The best stocks to buy now, Enbridge (TSX:ENB)(NYSE:ENB) stock and Fortis (TSX:FTS)(NYSE:FTS) stock, have very specific characteristics. In my view, the market and economic environment necessitates caution. This is because the market is trading at highs. Investors are shrugging off the potential economic hits in 2021. I mean, the COVID pandemic crisis is not over. There’s increasing talk of a third wave. And this third wave will be driven by the more contagious virus variants. They’ve already made their way into Canada. Here at Motley Fool, we want to help investors makes sense of all of this. It’s not easy. But I’ll share with you what my experience tells me.

I think that market has gotten ahead of itself in all the hope and excitement about the vaccine. In fact, many economists caution that things will get worse before they get better in 2021. The struggle is not over.

The best stocks to buy now are defensive, like Fortis stock

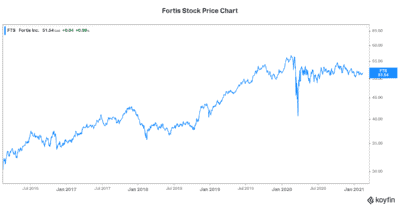

Both Fortis and Enbridge are highly defensive stocks. These businesses provide society with the vital energy that’s needed. Businesses and residential customers will always need energy. Fortis is a $24 billion utility stock and one of the best stocks to buy now.

Fortis is a leader in the regulated gas and electric utility industry in North America. This is a highly defensive business. Cash flows are highly predictable and highly resilient. Latest results highlight this. 2020 was a year like no other. The COVID pandemic wreaked havoc on the economy. Lockdowns crippled certain industries. But Fortis stood tall in its defensive bubble.

In fact, adjusted earnings increased 7% in 2020. Also, cash flows remain resilient, rising slightly in 2020. If the market and the economy are hit, then this resilience is a key characteristic to look for. Likewise, Enbridge also has a great deal of defensiveness in its business. Enbridge is characterized by strong and predictable cash flows. This is due to the utility-like nature of its assets.

The best stocks to buy now provide dividend income, like Enbridge stock

The best stocks to buy now also consist of stocks that provide a generous dividend yield. Enbridge stock is currently doing this wonderfully. Its 7.5% dividend yield is one that comes once in a lifetime for a company as defensive as this. It is unheard of for a company like Enbridge. This company generates massive amounts of cash flows. And it provides the necessary infrastructure to meet the energy needs of society. It’s essential.

But the stock is suffering from negative sentiment. It’s suffering from the expectation that fossil fuels are not the future. The disconnection here is big. First of all, we will need this energy for decades to come. Second of all, Enbridge and other fossil fuel companies are cleaning up their acts. And thirdly, Enbridge and other fossil fuel companies are diversifying into renewable energy.

So, Enbridge continues to grow its dividend. In fact, Enbridge has 26 years of dividend growth under its belt. Similarly, Fortis is also growing its dividend. Fortis has 47 years of consecutive dividend growth under its belt.

Buy Enbridge and Fortis stocks now to shelter your money from an upcoming storm

As you can see, I’m of the viewpoint that the TSX stock market is due for some downside. I can’t time it perfectly. I can’t tell you how long it will last. Nobody can. But at Motley Fool, we seek to guide and educate.

So, what I can do is tell you that the risk/reward for buying stocks has deteriorated. What this means is that the upside potential in the market relative to the risk for downside losses is not attractive. I don’t think the market understands this fully. The excitement over the COVID vaccine has taken over.

Motley Fool: The bottom line

Enbridge and Fortis stocks are in my best stocks to buy now list for the reasons outlined in this article. To put it simply, in the event of a weak, falling market, your money is safe in these stocks. For example, they have lower downside, because of the defensive nature of their businesses. Also, shareholders of these stocks will at least return a sure dividend return — 7.5% for Enbridge stock and 4% for Fortis stock.