Dogecoin is a cryptocurrency that has been garnering much attention these days. Despite its recent sharp fall, Dogecoin has returned a spectacular 8,600% in 2021. This is very appealing to investors. It makes our dreams of getting rich fast seem attainable. But is this actually so? Is Dogecoin worth the risk? Well, there are disruptor stocks that also offer explosive upside. They also come with risks, especially when they’re in the early stages, like Ballard Power Systems (TSX:BLDP)(NASDAQ:BLDP). But investing in Ballard Power stock is very different than investing in Dogecoin. There are real fundamentals behind it. Let’s take a closer look.

Dogecoin is all the rage, but is this justified?

Remember, cryptocurrency is a speculative bet. Some of the best and brightest minds have steered clear. And looking at the price history of Dogecoin and other cryptocurrencies like Bitcoin, we can see that volatility rules the day. Sharp increases are followed by sharp decreases. And there seems to be no easy way of forecasting what will happen next. Well, what I just described sounds like a gamble. That is exactly what Bitcoin is — a gamble. Perhaps cryptocurrency will one day be an accepted method of payment. Today, it has many risks that investors should not be willing to assume.

So, Dogecoin has rallied spectacularly over 8,000% in 2021. It has got many of us dreaming of making it rich in an instant. But the reality is that there’s great risk in this volatile instrument. For example, since May 7, Dogecoin has fallen 50% — just like that in two short weeks. This is a high-stakes game. And there’s no real way to forecast where Dogecoin will trade in the next month, or two months, or in the next year. It’s a guessing game. I think we’re better off focusing our attention on real businesses.

Ballard Power stock: Better than Dogecoin as fuel cell acceptance and deployment rises

Yes, Ballard has been slow to get its revenue ramped up. The company is breaking ground in a pretty new and early industry. There are many hurdles that still need to be overcome. But there are clear fundamental reasons behind placing a bet on Ballard Power stock. For example, Ballard Power currently holds a roughly 80% market share of the heavy-duty fuel cell (HDFC) market. The transition to fuel cells in bus, truck, train, and marine markets is increasingly making more sense. It’s supported by the global push toward clean energy. There are mandated targets for carbon reduction that simply must be met. Ballard is helping this happen.

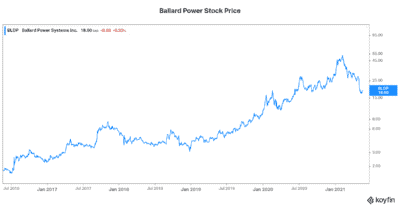

So, Ballard Power stock has also had a volatile ride. It has skyrocketed over 500% since the end of 2019 to February 2021 highs of $43. But since then, Ballard stock has plummeted 62%. That’s a 62% fall in three months. So, as we can see, Ballard Power stock is also not for the faint of heart. Like Dogecoin and cryptocurrency in general, it’s also very volatile. But the level of volatility is lower. And with Ballard, there are some strong fundamental drivers.

The fuel cell market rises: A much better bet than Dogecoin

The fuel cell market is rising and on the cusp of booming. Costs have been cut significantly. And governments around the world are deploying fuel cell vehicles. For example, Europe is pushing hard for a fuel cell public transportation system. Also, China is even more advanced in this push. Fuel cell powered heavy-duty vehicles such as buses have outperformed. They outperform on reliability, power, distance, and recharging times.

ResearchandMarkets.com estimates that the global fuel cell industry will experience massive growth in the next five years. The estimate stands at an average annual rate of 26%. Ballard is at the forefront of the fuel cell market. The company has the expertise and unrivalled relationships.

Motley Fool: The bottom line

Dogecoin is one way that investors are looking to get rich quick. But these get-rich schemes are usually quite dangerous. Dogecoin is no exception. Consider Ballard Power stock instead. This is a stock that has a bright future and big upside. It’s not without its risks, but I view it as a sound investment that should benefit from the rising fuel cell market.