If you want to improve your investing performance, sometimes it’s about the Canadian stocks you’re buying. Other times, it has nothing to do with the best stocks to buy now.

Instead, sometimes investors need to make better decisions and eliminate mistakes. Of course, investing in poor stocks are mistakes to avoid, but investors can avoid those mistakes by getting to the root of each decision they make.

Improving when you buy and sell stocks, as well as the reasons for doing so, can go a long way. And the better the decisions you make, the better the stocks you’ll buy, and the better your investment performance will be.

So, with that being said, in addition to looking for the best Canadian stocks to buy, investors should always be looking to improve their decision-making process and eliminate mistakes. Here are three of the most common mistakes investors make.

Buying a stock then researching it after

Often, I see investors buy a stock and then ask what others think after the fact. Of course, it’s never a bad idea to get other’s opinions. However, at the end of the day, it’s your own decision. Plus, by the time you’ve already bought a stock, you should have made up your mind long ago.

The ease of buying Canadian stocks makes it possible to buy and sell the stocks multiple times on the same day.

So, you do have the luxury of being able to sell the stock tomorrow if you need to. However, when you look at buying a stock, you should be buying its underlying business for the long term.

Research is crucial, and you shouldn’t make an investment unless you’re absolutely confident you want to own that business for the long term. So, not only should you buy a stock because you believe in its long-term potential, but you should also decide that well before you’ve pulled the trigger.

Worrying about the price of your Canadian stocks when they’re falling

Another major mistake I see commonly from investors is the concern they have when stocks they bought stop rallying and begin to fall.

It’s fine to want to know why your stock is falling in price. In fact, it’s important you do. You need to keep up to date with the developments of your businesses.

However, 99 times out of 100, it’s going to be some type of short-term issue that has no real impact on your company long term. As long as that reason doesn’t change your long-term outlook of the Canadian stock, then there is no reason to worry about the price falling.

In fact, often, when some of your favourite stocks fall, you’ll welcome these opportunities, so you can add to your position.

Looking at the price a stock has been in the past

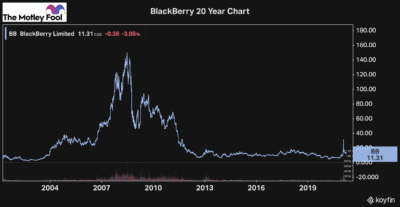

Lastly, one of the most common mistakes I continue to see investors make is looking at the past charts of Canadian stocks and trying to figure out if a stock is undervalued today.

Don’t get me wrong, charts are important. However, they serve a limited purpose. At the end of the day, you’re buying a business. So, to tell how much potential a company has, you need to look at its industry, its clients, its strategy, and its fundamentals.

I’ve seen investors comparing Canadian stocks to what they used to be worth 10 and sometimes even 20 years ago. A common Canadian stock this happens with is BlackBerry (TSX:BB)(NYSE:BB).

This is a major mistake with any stock, but especially with BlackBerry, and for a few reasons. First of all, the business and its operations are much different today than they were in the past. So too is the industry that BlackBerry operates in. That’s why it’s difficult with any Canadian stock to try and compare it to its past price.

Furthermore, the chart only tells you the stock price. It doesn’t tell you the market value of the company, which could have changed significantly if the company has been issuing shares over the years.

So, in order to save yourself from making major mistakes, I would avoid trying to use stock charts as a way to gauge long-term value.