goeasy (TSX:GSY) and Royal Bank of Canada (TSX:RY)(NYSE:RY) are two top TSX stocks to buy now. Here’s why.

goeasy

This financial services company is a consumer lender to Canadians across the country — and goeasy offers its clients all kinds of loans, including home and auto. In addition to loans, the company also offers credit monitoring services to its clients.

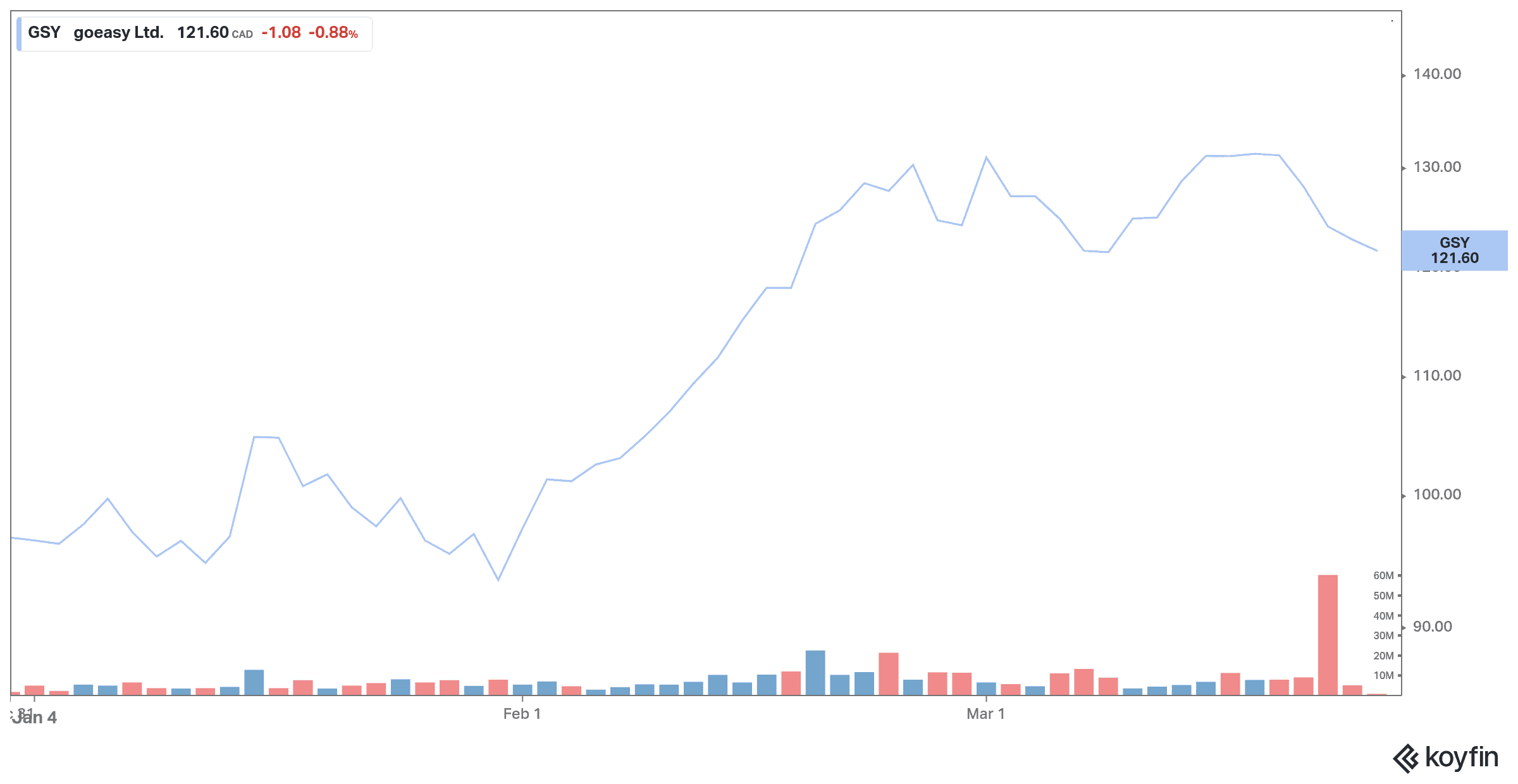

goeasy stock has created considerable wealth for its investors over the past two decades. Meanwhile, shares of the subprime lender have returned near 30% year to date, outperforming the market.

If the economy does indeed experience a strong rebound this year, we could very well see goeasy stock continue to soar in 2021.

The rally in the stock is driven by favourable industry trends and picking up consumer demand. goeasy is expected to benefit from the strong growth of its loan portfolio and the expansion of its products. In addition, a large addressable market and strong payments performance are likely to boost its finances. In addition, a large market for non-senior loans, new products, and geographic expansion could further accelerate its growth rate.

goeasy’s revenue and profits have grown steadily at a double-digit rate in the past. The company had an impressive performance in the fourth quarter.

goeasy’s revenue and net income are expected to continue to grow at a strong pace in the years to come, which will likely lead to increased dividend payouts. The dividend aristocrat has been increasing its dividends at a fast pace, and the trend is expected to continue. Currently, the company pays quarterly dividends of $0.66 per share, which represents a return of dividend of 1.5%.

Reopening the country could lead to a massive increase in consumer spending. If that happens, goeasy could see demand for its top-selling products skyrocket as the year progresses. So, you see why goeasy is one of the top TSX stocks to buy now.

Royal Bank of Canada

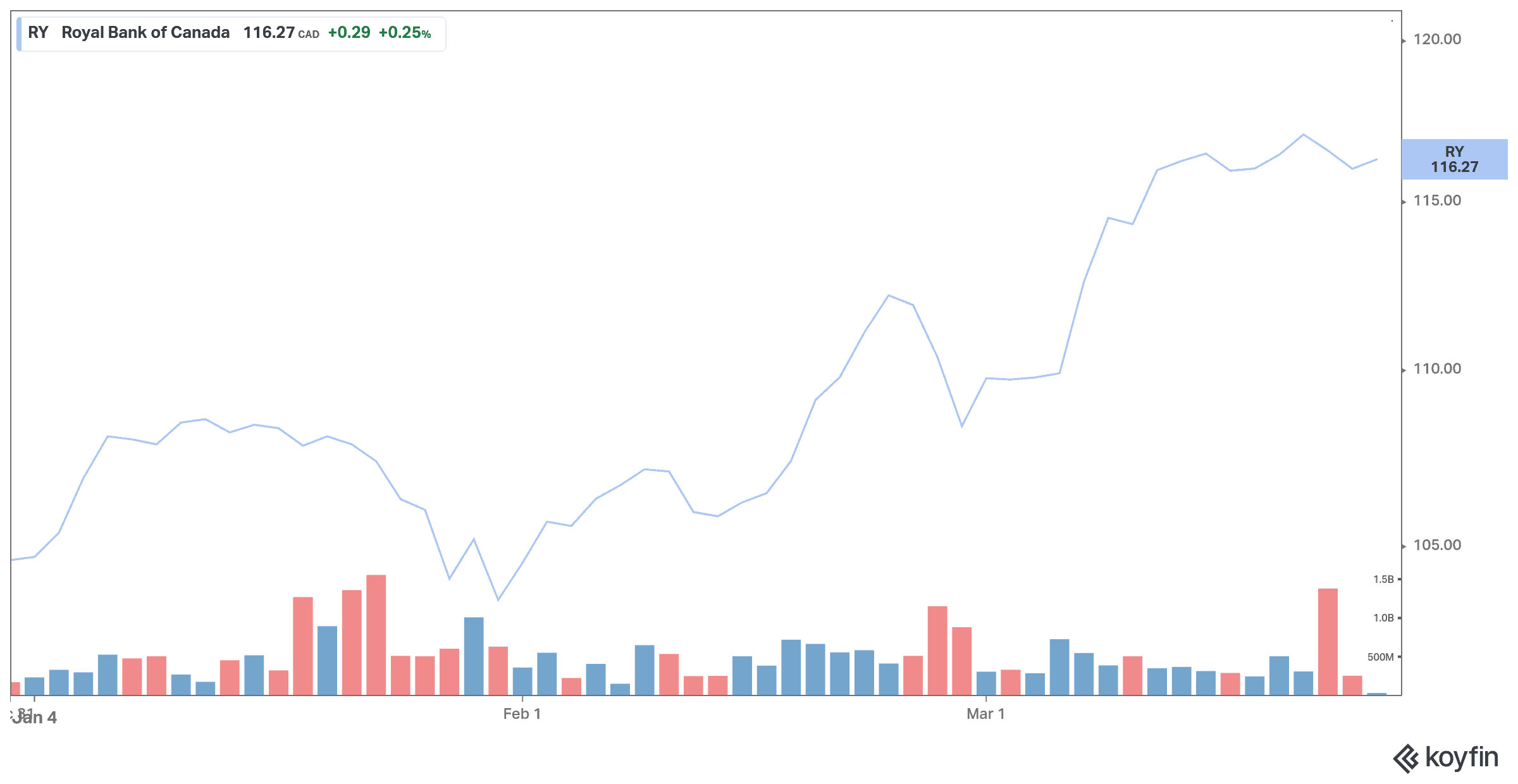

Canada’s biggest bank has been around since 1864 and has seen its best and worst times. Yet in the wake of every downturn or recession, RBC stands tall.

The resilience of the banking giant is once again fully displayed in 2021. Despite the impact of COVID-19 and massive headwinds in the industry, the blue-chip stock is up more than 10% since the start of the year.

Now may be the time to buy, as the rally has only just begun.

RBC is in good shape in 2021. The bank is over-reserved with impressive growth in banking and trading services. It’s also the best wealth management franchise in Canada. The country’s banking sector is more stable than ever thanks to a strong regulatory environment.

Today, the largest Canadian brand is one of the 10 largest banks in the world. RBC is well diversified. The bank is familiar with complex market environments and easily adapts to industry trends.

RBC just reported strong results for the first quarter of fiscal 2021. Net income was $3.85 billion for the quarter ended January 31. RBC pays a quarterly dividend which currently yields 3.7%. This is one of the best dividend stocks as RBC’s payout is safe and reliable.

The bank has weathered the worst of the pandemic in good shape. It is now poised to take advantage of the economic recovery, making it one of the top TSX stocks to buy now.

Low-interest rates continue to fuel strong demand for housing. This bodes well for the mortgage business of RBC. Stock markets are trading at record highs and investor activity has increased with a wave of young people who have become started trading stocks over the past year. These situations support the growth of the wealth management and capital markets divisions.