Warren Buffett is investing in 5G stocks. Buffett recently bought 147 million Verizon shares worth about US$8 billion. Buffett also recently increased its stake in T-Mobile to around US$706 million from US$276 million last year. “He [Buffett] sees the value of this sector,” T-Mobile CEO Mike Sievert told Yahoo Finance.

Here in Canada, BCE (TSX:BCE)(NYSE:BCE) and Telus (TSX:T)(NYSE:TU) are two top 5G stocks. Let’s have a look at these two telecom companies.

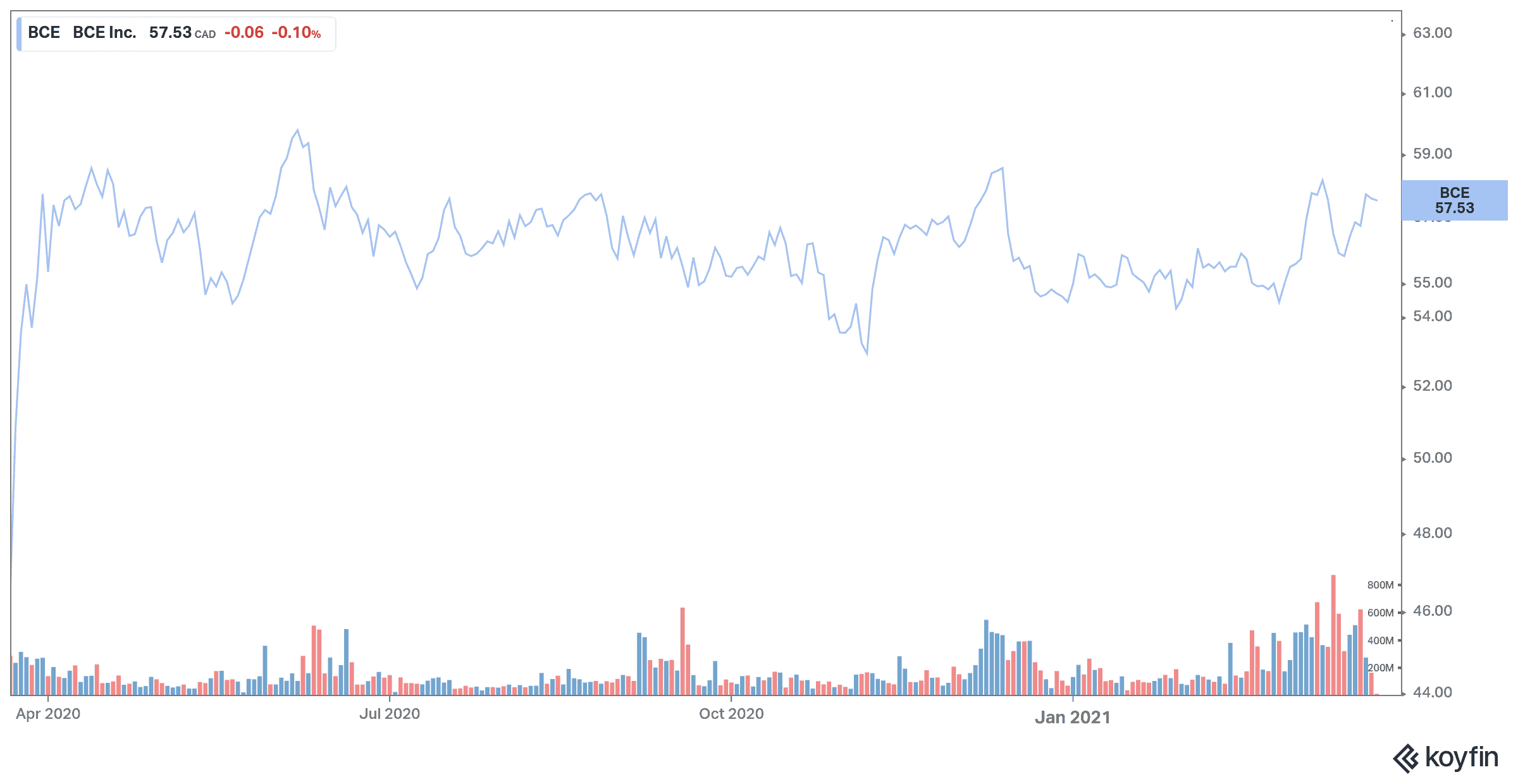

BCE

BCE has the largest data centres, wireless, and wireline networks.

Throughout the pandemic, BCE has been incredibly resilient. The two main impacts it has faced have been in its media division, which represents only a small part of its consolidated operations. The other significant impact was on mobile roaming charges and data overage charges.

Sales have only declined by 4.5% in the last four quarters. And because it’s so robust, it’s the perfect long-term growth stock to buy today and hold on to for years to come. BCE stock has risen by more than 10% in the past 12 months.

In February, BCE announced it would spend $1 billion to double its 5G coverage over the next two years. With liquidity of $3.8 billion and an adjusted EBITDA margin of 42% in 2020, BCE is well capitalized to accelerate its 5G expansion and pay additional dividends. Profits are expected to grow at a compound annual rate of 4% over the next five years.

BCE has been a Dividend Aristocrat for over a decade now and has maintained his payout, despite the accounting losses induced by COVID-19. It has increased its dividends at an average annual rate of 6.4% over the past decade.

BCE had recently increased its quarterly dividends by 5.1% to $0.875 per share, which represents a dividend yield close to 6%. The hike in its dividends shows the company’s confidence in its post-pandemic recovery.

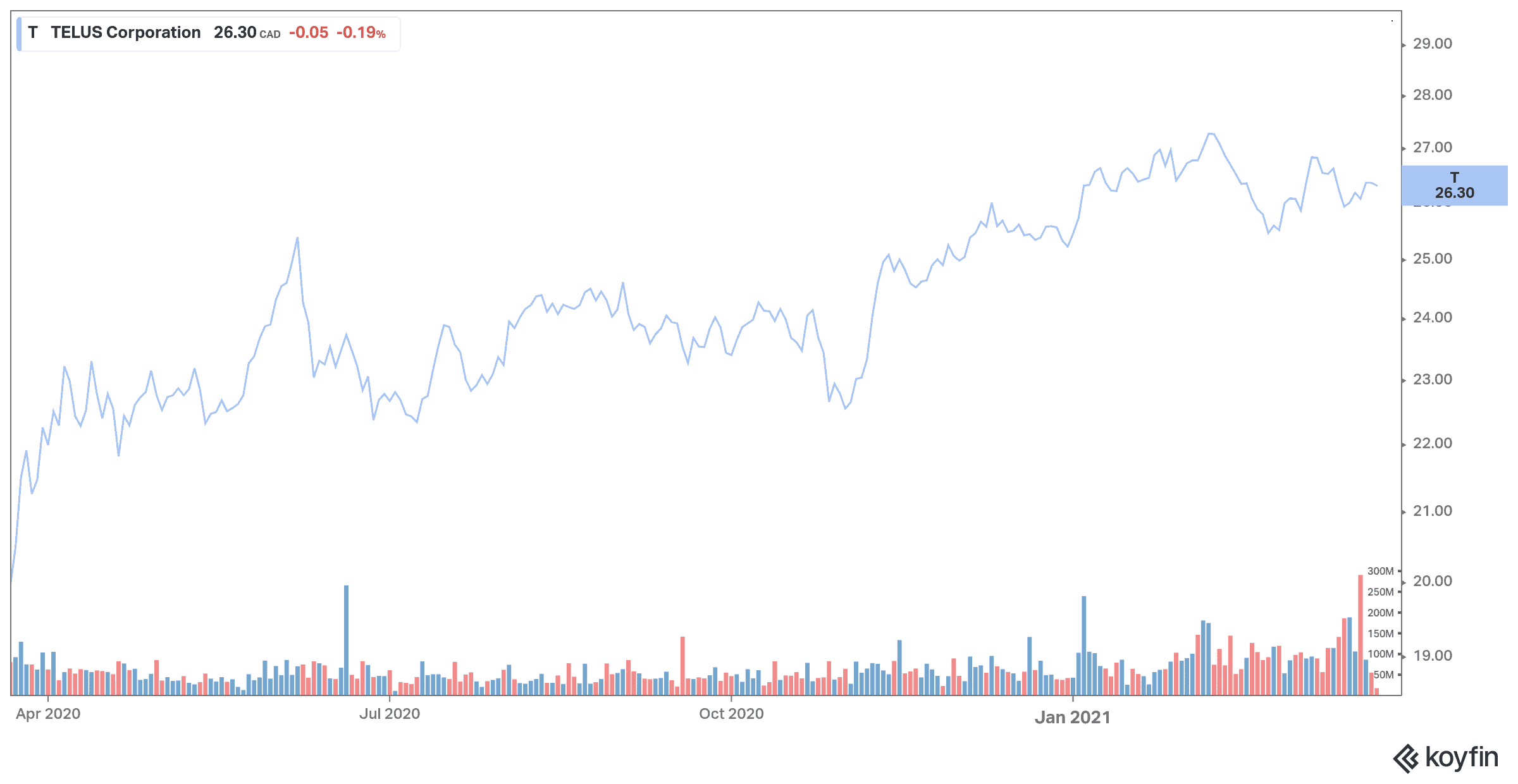

Telus

Telus is one of the largest telecommunications companies in Canada and one of the best 5G stocks to buy now. In 2020, it saw some of the biggest customer additions in the industry and was rated one of the best networks in the world. Telus has invested heavily in its fibre optic networks. Now, 85% of its network has high-quality, high-speed broadband. This will be a crucial benefit, as Telus will further deploy 5G technology in its data network.

This Canadian stock is more than a telecom company. Telus has invested heavily in the digital companies of the future, including investments in digital healthcare, agriculture, customer experience, security, and the Internet of Things. It just created Telus International, one of the largest tech IPOs in Canada in history. Telus is building a digital empire, which for the most part is still sidelined by the market.

Telus has a head start when it comes to its 5G network. The company’s wireless and wireline businesses were placed before the pandemic as competitors struggled to abandon theirs. This means that the company has achieved strong revenue growth with very little cost while renegotiating telecommunications contracts.

Profits are expected to grow at a compound annual rate of 13.6% over the next five years. That’s pretty incredible growth for any business, let alone a telecommunications player. Telus shares have risen by about 30% over the past year.

Telus pays a quarterly dividend of $0.311 per share, which represents a strong return of 4.5%. It aims to increase its dividend at an annual rate of 7-10% by the end of 2022.