Bank stocks are always a favourite for investors to consider, and Toronto-Dominion Bank (TSX:TD)(NYSE:TD), the largest bank in Canada by assets, is one of the top choices. TD stock and the other banks are consistently at the top of watchlists, because banking is a great business. That’s why they’re some of the best long-term Canadian growth stocks you can own.

Canada has an especially safe banking system, and these stocks have shown to be highly resilient. In addition to their incredible long-term stability, though, they also offer significant growth potential and pay attractive dividends.

TD stock, for example, currently pays out a roughly 3.8% dividend. That’s not bad for a stock that’s up 33% over the last three years. TD is clearly not a bad investment. In my view, though, it’s just not that great of an investment either.

So, rather than TD stock, here are two top Canadian growth stocks I would consider instead.

A top Canadian financial stock to buy instead of TD

If you’re interested in financial stocks, I’d consider Brookfield Asset Management (TSX:BAM.A)(NYSE:BAM) rather than TD stock. The two have businesses that are like apples compared to oranges, but both operate in the financial sector, and both have significant opportunities over the next few years.

Brookfield, though, offers a lot more growth potential, with a similar level of long-term stability. That’s why, if you’re investing for the long term, Brookfield is a better choice.

The massive Canadian conglomerate has proven time and again that it’s not just a great financial company. It’s also an incredible investment manager.

Brookfield and its subsidiary businesses are well known to be some of the best capital allocators. So, whether the world economy is booming, or the economy is slowing, and the market is in jeopardy of a pullback, Brookfield is always taking advantage and looking at the best opportunities to grow shareholder value over the long term.

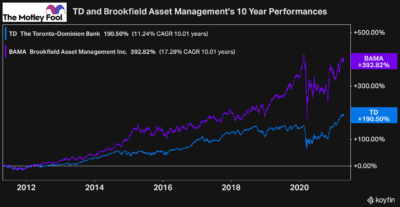

That’s why over the last 10 years, Brookfield has returned investors nearly 400% compared to TD stock, which is up less than half as much.

A 190% return for TD isn’t a poor performance by any stretch of the imagination. It just goes to show how incredible of a growth stock Brookfield has been.

So, if you’re looking for a Canadian growth stock to buy today, Brookfield is one of the top choices in the finance sector.

A top Canadian growth stock with robust operations

Often investors buy bank stocks because the risk to reward is so appealing. These stocks are usually quite resilient but also offer significant growth over the long term.

If that’s what you’re looking for, one of the best Canadian growth stocks to buy instead of TD is Algonquin Power and Utilities (TSX:AQN)(NYSE:AQN).

Algonquin is a utility and renewable energy stock. This is important, because utility stocks are some of the safest companies you can buy — even safer than banks.

However, utilities often don’t offer that much growth potential. That’s where Algonquin’s renewable energy segment comes in.

There is a tonne of opportunity for growth in the green energy sector, making Algonquin a top Canadian growth stock.

Governments continue to make pledges to improve their carbon footprints all over the world, and that starts with renewable energy. Just this morning, Joe Biden announced a pledge to reduce greenhouse gas emissions in half from 2005 levels by 2030.

So, with Algonquin offering incredible growth potential, as well as a tonne of safety, it’s a stock I’d recommend investors consider over TD today.

Bottom line

As I said before, TD isn’t a poor stock. However, there are better Canadian growth stocks with more potential to buy today.

Investing is all about maximizing opportunities. That’s why, although TD isn’t a stock to avoid, you’ll want to buy stocks with the best prospects for growth today.