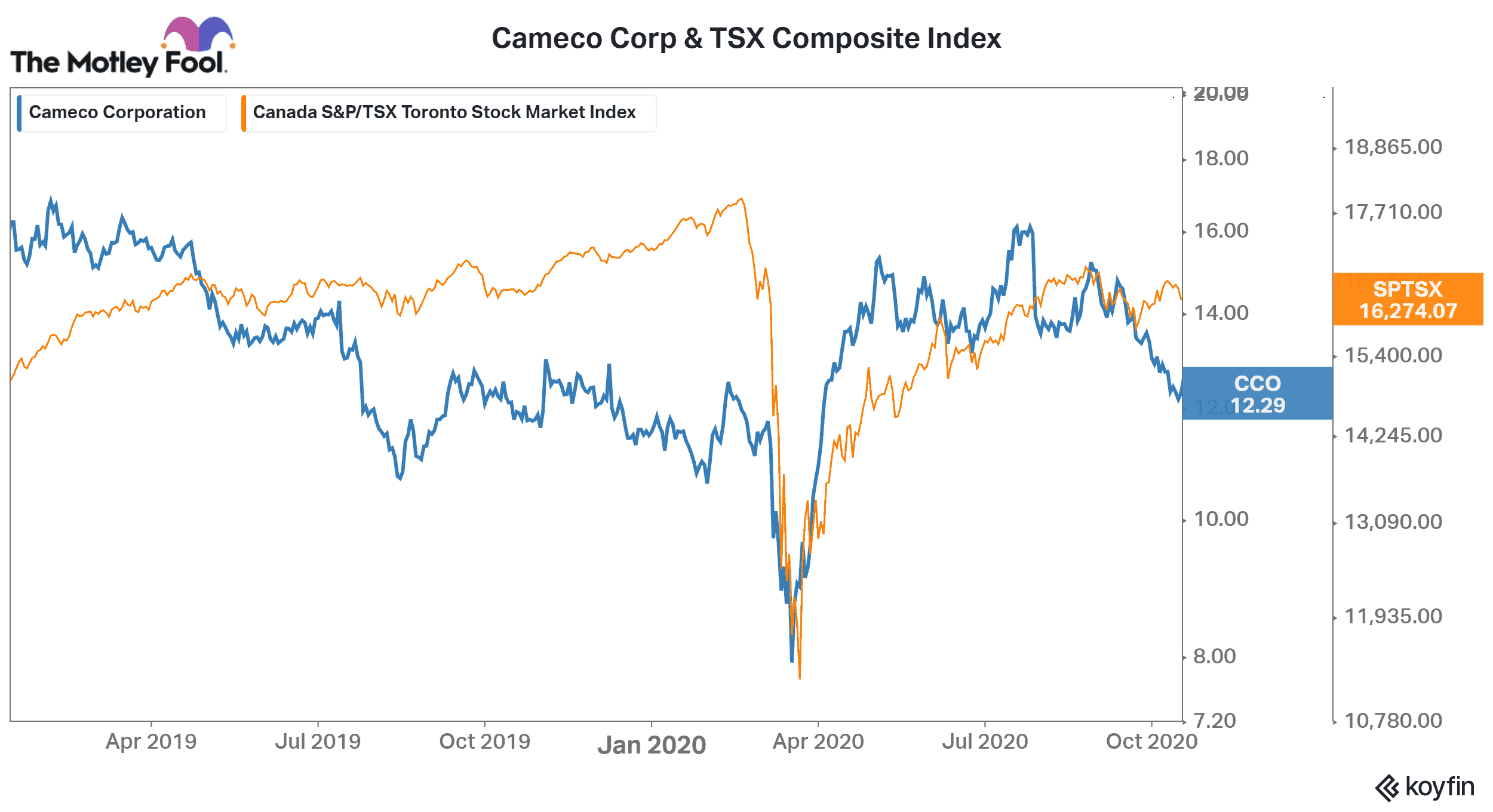

The shares of Cameco (TSX:CCO)(NYSE:CCJ) — the Canadian uranium company — are rallying in December. As of Monday, its stock has risen by about 20% on a month-to-date basis — making it the top S&P/TSX60 Index gainer for the month.

Cameco stock

Cameco is a Saskatoon-based company with its focus on uranium production and fuel services. Over 70% of its total 2019 revenue came from the uranium segment, while the remaining came from fuel services. Despite Canada being its home market, the United States accounts for most of Cameco’s revenues.

The year 2020 has mostly been positive for Cameco investors. Its stock fell by 7% in the first quarter but turned positive and erased all these losses in the second quarter as it rose by 30%. After trading on a mixed note in the third quarter, its stock is rallying again in Q4. On a quarter-to-date basis, Cameco stock has risen by 15.6% against 8.2% gains in the TSX 60 stocks.

Cameco’s recent financials

The ongoing trend in Cameco’s quarterly financials is negative due to the negative impact of the COVID-19. The company has missed analysts’ consensus estimates in the last couple of quarters by a wide margin. In the second quarter, Cameco reported an adjusted net loss of $0.16 per share — much worse than analysts’ expectation of a five cents loss per share.

In Q3 2020, its adjusted net loss widened further sequentially to $0.20 adjusted loss per share — once again missing the consensus estimate of $0.05 loss per share. It was also the first time when the company missed its quarterly revenue estimates in the last year.

On the positive side, Cameco’s revenue has consistently been rising on a YoY (year-over-year) basis for the last four quarters in a row. In the third quarter, its revenue increased by 25% YoY to $379 million.

Will 2021 be better?

COVID-19 has badly affected Cameco’s overall business. The pandemic has caused some delays in its uranium and conversion services pipeline. During Cameco’s third-quarter earnings conference call, its CFO, Grant Isaac, noted that “COVID is not just a 2020 event, but could have an echo into 2021.”

Nonetheless, the economic and the overall business situation should improve in 2021 as the pandemic subsides. That’s one of the reasons why analysts expect the company’s annual losses to significantly improve next year compared to expected 2020 losses. In 2020, analysts expect Cameco to report a $260 million loss, and it’s expected to improve to a $34 million loss in 2021.

An excellent stock for long-term investors

The year 2020 has been exceptionally bad for many traditional and clean energy stocks, and Cameco was no exception.

However, we should remember that Cameco belongs to an industry with massive growth potential in the coming years. The demand for uranium is likely to surge as more eastern countries plan to deploy more nuclear plants in the future. That’s one reason why I consider Cameco the stock a great long-term buy.