Positive vaccine news has propped up oversold value stocks that were impacted by the pandemic. The rallies in these stocks can weaken or even dissipate altogether.

There are near-term risks, such as potential delays/hiccups in vaccine distribution, or maybe the vaccine programs won’t be as effective as expected. If these risks play out, there will be renewed sell interests.

Investors who’d bought at a low in these stocks might decide to book a profit. Those who bought at pre-pandemic levels might also perform tax-loss selling before the year ends.

Retail REITs

Retail REIT stocks, especially those with greater exposure to enclosed malls, could be in for another crash depending on how the pandemic situation plays out in the near term.

During the March market crash RioCan REIT (TSX:REI.UN) stock overshot to the downside by falling more than 50%. It took eight months for it to stabilize in the $14-15 per unit range before value investors jumped back in. They bid up the retail REIT stock by about 25%.

Although RioCan has been diversifying its portfolio, it’s still primarily a retail REIT, collecting about 90% of its rents from its retail portfolio versus 8% from office and less than 2% from residential.

It’ll take years for RioCan to diversify. For example, over the next five years, the REIT is expanding into non-traditional REIT industries, such as micro-fulfillment and medical centres. In the meantime, its cash flow still heavily relies on its retail portfolio.

The new normal retail environment post-pandemic is unclear. It could take a couple of years to get there. For this reason, we can’t determine its intrinsic using its pre-pandemic multiple. Some sort of discount must be applied for the time being.

The stock yields close to 8% right now, while its funds from operations payout ratio is estimated to be elevated to about 90% this year, which would make its dividend less safe. That said, management is keen on maintaining its cash distribution.

Oil and gas producers

Other than retail REITs, another industry that’s subject to another market crash is oil and gas producers, especially companies with poor balance sheets.

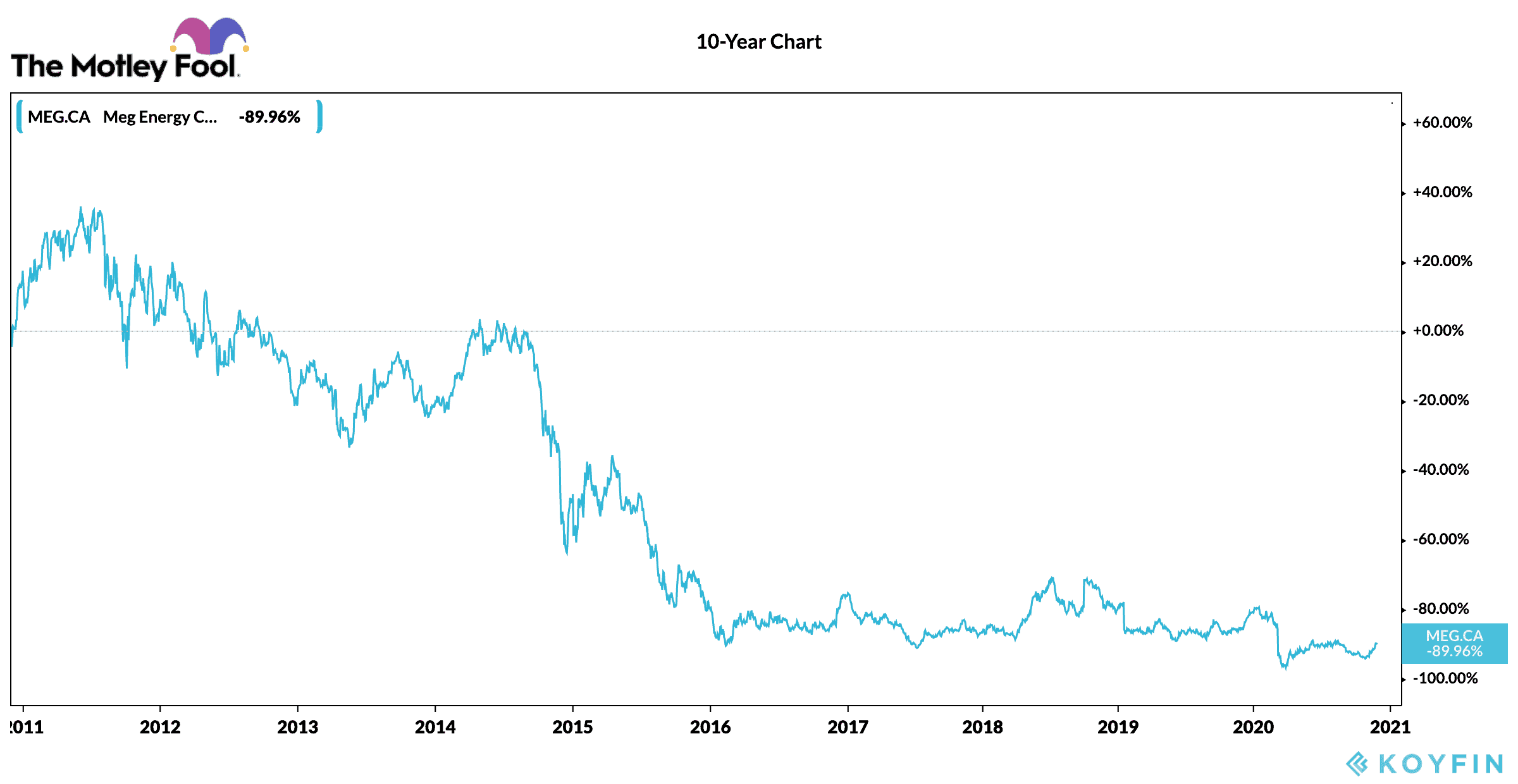

Oil and gas producers like MEG Energy (TSX:MEG) have highly unpredictable earnings due to the volatile prices of the underlying commodities.

One look at its 10-year price chart, and you can tell that it’s not an ideal buy-and-hold investment. Investors who jump in pretty much aim to buy at a low point and get out at a higher point.

MEG doesn’t have the best of balance sheets. In fact, S&P deems it non-investable with a credit rating of CCC+. (BBB- implies investment grade.) So, investors who buy are really gambling for higher commodity prices.

Interested investors should be cautious after the stock’s recent rally of +60% from a low in October.

The Foolish takeaway

Stocks in both the retail REIT and oil and gas industries experienced awesome rallies in the last month or so. The stocks have reached their near-term fair valuations, and it’s time for caution.

If there’s negative pandemic news or hiccups in the execution of vaccine programs, another market crash in these industries is imminent.