The holiday season requires a lot of planning: there are gifts to buy, food to prepare, parties to plan, etc. But have you thought about your tax planning? Neglecting it could have financial consequences, such as owing more taxes than you thought to the Canada Revenue Agency (CRA). Here are some important points you should consider.

Did you receive taxable benefits through the CRA?

You should start saving money now for the taxes you’ll have to pay in April to the CRA.

For example, no tax was withheld at the source for the Canada Emergency Response Benefit (CERB). You must therefore plan this payment. The amount of tax payable depends on your marginal tax rate. This is based on all of your income for the year 2020, including benefits.

The Canada Recovery Benefit (CRB) is also taxable. The government has already withheld 10% of the amount paid for tax purposes. However, the amount withheld could be insufficient. In addition, if your annual income is greater than $38,000, you will have to reimburse 50% of the sums received in excess of this amount.

Do you have CERB overpayments?

In order to complete your tax returns, the CRA will send you a T4A showing the total amount of CERB payments you received.

If you received overpayments, you must repay them before December 31, 2020. If you do so after that date, the T4A will show the total received without taking into account any refunds made in 2021. You will therefore have to pay tax on overpayments. In addition, your government benefits based on your income, such as children’s allowances, will be reduced.

Eventually, you can request a correction to recover the overpaid tax on the amounts reimbursed. However, you will have to take additional steps and suffer delays in your repayments.

Make sure you repay your overpayments at the right place — either at the CRA or at Services Canada. Money cannot be transferred from one department to another. If you make a mistake, you will have to request a refund from one place and then give it to the other.

Go to the refund page on Canada.ca to find out how and where to make your refund. If you have any questions, contact an agent at the CRA call centre.

Don’t forget your CRA credits and deductions

Certain expenses may be deducted from your taxable income or give you the right to a tax credit. For example:

- Medical expenses for you, your spouse, your minor children, or other dependents. Ask the relevant professional to give you a receipt that covers your expenses for the year;

- Charitable donations;

- Political contributions;

- Moving expenses;

- Investment fees.

Do you plan to withdraw money from your TFSA?

Thinking of withdrawing money from your Tax-Free Savings Account (TFSA) in early 2021? Instead, do so before December 31, 2020. You will then regain your contribution room as of January 1. This strategy will prevent you from waiting for another calendar year.

For 2021, the TFSA limit will be $6,000, so you can add this amount to your contribution room. As TFSA withdrawals aren’t taxable, investors should focus on investments that will provide the best long-term returns. Given the current level of interest rates, stocks remain the best option.

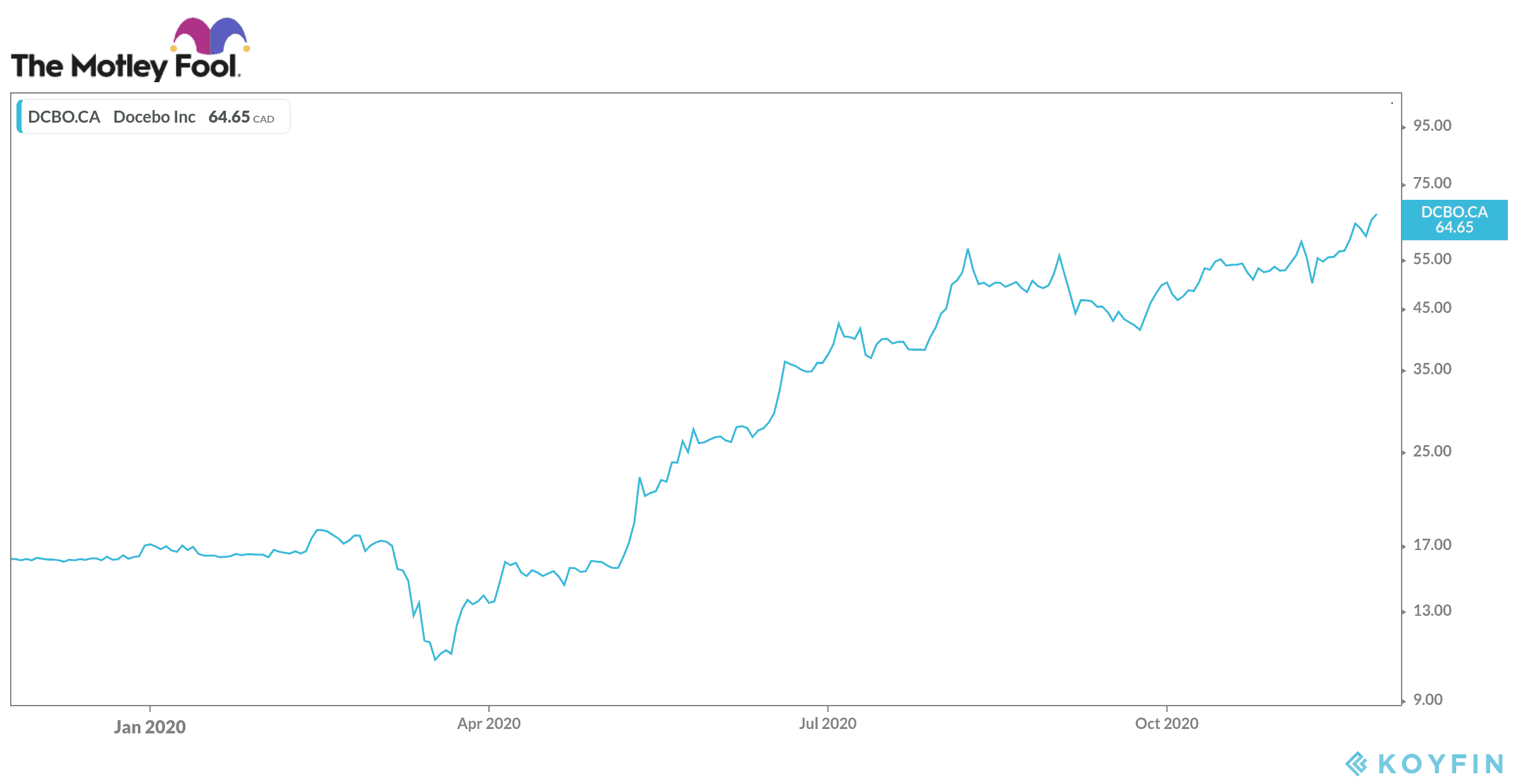

Many tech stocks have performed very well this year. Docebo is one of the best-performing Canadian tech stocks so far this year and has more upside.

Docebo has a cloud-based, customizable, artificial intelligence-based e-learning platform that offers end-to-end capabilities for training internal and external staff, partners, and customers, as well as the possibility to track and certify online courses and training. This is a stock you should consider buying in your TFSA to boost your returns.