About six weeks ago, I laid out the differences in choice investors had between buying WestJet’s parent company’s stock, ONEX (TSX:ONEX), against the prospects of buying Air Canada (TSX:AC) stock.

At the time, I’d mentioned that ONEX is the safer pick, but Air Canada would offer more upside potential in the case of positive news that could act as a catalyst.

Sure enough, only a couple of weeks later, the first vaccine news came out, and these stocks, among other distressed businesses, began a massive rally.

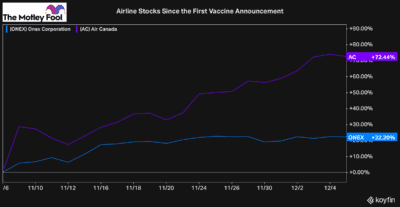

As was expected, both stocks have seen strong performance, but the difference between WestJet’s parent stock and Air Canada stock have been strikingly different.

As you can see, Air Canada has significantly outperformed ONEX since the news of the vaccine. That’s to be expected. Air Canada is now up more than three times as much as ONEX since the vaccine news came out.

Essentially, all of Air Canada’s business has been impacted by the pandemic. ONEX, however, is seeing the most impact from WestJet, but the stock also has several other subsidiaries, which is why it’s been a lot less volatile in comparison to Air Canada.

While that may make Air Canada the more appealing stock right now, when looking at both companies’ performances over the last month, it’s worth it to keep in mind that Air Canada still has a lot more risk in the current environment.

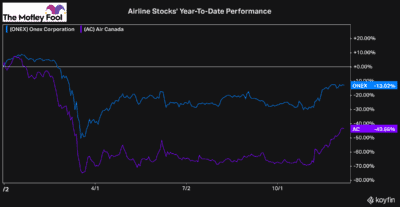

The chart above shows the year-to-date performance for both airline stocks. Although the right-hand side of the chart is the last month, when Air Canada overperformed, it’s clear that throughout the year, Air Canada has significantly underperformed WestJet’s parent stock.

So, where does that leave us today, and what stocks should investors consider?

Should you buy Air Canada or WestJet’s parent stock?

To figure out which airline stock you should buy is relatively simple. These two stocks have a wide range of risk-and-reward potential, so it all depends on what you feel comfortable with.

Air Canada is a pure-play airline. So, if you’re interested in airlines for their major recovery potential, then this is probably the stock you’ll want to choose.

ONEX, WestJet’s parent stock, is a better choice for investors who want some exposure to the recovery potential of airlines but don’t want their entire investment exposed to the sector.

ONEX is considerably less risky, as evidenced by the year-to-date chart above. So, if things don’t turn out as expected with the pandemic, and the impact on airlines is longer than many are expecting, investors in ONEX will see less of an impact.

However, if the sector does recover as investors expect it to or even faster, there won’t be anywhere close to as much potential as Air Canada stock. That’s evidenced by the first chart showing both stock’s performances in the month since the vaccine news.

A more than 20% gain in the last month by ONEX is not bad at all. But when one of its peers returns more than three times as much, it’s clear there are stark differences in both companies.