These days one of the biggest fears from investors and economists is rapidly rising inflation. The potential for higher inflation has many stocks selling off and investors looking to improve their portfolio resiliency. So let’s look at which Canadian stocks to buy if inflation continues to rise.

When the pandemic hit, many countries around the world were caught off guard. This resulted in massive spending by governments on a global scale. Despite warnings from economists that massive inflation could be created, there was not much else the governments could do.

So now that the pandemic is in the rear-view mirror, inflation looks like it could pick up rapidly, which has many calling this the biggest inflation scare in 40 years. It doesn’t necessarily mean it will even materialize, but it’s certainly a possibility, which has investors on edge lately and reassessing their portfolios.

With excess cash flowing around the economy, it will almost certainly push prices up faster than any central bank would want, potentially causing interest rates to rise faster than would be ideal. It would cool inflation in the process but also potentially cool the recovery effort.

In this case, the best stocks to buy are more cyclical companies, as they tend to pass on price increases to their customers, which helps preserve their margins.

Here are two of the top Canadian stocks to buy today.

A top Canadian agriculture stock to buy

One of the best stocks to buy now in Canada and a perfect stock for periods of higher inflation is Nutrien (TSX:NTR)(NYSE:NTR).

Nutrien is a massive agriculture company that’s the largest producer of potash globally and the third-largest producer of nitrogen fertilizer.

Nutrien is a high-quality, blue-chip stock to own long-term for a few reasons. The agriculture industry is crucial and has a massive growth runway as the population continues to grow and the healthy eating trend continues to gain popularity.

It’s also a top stock to own because it’s vertically integrated and owns one of the biggest retail networks of stores. It’s therefore a top stock to consider adding for resiliency today in addition to being a stock you can hold for years.

With prices of many commodities rising and demand not expected to drop off, Nutrien could have a significant tailwind over the next few years.

A massive blue-chip stock like this also makes a great dividend stock. So while you buy this blue chip for great long-term growth and stability, it will also return cash to shareholders. Currently, the dividend yields over 3%.

Of the nine analysts who cover the stock, eight have it rated a buy with a nearly $80 target price. So if you’re looking for a massive blue chip that can protect you from inflation, Nutrien is one of the top Canadian stocks to buy today.

Base metals stock

Another high-quality Canadian stock to consider in this economic environment is Teck Resources (TSX:TECK.B)(NYSE:TECK).

Teck is one of the best metals and mining stocks for Canadian investors to consider. Plus, it operates in an industry that typically does well during periods of higher inflation.

Teck is a diversified mining company with significant operations in copper, metallurgical coal and zinc. It also has interests in the oil sands. Not only is the stock well diversified by base metal, but it’s also well diversified geographically. These diversified operations are part of what makes the Canadian stock one of the best to buy now.

Plus, Teck’s massive mines and operations allow it to ramp up production with low capital cost inputs when prices are rising. So if inflation continues to soar and the demand for base metals continues to pick up, Teck Resources could see massive growth.

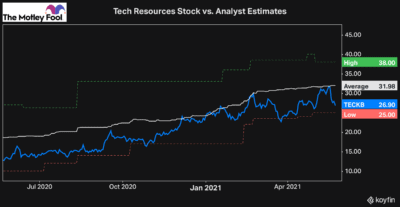

Currently, the stock’s average target price of roughly $32 means significant upside potential for investors today.

Plus, as you can see by the chart, the target price, along with the stock, only continues to rise. Teck’s target price last year was just $18 and it’s entirely possible the stock could be a lot higher than its $32 price target by this time next year.

If you’re looking for a stock to protect you from inflation, Teck Resources is one of the top Canadian stocks in the basic materials sector to buy now.