The Edmonton-based Canadian Western Bank (TSX:CWB) will report its Q4 of fiscal 2020 earnings on Friday next week. This month, its stock has seen sharp gains like most of its peers — outperforming the broader market. It has gone up by 16.1% in the last month, whereas the TSX 60 Index has risen by 6.3% during this period.

Let’s look at analysts’ expectations from Canadian Western Bank’s coming earnings event, which is crucial to maintain its recent positive stock price trend.

Bay Street’s expectations from Canadian Western Bank

As we know, the COVID-19 headwinds have been hurting all large banks for the last couple of quarters. However, Canadian Western Bank’s overall financial performance has remained relatively better than most of its larger peers. In the second quarter of fiscal 2020, it reported a 19.6% YoY (year-over-year) drop in its adjusted net profit to $52.3 million. The net profit rose sequentially to $64.7 million in the third quarter — but still down 9.7% on a YoY basis.

As we advance in the fourth quarter, Bay Street predicts its net profit drop rate to improve further. According to their estimates, Canadian Western Bank is expected to report a $64 million bottom line in the fourth quarter — down 6.4% YoY.

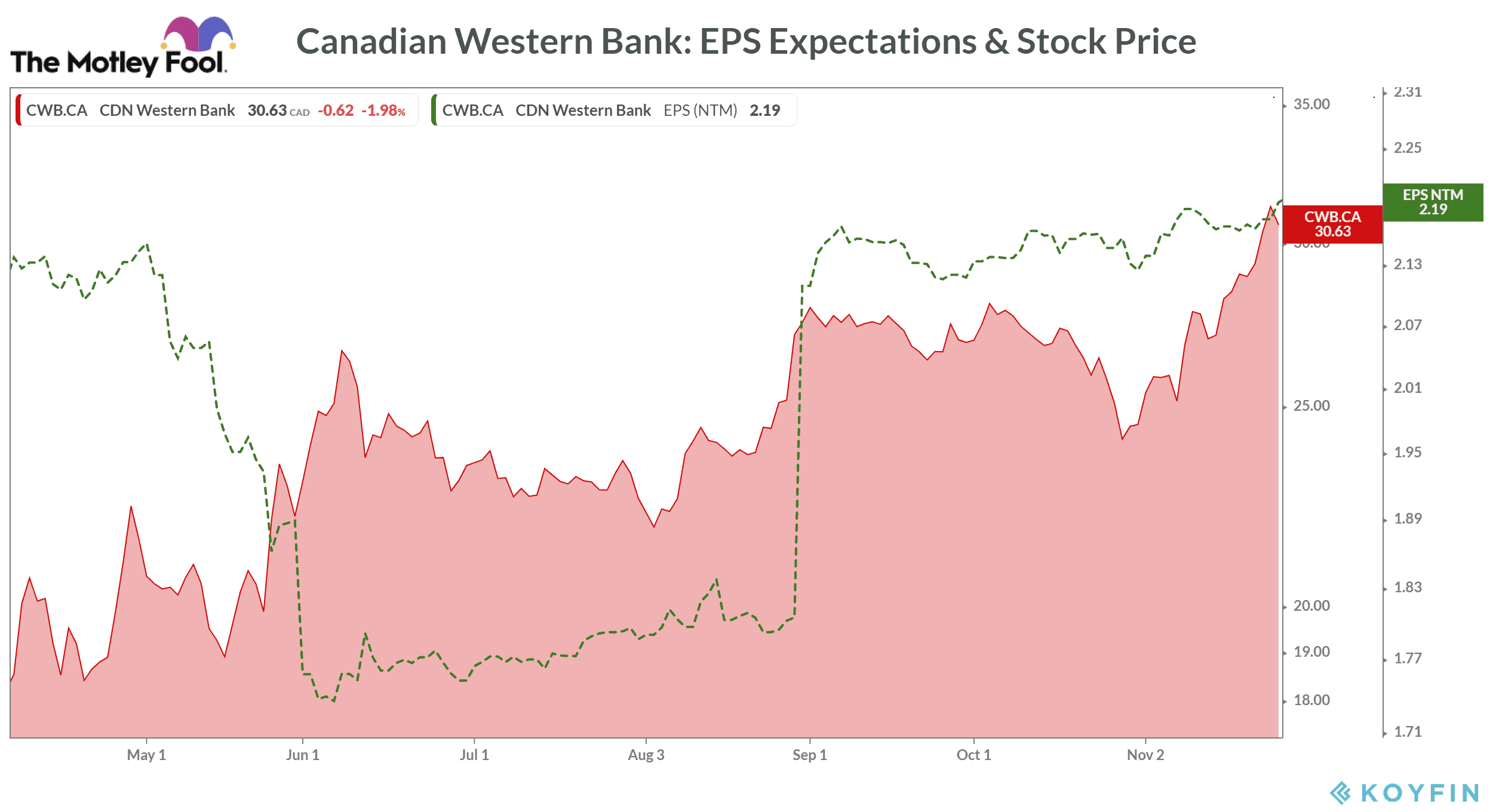

It would translate into $0.74 earnings per share — at par with its earnings in the previous quarter and 5.4% lower from a year ago.

Analyzing the existing trend in CWB’s financials

In the third quarter, Canadian Western Bank reported a 4% rise in its total revenue to $226.5 million — it was also 9% better than analysts’ consensus expectations. Interestingly, the bank completed the acquisition of T.E. Wealth and Leon Frazer & Associates. This newly acquired business should help CWB to expand its presence in Toronto and Montreal.

Like many other banks, Canadian Western Bank has also tried to improve its digital presence in the last couple of quarters to help it minimize the pandemic’s negative impact on its business. On the other side, the bank also managed to register 22% annual growth in its branch-raised deposits in the last quarter — showcasing strength in its digital as well as in its offline banking operations.

Stable net interest income

Despite coronavirus’s negative impact on its overall business, Canadian Western Bank’s net interest income has remained stable in the last couple of quarters. In the quarter ended in July 2020, its net interest income stood at $200.8 million against $199.7 million a year ago and $191 million in the previous quarter.

Foolish takeaway

If CWB’s net interest income continues to remain stable in the coming quarters — along with an improvement in its profit margin — the rally in its stock is likely to continue in the coming months.

Canadian Western Bank is continuing to focus on business expansion, despite the challenges posed by the pandemic. A major portion of the bank’s interest income comes from general commercial and personal loans. That’s why its expansion strategy could help it reach more customers and pay off well in the coming years. That’s why I will look for a buying opportunity around its Q4 earnings event next week, as it’s a great stock to hold for the long term.