Another stock market crash or decline could be on the horizon for 2021. Stock markets have been soaring on news related to COVID-19 vaccines. Since then, the S&P/TSX Composite soared almost 13% to just below all-time highs.

Similarly, the S&P 500 has continued to break through all-time highs, gaining almost 11%! Investors are looking six-to-eight months ahead at a world that will hopefully be recovering out of this pandemic.

Stock markets could be setting up for a crash

While there is nothing wrong with the optimism, there is a risk that markets are starting to overshoot. We are still in a pandemic. Many portions of the economy are at risk from lock-downs or stricter pandemic restrictions. COVID-19 cases continue to explode across North America.

Lockdowns are still a major risk across most economies, as is evident by what just happened in Alberta. If further wide-scale lock-downs occur, markets could get jittery and stock markets could certainly be set for a correction or a minor crash. If you are worried about another market crash, there are two stocks I would certainly be owning now.

Fortis was made for market crashes

The first market crash stock to own is Fortis (TSX:FTS)(NYSE:FTS). It is one of North America’s largest essential utility providers. Fortis has 10 regulated natural gas, electric transmission, and power production operations in Canada, the U.S., and the Caribbean. It provides electricity services and natural gas to over 3.3 million customers.

With a potential market crash imminent, this is a core stock to hold. It has a beta of 0.05. This means its price movement has a very low correlation to the overall stock market.

Regardless of market volatility, it will continue to chug away, relatively stable, largely because 99% of its assets are contracted or regulated. Its cash flows are incredibly stable and resilient regardless of economic conditions and stock market turmoil.

Despite a strong safety profile, Fortis is still growing at an attractive rate. Based on a new capital investment cycle, management believes it can grow its rate base by 6% a year for the next five years, which will translate in an annual dividend growth target of 6% over that same period.

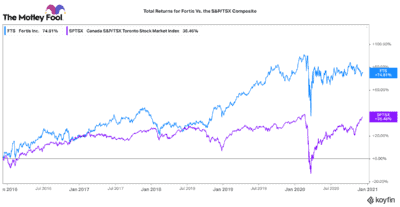

While this stock is boring, it pays a well-covered 3.85% dividend. It has nearly doubled the returns of the TSX Index over the past five years! That makes it a top stock to hold, especially if you expect another market crash to come.

Brookfield will grow in any market

Another core TSX stock that every Canadian should own through a market crash is Brookfield Infrastructure Partners (TSX:BIP.UN)(NYSE:BIP). BIP has a more aggressive growth profile than Fortis, yet its business has many similar safety characteristics, with a diversified portfolio of infrastructure assets that span the globe.

Like Fortis, it owns essential assets like power lines, pipelines, LNG facilities, railroads, data centres, and cell towers.

Unlike Fortis, it has broader asset and geographic diversification, giving it an interesting balance of growth and stability. It has diverse counter-party exposure, a well-managed debt profile, and over 95% of its portfolio is contracted or regulated. Consequently, its results were hardly impacted through the pandemic shutdowns.

Its asset and geographic exposure make it attractive because it can actively acquire assets anywhere opportunity or attractive pricing exist. It is an experienced operator and investor in most geographies globally. Similarly, it has $5 billion of potential liquidity to deploy over the next few years.

Interest rates are at rock bottom, so it can finance assets with very attractive once-in-a-lifetime cash flow spreads.

Combine a growing 4% dividend, 7-9% annual organic growth, and even more upside from acquisitions and you get a utility-like, growth stock. Market crash or not, I expect BIP to keep up its strong growth trajectory for a long time to come.