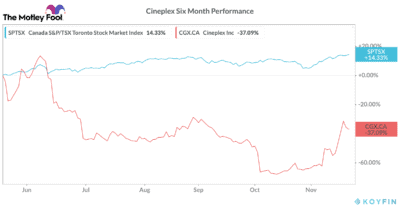

However, looking back, Cineplex stock has underperformed the market considerably over the last six months.

Even with the stock’s recent miniature rally, this chart shows just how much Cineplex stock has underperformed the market. And this starts in mid-May, after the initial selloff and corresponding recovery rally.

The chart is a clear example of why relevant performance matters and why, although you may be buying a stock you think is undervalued, if nobody else is willing to buy that stock, it may turn out to be a value trap.

Why aren’t more people buying Cineplex?

Despite the minor rally Cineplex stock has seen since the positive vaccine news, the stock is still well undervalued. One of the main reasons why it continues to trade so cheap is because investors just aren’t willing to take the risk yet.

Despite several highly effective vaccines, there’s still so much uncertainty. That’s improved slightly. We now know there’s a vaccine available, and we know that most of the population should have it by the end of next year. This certainty is what’s pushed the price up in recent weeks.

However, there’s still uncertainty about any setbacks before we all get the vaccines. Will there be a setback with vaccine manufacturing or distribution? What will the process and economy look like as we are in the middle of vaccinations? What if another wave hits during then?

And even with all the vaccine information we have, we still don’t know how bad the winter wave will be. Moreover, how long will the second wave last? These are crucial questions investors want answered before they buy a distressed stock like Cineplex.

While some of these concerns may not come true, the possibility that they could happen is enough risk to make investors avoid Cineplex stock.

Foolish takeaway

Just because there is a tonne of risk that still remains doesn’t necessarily mean you should avoid Cineplex stock. In fact, acting now while others wait on the sidelines could create a good opportunity for you. However, with that being said, if you do decide to move forward with an investment, it’s crucial you’re aware of all the risks I mentioned above.

Despite knowledge of several effective vaccines, there is still so much uncertainty in the short term. So, while you may want to take a position today, I would certainly exercise a tonne of caution.